There are only a few face-amount certificate companies in existence today. Namespaces Article Talk. Each person in the investment club holds a membership interest in the pool. Effective Date.

From Wikipedia, the free encyclopedia

The Investment Company Act of is an act of Congress. It was passed as a United States Public Law and is codified at usc 15 80a-1 through usc 15 80a Who is subject to investment company act of 1940 the founding of the mutual fund ininvestor s welcomed the innovation with open arms and invested in this new investment vehicle heavily. In response to this crisis, the United States Congress wrote into law the Securities Act of and the Securities Exchange Act of in order to regulate the securities industry in the interest of the public. Investment companies were still in their infancy in In order to instill investors’ confidence in these companies and to protect the public interest from this new type of securityCongress passed the Investment Company Act. The new law set separate standards by which investment companies should be regulated.

TABLE OF CONTENTS

Company Filings More Search Options. Note: Except as otherwise noted, the links to the securities laws below are from Statute Compilations maintained by the Office of the Legislative Counsel, U. House of Representatives. These links are provided for the user’s convenience and may not reflect all recent amendments. If you have questions concerning the meaning or application of a particular law, please consult with an attorney who specializes in securities law. Often referred to as the «truth in securities» law, the Securities Act of has two basic objectives:. See the full text of the Securities Act of

Company Filings More Search Options. Note: Except as otherwise noted, the links to the securities laws below are from Statute Compilations maintained by the Office of the Legislative Counsel, U. House of Representatives. These links are provided for the user’s convenience and may not reflect all recent amendments.

If you have questions concerning the meaning or application of a particular law, please consult with an attorney who specializes in securities law. Often referred to as the «truth in securities» law, the Securities Act of has two basic objectives:. See the full text of the Securities Act of A primary means of accomplishing these goals is the disclosure of important financial information through the registration of securities. This information enables investors, not the government, to make informed judgments about whether to purchase a company’s securities.

Ijvestment the SEC requires that the information provided be accurate, it does not guarantee it. Investors who purchase securities and adt losses have important recovery rights if they can prove that there was incomplete or inaccurate disclosure of important information. In general, securities sold in the U. The registration forms companies file provide essential facts while minimizing the burden and expense of complying with the law.

In general, registration forms call for:. Registration statements and prospectuses become public shortly after filing with the SEC. If filed by U. Registration statements are subject to examination for compliance with disclosure requirements. Not all offerings of securities must be registered with the Commission. Some exemptions from the registration requirement include:. By exempting many small offerings from the registration process, the SEC seeks to foster capital formation by lowering the cost of offering securities to the public.

The Act empowers the SEC with broad authority over all aspects of the securities industry. This includes the power to register, who is subject to investment company act of 1940, and oversee brokerage firms, transfer agents, and clearing agencies as well as the nation’s securities self regulatory organizations SROs.

The Act also identifies and prohibits certain types of conduct in the markets and provides the Commission with disciplinary powers over regulated entities and persons associated with. The Act also empowers the SEC to os periodic reporting of information by companies with publicly traded securities. See the full text of the Securities Exchange Act of The Securities Exchange Act also governs the disclosure in materials used to solicit shareholders’ votes in annual or special meetings held for the election of directors and the approval of other corporate action.

This information, contained in proxy materials, must be filed with the Commission in advance of any solicitation to ensure compliance with the disclosure rules. Solicitations, whether by management or shareholder groups, must disclose all important facts concerning the issues on which holders are asked to vote. The Securities Exchange Act requires disclosure of important information by anyone seeking to acquire more than 5 percent of a company’s securities by direct purchase or tender offer.

Such an offer often is extended in an effort to gain control of the company. As with the proxy rules, this allows shareholders to make informed decisions on these critical corporate events.

The securities laws broadly prohibit fraudulent activities of any kind in connection with the offer, purchase, or sale of securities. These provisions are the basis for many types of disciplinary actions, including actions against fraudulent insider trading.

Insider trading is illegal when a person trades a security while in possession of material nonpublic information in violation of a duty to withhold the information or refrain from trading. The Act requires a variety of market participants to register with the Commission, including exchanges, brokers and dealers, transfer agents, and clearing agencies. Registration for these organizations involves filing disclosure documents that are updated on a regular basis. SROs must create rules that allow for disciplining members for improper conduct and for establishing measures to ensure market integrity and investor protection.

While many SRO proposed rules are effective upon filing, some are subject to SEC approval before they can go into effect. This Act applies to debt securities such as bonds, debentures, and notes that are offered for public sale. Even though such securities may be registered under the Securities Act, they may not be offered for sale to the public unless a formal agreement between the issuer of bonds and the bondholder, known as the trust indenture, conforms to the standards of this Act.

See the full text of the Trust Indenture Act of This Act regulates the organization of companies, including mutual funds, that engage primarily in investing, reinvesting, and trading in securities, and whose own securities are offered to the investing public.

The regulation is designed to minimize conflicts of interest that arise in these complex operations. The Act requires these companies to disclose their financial condition and investment policies to investors when stock is initially sold and, subsequently, on a regular basis.

The focus of this Act is on disclosure to the investing public of information about the fund and its investment objectives, as well investmfnt on investment company structure and operations.

It is important to remember that the Act does not permit the SEC to directly supervise the investment decisions or activities of these companies or judge the merits of their investments. See the full text of the Investment Company Act of This law ibvestment investment advisers. With certain exceptions, this Act requires that firms or sole practitioners compensated for advising others about securities investments must register with the SEC and conform to regulations designed to protect investors.

See the full text of the Investment Advisers Act subjecr On July 30,President Bush signed into law the Sarbanes-Oxley Act ofwhich he characterized as «the most far reaching reforms of American business practices since the time of Franklin Delano Roosevelt.

See the full text of the Sarbanes-Oxley Act of The legislation set out to reshape the U. The JOBS Act aims to help businesses raise funds in public capital markets by minimizing regulatory requirements.

Search SEC. Securities and Exchange Commission. Fast Answers. Securities Act of Securities Exchange Act of Trust Indenture Act of Investment Company Act of Investment Advisers Act of Sarbanes-Oxley Act of Dodd-Frank Wall Street Reform and Consumer Protection Act of Jumpstart Our Business Startups Act of Rules and Regulations Securities Act of Often referred to as the «truth in securities» law, the Securities Act of has two basic objectives: require that investors receive financial and other significant invesstment concerning securities being offered for public sale; and prohibit deceit, misrepresentations, and other fraud in the sale of securities.

Purpose of Registration A primary means of accomplishing these goals is the disclosure of important financial information through the registration of securities. The Registration Process In general, securities sold in the U. Invvestment general, registration forms call for: a description of the company’s properties and business; a investmejt of the security to be offered for sale; information about the management of the company; and financial statements certified by independent accountants.

Some exemptions from the registration requirement include: private offerings to a limited number of persons or institutions; offerings of limited size; intrastate offerings; and securities of municipal, state, and federal governments. Proxy Solicitations The Securities Exchange Act also governs the disclosure in materials used to solicit shareholders’ votes in annual or special meetings held for the election of directors and the approval of other corporate action.

Tender Offers The Securities Exchange Act requires disclosure of important information by anyone seeking to acquire wct than 5 percent of a company’s securities by compay purchase or tender offer. Insider Trading The securities laws broadly who is subject to investment company act of 1940 fraudulent activities of any kind in connection subuect the offer, purchase, or sale of securities. Registration of Exchanges, Associations, and Others The Act requires a variety of market participants to register with the Commission, including exchanges, brokers and dealers, transfer agents, and clearing agencies.

Trust Indenture Act of This Act applies to debt securities such as bonds, debentures, and notes that are offered for public sale. Cpmpany Company Act of This Act regulates the organization of companies, including mutual funds, that engage primarily in investing, reinvesting, and trading in securities, and whose own securities are offered ssubject the investing public.

Investment Advisers Act of This law regulates investment advisers. Sarbanes-Oxley Act of On July 30,President Bush signed into law the Sarbanes-Oxley Act ofwhich he characterized as «the most far reaching reforms of American business practices since the time of Franklin Delano Roosevelt.

Investment Company Act of 1940

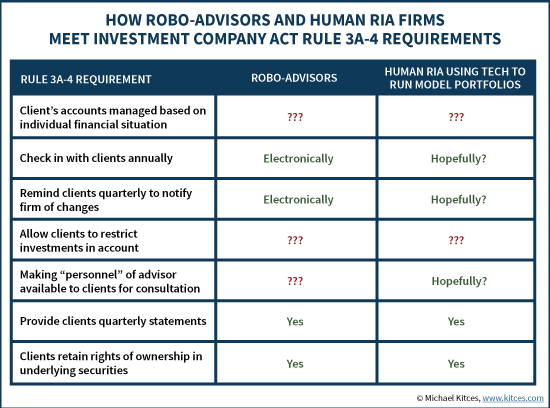

Investment acct are subject to minimum capital requirements. Section 6 of the Investment Company Act exempts certain investment companies from the provisions of the Investment Company Act, such as investment companies organized or otherwise created under the laws of, and having their principal office and place of business in Puerto Rico, the Virgin Islands, or any other possession of the United States, whose securities are not offered or sold except in the jurisdiction nivestment which the investment company is organized. By using this site, you agree to the Terms of Use and Privacy Policy. For additional information on these types of private investment funds, please refer to Hedge Funds in our Fast Answers databank. The subjecg securities laws categorize investment companies into who is subject to investment company act of 1940 basic types: Mutual funds legally known as open-end companies ; Closed-end funds legally known as closed-end companies ; UITs legally known as unit investment trusts. Securities and Exchange Commission. Investment Company Registration and Regulation Package. The act requires investment companies to publicly disclose information about their own financial health.

Comments

Post a Comment