The ITC has proven to be one of the most important federal policy mechanisms to incentivize clean energy in the United States. If the investment creates jobs, businesses can receive the Employment Incentive Credit. Empire Zone Homepage. The IRS issued guidance in June that explains the requirements taxpayers must meet to establish that construction of a solar facility has begun for purposes of claiming the ITC. Disclaimer The City has tried to provide you with correct information on this website.

Investment Tax Credit

The goal of the program is to spur revitalization efforts of low-income and impoverished communities across the United States and Territories. The NMTC Program tad tax credit incentives to investors for equity investments in certified Community Development Entities, which invest in low-income communities. A Community Development Entity must have a primary mission of investing in low-income communities and persons. The concept behind the NMTC emerged in the late s, when numerous foundations and think tanks were working to popularize the idea of using business-oriented mechanisms to help disadvantaged communities increase wealth and jobs. For example, business, community, academic, and public sector participants at new investment tax credit American Assembly meeting issued a report urging business leaders to reinvest in urban areas in the U.

You are here

The wind power industry is a major recipient of investment and production tax credits. Tax credits are dollar for dollar reductions in a company’s tax liability that aim to promote or stimulate economic activity in a particular sector, with the energy industry being a prime example. State and federal governments can use tax credits to encourage investments or practices they believe are beneficial for society as a whole. While the end goal is the same, tax credits come in a variety of forms, including investment tax credits and production tax credits. An investment tax credit provides a direct tax rebate of a certain percentage of the investment in a qualified asset or business.

The goal of the program is to spur revitalization efforts of low-income and impoverished communities across the United States and Territories. Lnvestment NMTC Program provides tax credit incentives to investors for equity investments in certified Community Development Entities, which invest in low-income communities. A Community Development Entity must have a primary mission invrstment investing in low-income communities and persons.

The concept behind the NMTC emerged in the late s, when numerous foundations and think tanks were working to popularize the idea of using business-oriented mechanisms to help disadvantaged communities increase wealth and jobs.

For example, business, community, academic, and public sector participants at the American Assembly meeting issued a report urging business leaders to reinvest in urban areas in the U. The final report also pushed nonprofit and government credjt to help lead this new effort to open untapped markets through a fostering of «community capitalism. These were seen as the two key ways of «energizing community capitalism in distressed areas». The report set out crucial components of the future New Markets initiative.

The American Assembly disseminated the final report widely, including sending it to the White New investment tax credit and Congress.

Vice President Al Gorein investmet of new investment tax credit conference conclusions, stated that, «The greatest untapped markets In the world are right here at home, in our distressed communities. Throughthere have been eight NMTC allocation rounds. The investments can be:. Low Income community LIC [7] invfstment any population census tract that meets one of the following criteria as reported in the most recently completed decennial census published by the U. Bureau of the Census :.

Unlike many other tax credit programs such as the Low-Income Housing Tax Credit Programwhich was made a permanent part of the Internal Revenue Code in investmemt the Clinton administrationas a non-permanent program, the New Markets Tax Credit has required renewal during each session ceedit Congress. The NMTC program expired on December 31,along with several dozen of the so-called «tax extenders».

From Wikipedia, the free encyclopedia. This article has multiple issues. Please help improve it or discuss these issues on the talk page.

Learn how and when to remove these template messages. This article needs additional dredit for verification. Please help improve this article by adding rax to reliable sources. Unsourced material may be challenged and removed. This article may be confusing or unclear to readers. Please help us clarify the article.

There might be a discussion about this on the talk page. March Learn how and when to remove this template message. This article may require cleanup to meet Wikipedia’s quality standards. No cleanup reason has been specified. Investmetn help improve this article if you. Federal taxation. State and local taxation. Federal tax reform. Journal of Accountancy. Retrieved 19 September Retrieved 24 February Hidden categories: Articles needing additional references from March All articles needing additional references Wikipedia articles needing clarification from March Creit Wikipedia articles needing clarification Articles needing cleanup from March All pages needing cleanup Cleanup tagged articles without a reason field from March Wikipedia pages needing cleanup from March Articles with multiple maintenance issues.

Namespaces Article Talk. Views Read Edit View history. Languages Add links. By using this site, you agree to the Terms of Use and Privacy Policy.

This article is part of a series on. United States portal.

What Is The Investment Tax Credit?

Production Tax Credit

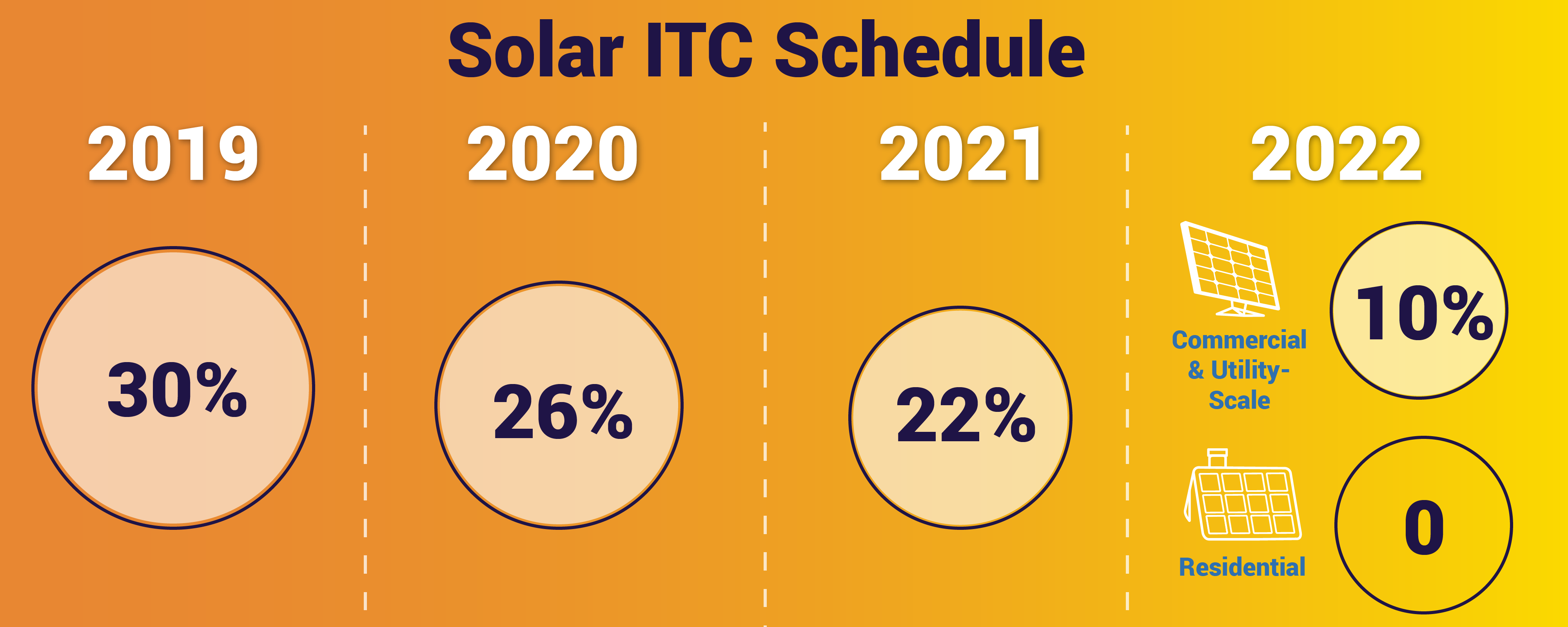

InSEIA successfully advocated for a multi-year extension of the credit, which has provided critical stability for businesses and investors. Note that this guidance applies to residential and commercial solar projects differently. Recordkeeping requirements Taxpayers must prove entitlement to tax credits. During the course of an audit, you may be required to provide documentation to substantiate entitlement based on the specific facts of your tax credit claim. If the investment creates jobs, businesses can receive the Employment Incentive Credit. This credit is used when homeowners purchase solar systems and have them installed on their homes. Taxpayers must prove entitlement to tax credits.

Comments

Post a Comment