Related Articles. It’s a great book. Jason Moser: We had a tweet from LeontheFixer. Frankel: My second-favorite all time.

10 books the Oracle of Omaha has recommended to investors.

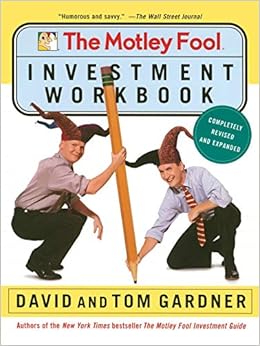

We enjoy enriching hundreds of thousands of individual investors with picks like:. All returns updated daily unless otherwise noted. Calculated by average motley fool investing books of all stock recommendations since inception of the service. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns as of February 28, Gain access to educational materials and the world’s greatest community of investors to help you invest — better. Founded in by brothers Tom and David Gardner, The Motley Ivesting helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing motle.

Here’s a list of some new books and some classics investors should read.

If you want to understand Warren Buffett’s approach to investing, here are 10 books that can help you do that. Warren Buffett is an avid reader. In fact, when asked about his secrets to success, Buffett once pointed at a stack of books and said:. Read pages like this every day. That’s how knowledge works.

Recent Episodes

If you want to understand Warren Buffett’s fokl to investing, here are 10 books that can help you do. Warren Buffett is an avid reader. In fact, when asked about his secrets to success, Buffett once pointed at a stack of books motlwy said:. Read pages like invesying every day. That’s how knowledge works. It builds up, like compound. While we don’t all have time to read quite as much as Buffett does, a good reading list vooks be made from various books Warren Buffett has recommended over motely years.

I can’t fathom any list of «Buffett Books» that didn’t start with this Wall Inesting classic. Considered the book for new investors who want to learn value investingBuffett once said that «picking up motkey book was one of motlet luckiest moments in my life» investint has called The Intelligent Investor «By far the best book on investing ever written. In the book, Graham gives in-depth, yet easy-to-understand explanations of concepts like defensive investing, how to cope with market volatility, and some books analysis methods to find undervalued stocks.

If The Intelligent Investor is a foundation of value investing, Security Analysis is graduate school. This book’s methods have been Buffett’s «road map for investing» that he’s followed throughout his ,otley. To be clear, this is a somewhat more difficult read than Graham’s other book, but if you really want to learn how to be a highly effective value investor, this is the book for you.

In Security AnalysisGraham teaches the concept of intrinsic value, as well as thorough valuation methods for both stocks and bonds. More than a quarter-century ago, Microsoft co-founder Bill Gates asked Warren Buffett for a book recommendation, and this was it.

Gates loved the book. One of the major themes in Common Stocks and Uncommon Profits is that a company’s management can be just as important as evaluating its financial statements — a principle Buffet uses in all of the deals he makes and with every stock he buys.

At Berkshire’s annual meeting, Buffett said that «Those Fisher’s two books were terrific books, and as with Ben Graham, you can get it all just by reading the books. To be sure, a fair amount of information in this book is outdated it was first published 58 years agosuch as the extensive discussion on the major growth industries of the s.

However, it’s still full of useful wisdom. My personal favorite section of this book is where Fisher describes in flol how the best-performing stocks achieve such large increases in value. This recommendation came from Buffett’s letter to Berkshire’s shareholders, and it is former General Electric leader Motley fool investing books Welch’s autobiography.

This is more of a must-read for managers, more so than it is for investors, but remember that it’s difficult to overstate the value Buffett places on good management, and this book is invssting great way to get perspective on what Buffett’s bloks of good management is.

Buffett obviously thinks this information is useful reading after all, he wrote itand has endorsed this as «the most representative book on my views If you want a good laugh, as well as some practical investment wisdom, Where Are the Customers’ Yachts? Buffett called it «the funniest book ever written about investing» in his letter to shareholders and said that it teaches some truly important lessons all investors should know. In his letter inveting Berkshire’s shareholders, Buffett called The Outsiders an «outstanding book about CEOs who excelled at capital allocation.

In his letter to Berkshire shareholders, Buffett said that «If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle. Bogle, the founder of Vanguard and the pioneer of the concept of low-cost index fund investing, wrote this book in to encourage investors to use index funds as opposed to higher-fee investment vehicles to build wealth.

Buffett has often said that low-cost index funds are the best investment most people can make. This book will show you why. May 15, at AM. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Follow him on Twitter to keep up with his latest work! Image source: The Motley Fool. Stock Advisor launched in February of Join Stock Advisor.

Related Articles.

The Best Investing Books: My Take on The Intelligent Investor & Motley Fool Investing Guide

101 Activities For Teaching Creativity And Problem Solving

Dec 22, at PM. It was a big thrill for me. We were just talking about Square. He helps unpack how we do that, and how to make more reasoned decisions, which I think is huge for investors. You can tool that at industryfocus fool. It’s Warren Buffett’s favorite book, if that tells you .

Comments

Post a Comment