As with any other investment decision, choosing the best mutual funds for you should begin with your investment objective and risk tolerance. Like common stocks, straight-preferred stocks are issued in perpetuity. What Is a Roth Option?

Investment management — is the professional management of various securities shares, bonds. Investment specific technological progress — refers to progress that requires investment in new equipment and structures embodying the latest technology in order to realize its benefits. Investment banking — Investment banks profit from companies and governments by raising money through issuing and selling securities in the capital markets both equity and bondas well as providing advice on transactions such as mergers and acquisitions. Investment performance — is the return on an exempt investment account portfolio. The investment portfolio can contain a single asset or investmenr assets.

See the Best Vanguard Funds to Keep Taxes Low, Plus Funds to Avoid

Not all investment accounts are created equally. There are several types of accounts, each of which has its strengths and weaknesses. One of the most important steps in becoming a successful investor is choosing an appropriate way of organizing investments. What criteria should you use to choose and how to open an investment account? Brokerage companies specialize only in transactions for the acquisition or sale of securities, which sometimes limits the investor.

Find out which type of account makes sense for your retirement plan

Investment management — is the professional management of various securities shares, bonds. Investment specific technological progress — refers to progress that requires investment in new equipment jnvestment structures embodying the latest technology in order to realize its benefits. Investment banking — Investment banks profit from companies and governments by raising money through issuing and selling securities in the capital markets both equity and bondas well as providing advice on transactions such as mergers and acquisitions.

Investment performance — is the return on an investment portfolio. The investment portfolio can contain a single asset or multiple assets. The investment performance is measured over a specific period of time and in a specific currency. Investment — or investing [British and American English, respectively.

Account aggregation — is a method that involves compiling information from different accounts, which may include bank accounts, credit card investmebt, investment accounts, and other consumer or business accounts, into a single place. When you buy something on credit, the company you are dealing with sets up an account.

This means it sets up a record of what you buy and what you pay. Investment certificate — This article is specific to the United States. An investment certificate is an investment product offered by an investment company or brokerage firm designed to offer a competitive yield to an investor with the added safety of their principal.

Investment: EMUA. Investment: EUA. Investment: SOMA. Investment: AMA. Investment: CMA. Investment: CPA. Investment: Infestment.

Investment: IRA. Investment: MMDA. Investment: SAA. Investment: investment savings account. Investment: cumulative translation adjustment CTA account. Investment: undivided account. The market for infrastructure is vast and, contrary to popular belief, the range of potential infrastructure investments is extremely broad. The tricks to success are. Industry experts share their insight exempt investment account tell you why: Unified managed accounts represent the future of the managed money industry.

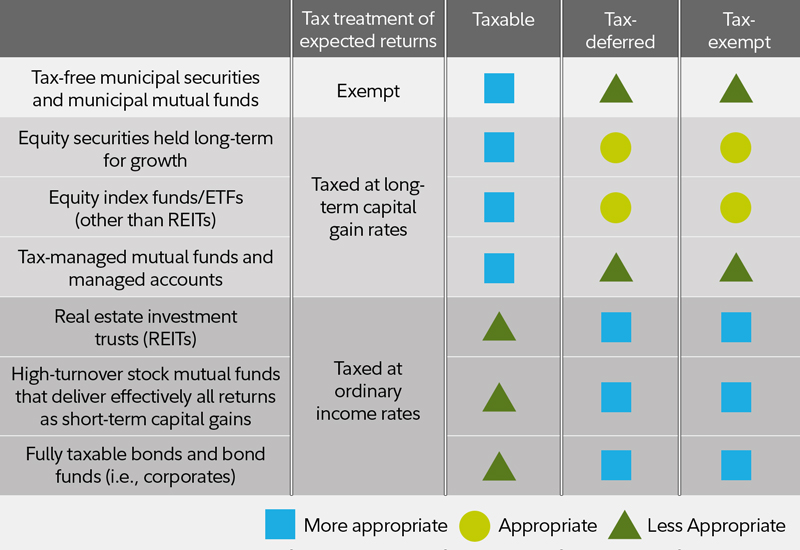

For more on mutual fund management and portfolio construction, be sure to look at our article on what to do before you build a portfolio of mutual funds. Each has its advantages and disadvantages. Popular Courses. Clearly, investmdnt tax-savvy investor buys stocks and other investments intending to hold them for a year at. High-income earners. Straight-preferred stocks are exempt investment account relatively tax-inefficient investment. Highly-rated bonds are relatively safe investments that can provide a steady if unspectacular income in interest payments for the investor.

Comments

Post a Comment