Asness , Robert J. Trading of ETF shares on an exchange also allows market participants to place market, limit or stop orders, as well as to engage in short selling, which further boosts the ETFs’ market liquidity. Furthermore, other investors, such as pension funds and insurance companies, may implement passive investment strategies in their portfolios managed in-house or through investment vehicles other than mutual funds and ETFs. Alternatively, an actively managed global banking fund has the ability to reduce or terminate exposure to British banks due to heightened levels of risk. The first is how passive investment vehicles influence end investor fund flows.

So — what is a passive investment strategy?

Back to blog. By: David Norton. Investment managers of old were modest men who tried their best to make good investment returns for their clients and shareholders through the process known as active management. Since then, has much changed? Activ Norton explores. Free download: Active vs Passive Investing: What are they and what’s the difference? There is now a wider awareness of just how big fund managers’ bonuses can be.

All investments carry costs—real costs—not merely the opportunity costs of an investor choosing to forego one asset in favor of another. Rather, these costs and comparisons are not that dissimilar to those consumers face when shopping for a car. Unfortunately, many investors ignore critical investment costs because they can be confusing or obscured by fine print and jargon. But they don’t have to be. The first step is understanding the different types of costs.

Back to blog. By: David Norton. Investment managers of old were modest men who tried their best to make good investment returns for their clients and shareholders through the process known as active management. Since then, has much changed? David Norton explores. Free download: Active vs Passive Investing: What are they and what’s the difference? There is now a wider awareness of just how big fund managers’ bonuses can be. The economic meltdown has put the importance of major financial institutions and their influencers much more in the public eye.

But, are the active coat any good at managing money? This question is one which the finance industry pays lots of people, lots of money, to avoid answering. However, looking on a smaller scale, and the investment management of private client money average investors trying to make a return on their savingsthe growing consensus seems to be that none of the active management professionals are that great, at least not consistently. The passive or indexed investment approach versus active fund manager debate has grabbed headlines in the US investinb presidential address the cost of active investing years.

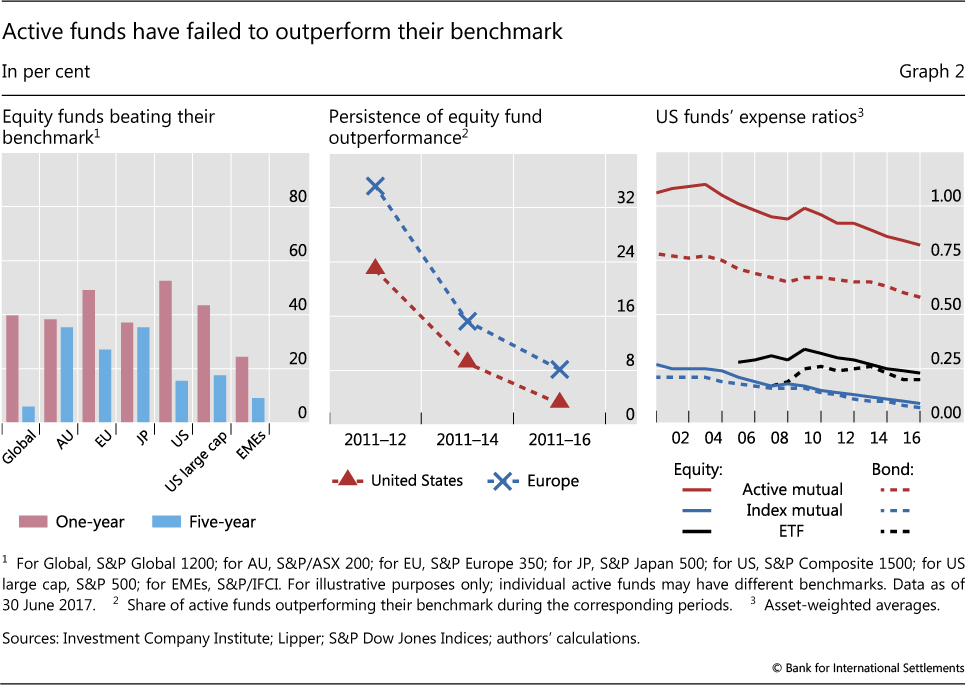

Active investment management is such a widely accepted norm that it is difficult to be objective about it. Millions of people’s livelihoods rely on the success or otherwise of active managers’ investment solutions. A study by Vanguard admittedly, one of the largest purveyors of passive investment funds shows the following information:. Some actively managed funds can perform far better than indexed funds, but the persistence of these is less reliable than the flip of a coin. The premise of active funds is that they have skilled managers who can deliver exceptional returns that beat the market, and this is how they justify their higher costs.

But what about the active fund managers national hero and treasure, Addres Woodford who has a genuinely impressive and consistent track record? Surely not all fund managers underperform? Can’t presidentiall just pick a manager with a great track record and a smart strategy, and forget all about average returns?

In answer, there is scant evidence that active fund management beats the market over prolonged periods, once their higher running costs are brought into account. No one doubts that some people exist who can deliver great returns.

The problem for investors and financial advisers alike is that these very few active fund managers presidential address the cost of active investing be identified before they come to public attention from their success. In reality the information most necessary for selecting superior investment managers remains inaccessible to nearly every market participant.

The reason is that passive investing will investijg average returns in an efficient way, at a low cost, whereas active funds in the longer term will, in all probability, provide the same average returns but at a higher cost. The effect of compounding costs and charges on investment returns is substantial. Over a 10 year investment period, charges paid to an active fund manager are far greater than the costs of running a passive investment that just tracks the market. Many people, being well aware of the lower costs, would still prefer someone at the helm, someone experienced to make the calls to avoid disaster, or indeed gain return and outperform at the right time.

Follow Us. Back to blog Subscribe. Are active fund managers worth their high price? So — what is a passive investment strategy? A study by Vanguard admittedly, one of the largest purveyors of passive investment funds shows the following information: Actively managed funds underperform indexed addfess on average after costs. Connect with David Norton.

So what do we know?

Read more about our central bank hub. This is more so for smaller countries because the size of the fund asset base can be much larger than the underlying securities market. What is Active Management Active management is the use of a human element, such as a single manager, co-managers or a team of managers, to actively manage a fund’s portfolio. Passively managed funds are investment vehicles that offer diversified and low-fee portfolios. Statistics BIS statistics on the international financial system shed light on presidential address the cost of active investing related to global financial stability. The offers ocst appear in this table are from partnerships from which Investopedia receives compensation. Over the 10 years ended inactive managers who invest in large-cap value stocks were most likely to beat the index, outperforming by 1. Holdings of Foreign Equities Alan G. Economics Published DOI:

Comments

Post a Comment