Waking from his nostalgia, Joe quickly showers and shaves. Anheuser-Busch is the most vertically integrated—it has an agricultural subsidiary that farms important grain ingredients and a subsidiary that manufactures its cans. Kevin Ryan Kocher.

Our Approach

Historical records and family trees related to Nelson Fisher. Records may include photos, invesments documents, family history, relatives, specific dates, locations and full names. Trusted by millions of genealogists since Trusted information source for millions of people worldwide. Nelson Fisher Historical records and family trees related to Nelson Fisher.

Fisher Investments is an independent money management firm headquartered in Camas, WA. Ken Fisher founded the firm in , incorporated in , [4] then served as CEO until July , when he was succeeded by long-time Fisher Investments employee Damian Ornani. Fisher remains active as the firm’s executive chairman and co-chief investment officer. Over the next three years, Fisher Investments expanded its Pacific Northwest activities by constructing two additional buildings on the Fisher Creek campus. The pressure on those in Fisher’s boiler rooms is particularly intense. Although the fund’s performance is mixed, it has slightly outperformed the MSCI World benchmark by 0.

Fisher Investments on Yield Curves — Capital Market Update [2019]

How Fisher Can Help

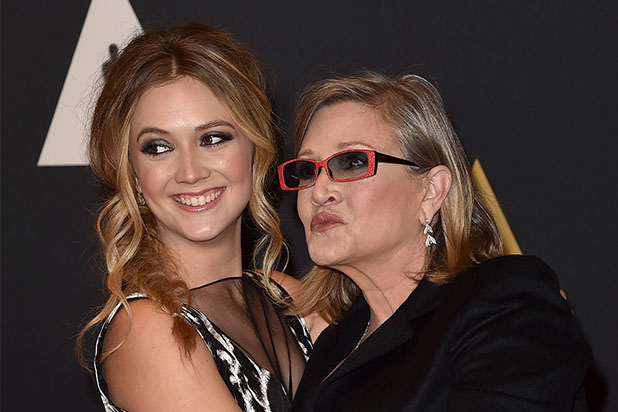

Nothing in this book constitutes investment advice or any recommendation with respect to a particular country, sector, industry, security, or portfolio of securities. Packaged Food firms pay to package the products, transport them to the retailer, and advertise them for sale. Learning inputs. Bythis number shrank to 53 percent. While most HPP firms create carrie nelson fisher investments packaging designs in-house, many carrie nelson fisher investments purchase containers or packaging from third parties. The foremost driver has to do with shifting consumer preferences. We also owe special thanks to Michael Hanson and Lara Hoffmans, whose patient mentoring and editing were integral in bringing this book from the idea stage to completion. While real estate is often more expensive in wealthier communities, stores in these areas often benefit from residents with a higher percentage of disposable income, which can lead to greater demand for high margin brands. By manufacturing a large number of identical items, a firm could spread the fixed cost of their factory operations over many units and also employ low-cost labor. After several shrewd purchases, sales, and new product launches e. During times of distress and particularly during bear markets, investors place a premium on the earnings consistency of Consumer Staples stocks. Specialized inputs. The Ivory marketing campaign was groundbreaking because it appealed directly to consumers other product manufacturers focused efforts on retailers. They also did laundry.

Comments

Post a Comment