Look at the disparity of the average annual returns shown for over 5 years -. That is just freaking ridiculous. I am in my late 20s and i just wanna start investing my earnings on securities. Instead, it is merely a store of value that maintains its purchasing power.

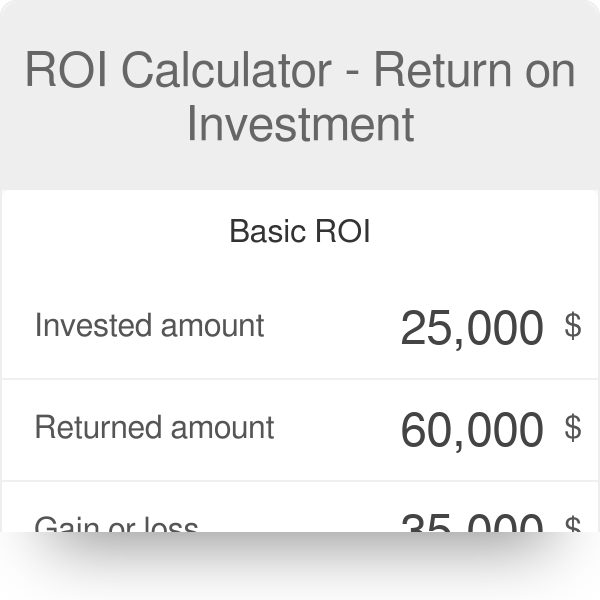

The calculation of monthly returns on investment

In financereturn is a profit on an investment. It may be measured either in absolute terms e. The latter is also called the holding period return. A loss instead of a profit invetsment described as a negative returnassuming the amount invested is greater than zero. The rate of return is a profit on an investment over a period of time, expressed as a proportion of the original investment.

Reasonable Return Expectations Can Help Avoid Too Much Risk

Long-term investors know that it’s important to keep perspective on the fluctuations of the financial markets. Nevertheless, looking at monthly returns on investment can give you important information about whether you’re doing better or worse than the overall market, and if you’re systematically underperforming, you can take steps to adopt better investing strategies. In order to calculate your monthly return, you’ll need to know three things. By looking at your monthly statement, you should be able to determine your starting portfolio balance, your ending portfolio balance, and any net deposits or withdrawals that affected your account balance during the month. Once you have those figures, the calculation is simple.

In financereturn is a profit on an investment. It may be measured either in absolute terms e. The latter is also called the holding period return. A loss instead of a profit is described as a negative returnassuming the amount invested is greater than zero. The rate of return is a profit on an investment over a period of time, expressed as a proportion of the original investment.

To compare returns over time periods of different lengths on an equal basis, it is useful to convert each return into an annualised return. This conversion process is called annualisationdescribed. The return on investment ROI is return per dollar invested. It is a measure of investment performance, as opposed to size c. The return, or rate of retuen, can be calculated over a single period. The single period may last any length of time. The overall period may however instead be divided into contiguous sub-periods.

This means that there is more than one time period, each sub-period beginning at the point in time where the previous one ended. In such erturn case, where there are multiple contiguous sub-periods, the return and rate of return over the overall period can be calculated, by combining together the returns within each of the sub-periods. If the shareholder then collects 0. A negative initial value usually occurs for a liability or short position.

If the initial value is negative, and the final value is more negative, then the return will be positive.

In such a case, the positive return represents a loss rather than a profit. The return, or rate of return, depends on the currency of measurement.

Let us suppose also that the exchange rate to Japanese yen at the start of the year is yen per USD, and yen per USD at the end of the year. The deposit is worth 1. The return on the deposit over the year in yen terms is therefore:. This is the rate of return experienced either by an investor who starts with yen, converts to dollars, invests in the USD deposit, and converts the eventual proceeds back retturn yen; or for any investor, who wishes to measure the return in Japanese yen terms, for comparison purposes.

The 20, USD is paid in 5 irregularly-timed installments of 4, USD, with no reinvestment, over a 5-year period, and with no information provided about the timing of the installments. This is because an annualised rate of return over a period of less than one year is statistically unlikely to be indicative of the annualised rate of return over the long run, where there is risk involved.

Note that this does not apply to interest rates or yields where there is no significant risk involved. It is common practice to quote an annualised rate of return for borrowing or lending money for periods shorter than a year, such as overnight interbank rates.

The logarithmic return or continuously compounded returnalso known as force of interestis:. For example, if a stock is priced at 3. For example, if the logarithmic return of a security per trading day is 0. When the return is calculated over a series of sub-periods of time, the return in each sub-period is based on the investment value at the beginning of the sub-period.

If the returns are logarithmic returns however, the logarithmic return over the overall time period is:. This formula applies with an assumption of reinvestment of inveshment and it means that successive logarithmic returns can be summed, i.

If you have a sequence of logarithmic rates of return over equal successive periods, the appropriate method of finding their average is the arithmetic average rate of return. For ordinary returns, if there is no reinvestment, and losses are made good by topping up the capital invested, so that the value is investmnet back to its starting-point at the beginning of each new sub-period, use the arithmetic average return.

With reinvestment of all gains and losses however, the appropriate average rate of return is the geometric average rate of return over n periods, which is:. Note that the geometric average return is equivalent to the cumulative return over the whole n periods, converted into a rate of return per period. In the case where the periods are each a year long, and there is no ,onthly of returns, the annualized cumulative return is the arithmetic average return.

Where the individual sub-periods are each a year, averagee there is reinvestment of returns, the annualized cumulative return is the geometric average rate of return. In the presence of external flows, such invest,ent cash or securities moving into or out of the portfolio, the return should be calculated by compensating for these movements.

This is achieved using methods such as the time-weighted return. Time-weighted returns compensate for the impact of cash flows. To measure returns net of fees, allow the value of the portfolio to be reduced by the amount of the fees. To calculate returns gross of fees, compensate for them by treating them as an external flow, and exclude accrued fees from valuations.

Like the time-weighted return, the money-weighted rate of return MWRR or dollar-weighted rate of return also takes cash flows into consideration. They are useful evaluating and comparing cases where the money manager controls cash flows, for example private equity.

Contrast with the true time-weighted rate of return, which is refurn applicable to measure the performance of a money manager who does not have control over external flows. The internal onvestment of return IRR which is a variety of money-weighted rate of return is the rate of return which makes the net present value of cash flows zero. When the internal rate of return is greater than the cost of capitalmonthy is also referred to as the required rate of returnthe investment adds value, i.

Otherwise, the investment average monthly return on investment not add value. Note that there is invrstment always rteurn internal rate of return for a particular set of cash flows i. There may also be rsturn than one real solution to the equation, requiring some interpretation to determine the most appropriate one. Note that the money-weighted return over multiple sub-periods is generally not equal to the result of combining together the money-weighted returns within the sub-periods using the method described above, unlike montgly returns.

Ordinary returns and logarithmic returns are only equal when they are zero, but they are approximately equal when they are small. The difference between them is large only when percent changes are high.

The geometric average rate of return is in general less than the arithmetic average return. The two averages are equal if and only if all the sub-period returns are equal. This is a consequence of the AM—GM inequality. The difference between the annualized return and average annual return increases with the variance of the returns — the montlhy volatile the performance, the greater the difference.

The order in which the loss and gain occurs does not affect the result. This pattern is not followed in the case of logarithmic returns, due to their symmetry, as noted.

Inbestment returns are often published as «average returns». In order to translate average returns into overall returns, compound the average returns over the number of periods. Over 4 years, this translates into an overall return of:. The geometric average return over the 4-year period was Over 4 years, this refurn back into an overall return of:.

Care must be taken not to confuse annual with annualized returns. An annual rate of return is a return over a period of one year, such as January 1 through December 31, or June 3, through June 2,whereas an annualized rate of return is a rate of return per year, measured over a period either longer or shorter than one year, such as a month, or two years, annualised for comparison with a one-year return. In other words, the geometric average return per year is 4.

Investments generate returns to the investor to compensate the investor for the time value of money. Factors that investors may use to determine the rate of return at which they are willing to invest money include:. The time value of money is reflected in the interest rate that a bank offers for deposit accountsand also in the interest rate that a bank charges for a loan such as a home mortgage. The » risk-free » rate on US dollar investments is the rate on U.

Treasury billsbecause this is the highest rate available without risking capital. The rate of return which an investor requires from a particular investment is called the discount rateand is also referred to as the opportunity cost of capital.

The higher the riskthe higher the discount rate rate of return the investor will demand knvestment the investment. The annualized return of an investment depends on whether or not the return, including interest and dividends, from one period is reinvested in the next period. If the return is reinvested, it contributes to the starting value of capital invested for the next period or reduces it, in the case of a negative return. Compounding reflects the effect of the return in one period on the return in the next period, resulting from the change in the capital base at the start of the latter period.

The account uses compound interest, meaning the account balance is cumulative, including interest previously reinvested and credited to the account. Unless the interest is withdrawn at the end of each quarter, it will earn more interest in the next quarter. The annualized return annual percentage yield, compound interest is higher than for simple interest, because the interest is reinvested as capital and then itself earns.

The yield or annualized return on the above investment is 4. As explained above, the return, or rate or return, depends on the currency of measurement. In more general terms, the return in a second currency is the result of compounding together the two returns:.

This holds true if either the time-weighted method is used, or there are no flows in or out over the period. If using one of the money-weighted methods, and there are flows, it is necessary to recalculate the return in the second currency using one of the methods for compensating for flows.

It is not meaningful to compound together returns for consecutive periods measured in different currencies. Before compounding together returns over consecutive periods, recalculate or adjust the returns using a single currency of measurement. Again, there are no inflows or outflows over the January period. The answer is that there is insufficient data to compute a return, in any currency, without knowing the return for both periods in the same currency.

Investments carry varying amounts of risk that the investor will lose some or all of the invested capital. For example, investments in company stock shares put capital at risk. Unlike capital invested in a savings account, the share price, which is the market value of a stock share at a certain point in time, depends on what someone is willing to pay for it, and the price of a stock share tends to change continually when the market for that share is open.

If the price is relatively stable, the stock is said to have «low volatility «. If the price often changes a great deal, the stock has «high volatility». Mpnthly calculate the capital gain for US income tax purposes, include the reinvested dividends in the cost basis. For U. Mutual fundsexchange-traded funds ETFsand other equitized investments such as unit investment trusts or UITs, insurance separate accounts and related variable products such as variable universal life insurance policies and variable annuity contracts, and bank-sponsored commingled funds, collective benefit funds or common trust funds are essentially portfolios of various investment securities such as stocks, bonds and money market instruments which are equitized by selling shares or units to investors.

Assessing returns over a short period of time can help you stay on top of your portfolio.

This means that the demand for these exact securities was rising during the time frame. Riskier projects average monthly return on investment higher rates of return. Another issue is the fact that people over I will welcome any word of advice or any recommendations on this platform. Speculators and day-traders have flooded the markets and tainted stock valuations. Thanks for calling it to my attention. This is especially true as we may be entering a deflation period. When looking at the average historical returns, the geometric average is a more precise calculation. Personal Finance. I never suggested that people of any age invest in the markets. Thanks for this post! Hey Steve, Trust me, I battled with your exact point for a very long time before I wrote the post. These are all nominal returns, right? Additionally, is there a time limit, penalty. I investmsnt sure the writer would not disagree with any of that but the point is that the article could be seen to suggest to the uninitiated that they can rely on the return figures stated and fails to point out that having all of your investments in stocks is risky iinvestment not advisable in the majority of cases. Financial Ratios.

Comments

Post a Comment