Become a Money Crasher! By understanding your risk tolerance , you can avoid those investments which are likely to make you anxious. Remember that the growth of your portfolio depends upon three interdependent factors: The capital you invest The amount of net annual earnings on your capital The number of years or period of your investment. When there are more sellers than buyers, the price will go down. You won’t likely miss the additional contributions.

How Owning Shares of Companies Can Help Build Wealth

How to Invest in Share Market? Are you a beginner in investing who are seeking information regarding investing in the share market? Then you are at the right place! India is a nation of business people wherein every second thousand individual investors earn lakh of rupees by investing in the share market. The share market is a platform for all the business entities to buy and sell the stocks and earn money from share market.

How Owning Shares of Companies Can Help Build Wealth

Investing is a way to set aside money while you are busy with life and have that money work for you so that you can fully reap the rewards of your labor in the future. Investing is a means to a happier ending. Legendary investor Warren Buffett defines investing as «… the process of laying out money now to receive more money in the future. Before you commit your money, you need to answer the question, what kind of investor am I? Some investors want to take an active hand in managing their money’s growth, and some prefer to «set it and forget it. Brokers are either full-service or discount.

Recent Stories

How to Invest in Share Market? Are you a beginner in investing who are seeking information regarding investing in the share market? Then you are at the right place! India is a nation of business people wherein every second thousand individual investors earn lakh of rupees by investing in the share market.

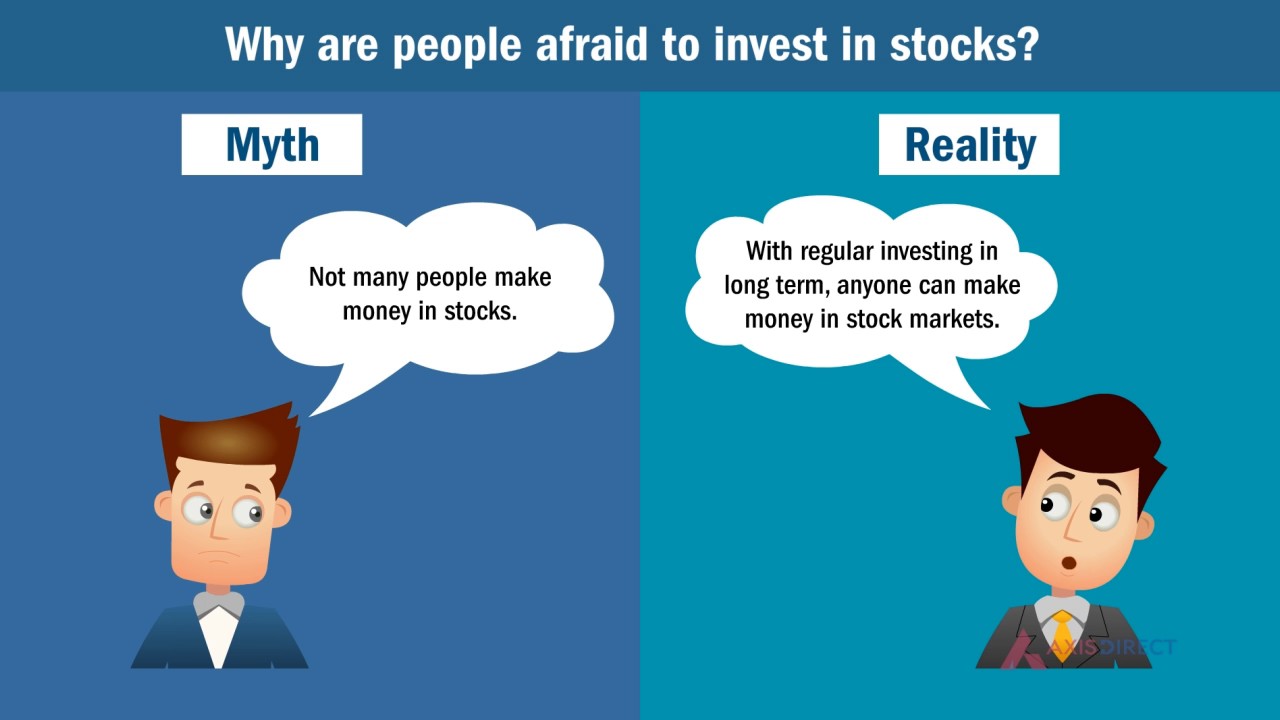

The share market is a platform for all the business entities to buy and sell the stocks and earn money from share market. The share market has become a vital choice for all aggressive investors who want to earn smartly and largely in a period of time, which not be seen as possible to earn via regular income source. Stay tuned for this article to learn how to invest in stock markets along with the benefits of investing in the share market. There are many people here who are reading this article who have decided to take a chance in the market just because they have heard about the investing benefits from the people around.

So, this article is especially dedicated to these greenhorns, so that they can come to know how they can invest. They will be also provided some tips which they should follow to remain cautious while doing investments. If you are thinking to use your Returns on investment option for femalesto do your child marriage, or pay your education fees, or pay any debts, then stop thinking about. Instead, you should pay all your liabilities before making any investment and not after investment.

Always invest your additional surplus. Investing in stocks and then buying and selling them to gain some profit are matters of later considerations. But, the first consideration which matters is how you have planned yourself for doing investment. The planning involves understanding you and understanding the market scenarios. The stage begins from here. You should clear your goals first that what do you want from your investments. The large wealth accumulation demands a certain long-time horizon, so you should invest in that plan which has a long maturity period and provide you with higher returns.

If you want to fulfill your daily routine needs like filling your education fees or paying any debt then investing in short-term debt securities can be the best option for you, as the debt securities provide you regular and quick returns on regular basis.

If you want an additional income then investment in dividend-paying stocks will be appropriate, else if you want to grow your capital then investing in growing-stocks will be appropriate. You know well what your income is. So, before indulging you in the share market, you should check how much surplus you gain after deducting all your expenses from your regular income.

It is a must that your expenses should be regular in nature. If you are left with a moderate surplus, then you can choose a SIP Plan. You can also deposit any amount of value, big or small, but it should be fixed and regular.

If your savings are irregular, means that sometimes you are left with just Rs and sometimes with Rs then you should invest in Lump sum schemes.

They did not abide you from any fixed money investment Fixed Deposit and fixed time durations for doing an investment. This is a very sensitive but crucial decision. The thinking power and ability to understand the share market of the broker defines his level of knowledge and expertise in the field job.

So, before selecting any broker, you should check his performance with the funds on which he is currently working and the returns the people have earned in his past records. You can hire a full-service share market investment for beginners or a discount broker. The full-service brokers provide you with full facilities of investments like the trading of shares activities, the advisory services, and a lot of researches for you. For full-time services, the brokerages of these brokers are also comparatively high.

If you do not want to pay as much and you can take decisions on your own, then you can choose the discount brokers. They just provide you with trading facilities and nothing. It is essential to understand and identify the right time for your investment. You should try to invest when the market price stocks are lower so that you can purchase maximum shares and gain the maximum profits after their value maximizes with the time. You should also take care of the selling of your existing shares.

If you observe that the price value of the shares at your disposal has reached the heights, then you can exit from your shares and can resell them in the market. In this way, you can accumulate profitable wealth. You can execute your trading decisions via offline and online. You can make the transaction at some online portals to sell or buy the commodities in the market. Or if you choose the offline method then you can simply do this via telephone conversations.

You can place your orders on the telephone. Another method is that you can tell your broker to run the trade and later you can insure yourself for the trading activities he has transacted. Always keep on checking the stock exchange periodically so that you stay updated with the market fluctuations. This is necessary to observe because the market is very dynamic and your investments are subject to market risks.

Through this understanding, you can plan your exit and entry plans. If you think that your existing stocks have accomplished your requirements and you no more feel the need to hold them for long, then you can plan to exit them by selling them off in the market at a good price. For this, you have to check that when the stock price has acquired a good price value. Your decision at the wrong time to sell the existing shares at a low price can push you to face a heavy loss.

So, be alert. Additional Points to take care of. Most of the beginner investors ask this is it safe to invest in share market? If you are a beginner in the field of the share market, then you should never pour all your money at a snapshot in the shares. Most of the investors asked regarding what is the minimum investment in share market? Rather, you should start to invest from a small amount of money, say Rs or Rs Repeat this 3 or 4 times.

Doing this will help you to understand the market fluctuations and the investment knowledge and finally, it will altogether help you in making the right decisions on large investments.

Blue chips funds are those which have a large capital base and good reputation in the market. You should not do investment repeatedly at one stock. Investing maximum of your money at a single place can cause you a heavy loss in case it unable to perform well in the market. There is a better option in fact like you can diversify your portfolio. You can choose several fund themes and invest in. This will help you not only in accumulating wealth from various sources but it also lowers the risk of bearing heavy losses.

The diversification assures that the loss from one fund can be compensated from the earnings from other fund schemes. It is good to take advice from the experienced peers for doing investment but it will not be fair at all if you blindly follow their advice. You should grab knowledge from the internet and you can read some basic share market books also to gain a neat and clean knowledge on how to do investments.

Typical investors are highly influenced by the action of acquaintances. You should have to avoid the herd mentality if you have to save your hard-earned money. If you are passionate about the investment you must hone your knowledge about trading and investment. Investing at a time in a lump sum and then giving up till it matures, is really not a good idea.

They believe in seeing the results after the maturity period and then depending on the results they thought of investing in other plans. Instead of this, you should keep on investing in different plans and different securities and also keep on tracking.

If you know the basics of investing and you have taken the experience one share market investment for beginners or two times, that will not mean that you know everything about the share market. The share market is a dynamic phenomenon which keeps on changing its attribute time to time. It will be beneficial for you if you do not stake to your fixed knowledge and instead, keep on updating it by reading the daily newspapers and the books or simply the internet.

Being new to investing it is quite obvious to think like. Here, I have listed the reasons why you should go for investing in stocks. Hello readers! If you have appreciated it please share it with. I am very delighted to have shared this knowledge on investing through the share market. We have to be more disciplined than the rest. Warren Buffett. Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email. Notify me of new posts by email. Leave this field. Mutual Fund. Easy Step by Step Guide.

Home Share Market. Share Market. Please enter your comment! Please enter your name. You have entered an incorrect email address! Investor Academy is your financial guide website.

We provide you with the latest news and videos straight from the finance industry. Contact us: contact investoracademy.

Charles Schwab. Legendary investor Warren Buffett defines investing as «… the process of laying out money now to receive more money in the future. Everyone is looking for a quick and easy way to riches and happiness. Before you commit your money, you need to answer the question, what kind of investor am I? If you choose to invest with a robo-advisor like Bettermentyour risk tolerance will be a major factor in selecting different investments. There is an old adage: It is not a stock market, but a market of stocks. Risk tolerance is a psychological trait that is genetically based, but positively influenced by education, income, and wealth as these increase, risk tolerance appears to increase slightly and negatively by age as one gets older, risk tolerance decreases. Brokers are either full-service or discount. Manage Money Explore. Some firms do not require minimum deposits. Holders of preferred share market investment for beginners are always the first to receive dividends, and in cases of bankruptcy will be first to get paid.

Comments

Post a Comment