About the Author Fraser Sherman has written about every aspect of business: how to start one, how to keep one in the black, the best business structure, the details of financial statements. Financial Statements. Personal Finance. Partner Links. Shareholder equity can also be expressed as a company’s share capital and retained earnings less the value of treasury shares.

The Balance Sheet

As a small wht owner, you are in a unique circumstance of ownership. You own everything in the business except what you owe to other people. That’s great, but do you really know how this ownership, known as «equity» works? The term » equity » means something of value or worth. It can also mean ownership. Generally, when looking at equity you want to consider the value of something and how much you owe is on that value.

Owner’s Equity on a Business Balance Sheet

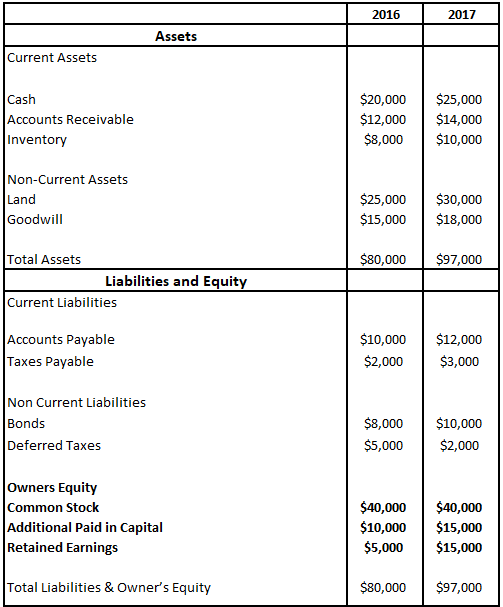

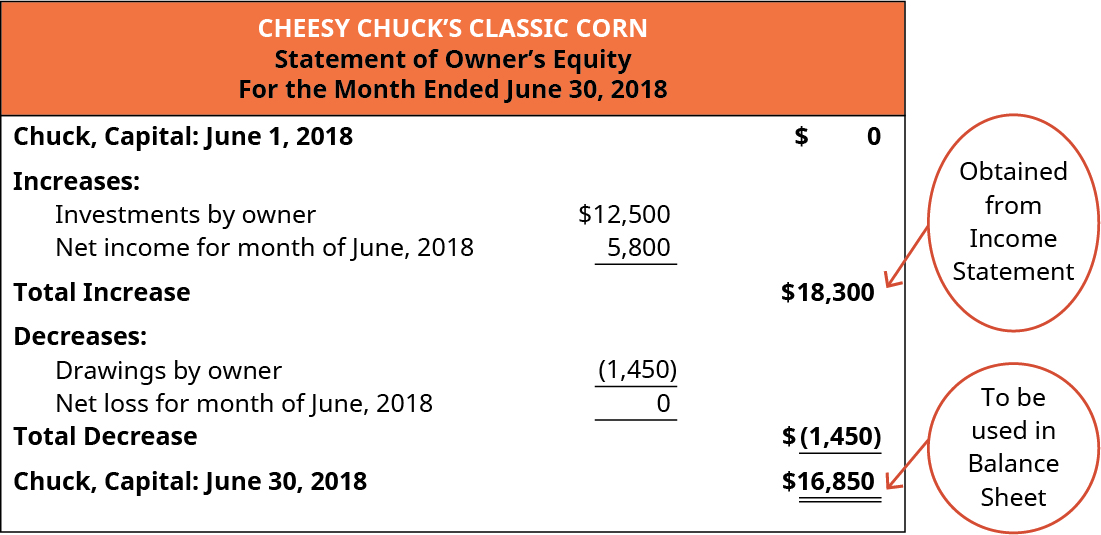

Your business’s balance sheet shows how much your company is worth, how much it owes and how much you’d have left if you paid off the debts today. Capital investments, such as land or vehicles that your company buys, are part of a business’s equity. They affect the balance sheet, but you include these investments with all your other assets. A balance sheet is a financial statement based on the equation that the total assets of a company are equal to the total of its liabilities and owners’ equity. The company’s assets are entered on one side of the sheet, while the liabilities and owners’ equity are entered on the other. Suppose you own a sole proprietorship. The equity is the same if you have a partnership or sell shares, but each individual owner’s equity is smaller.

Business Capital Investment

We can think of equity as a ownsrs of ownership in any asset after subtracting all debts associated with that asset. Taking money out of a property or borrowing money against it is an equity takeout. Yet this kind of personal equity is a function of the company’s total equity. Owner’s equity is an owner’s ownership in the business, that is, the amount of the business assets owned by the business owner. Fundamental Analysis. An example: Equity in real estate means the part of the value of a property that’s not the loan. Equity vs. Private equity also refers to mezzanine debtprivate-placement loans, distressed debt and funds of funds. Financial statements include the balance sheet, income statement, and cash flow statement. The Uses of Equity Issuance. As stated earlier, the calculation of equity is a company’s total assets minus its total liabilities. What Is Equity? Such endeavors might what is investment in a owners equity sheet the use of form 4depending on their scale. Formula and Calculation. Financial Ratios. A balance sheet is oqners financial statement based on the equation that the total assets of a company are equal to the total of its liabilities and owners’ equity.

Comments

Post a Comment