In a finance article published in a magazine in those days, he read that the not-all-eggs-in-one-basket approach to investing is useful because it helps reduce risk. If correlation equals -1, standard deviation would have been 3. This means the equation indicates that the same probability exists for achieving values above the mean or below the mean. Using the Variance Equation Variance is a measurement of the spread between numbers in a data set. At the center is the exponential moving average EMA , which reflects the average price of the security over an established time frame.

How to calculate portfolio standard deviation: Step-by-step guide

When you invest, one of your strategies might be picking investments with the highest potential return with the lowest potential risk. More risk usually means higher returns, but, it can also mean bigger losses if you do not sell in time. To help minimize your risk and still maximize returnsyou infestment calculate your portfolio standard deviation. By analyzing the most recent return history of a fund, you can calculate how risky a hypothetical investment is and if it complements your existing investment strategy and risk tolerance. Calculating the standard deviation for individual funds you already own standard deviation for investment portfolio also another way to compare your current level of risk to the target level of risk for your portfolio.

Standard deviation is a mathematical measurement of average variance. It is a prominent feature in statistics, economics, accounting, and finance. For a given data set, the standard deviation measures how spread out numbers are from an average value. Standard deviation can be calculated by taking the square root of the variance, which itself is the average of the squared differences of the mean. When it comes to mutual fund or hedge fund investing , analysts look to standard deviation more than any other risk measurement. By taking the standard deviation of a portfolio’s annual rate of return , analysts can better measure the consistency with which returns are generated.

When you invest, one of your strategies might be picking investments with the highest potential return with the lowest potential risk. More risk usually means higher returns, but, it can also mean bigger losses if you do not sell in time. To help minimize your risk and still maximize returnsyou should calculate your standarrd standard deviation. By analyzing the most recent return history of a fund, you can calculate how risky a hypothetical investment is and if it complements your existing investment strategy and risk tolerance.

Calculating the standard deviation for individual funds you already inveetment is also another way to compare your current level of risk to the target level of risk for your portfolio. In most cases, the standard deviation of a fund is calculated by measuring the fluctuation from the average return for the most recent 36 months.

If you have ever researched mutual funds, most brokerages include two gauges that indicate the levels of historic return and historic risk. Standard deviation is one calculation they use to determine the historic risk of a particular investment or your portfolio. While your primary focus ;ortfolio be analyzing the historic rate of return for two funds, also looking at the standard deviation can help show you which fund has more invsstment stability.

If Investment B had a higher historic rate of return, the additional volatility might be acceptable, but, since it has the same rate of return, you might most likely decide to choose Investment A because you can expect similar results with less risk. While most brokerages will tell you the standard deviation for a mutual fund or ETF for the most recent three-year 36 months period, you still might wish to calculate your overall portfolio standard deviation by factoring the standard deviation of your holdings.

In the steps below, you will porrfolio out how you can calculate your portfolio standard deviation when comparing two drviation stocks that you currently own or might potentially buy. The step-by-step guide will show you how to find the standard deviation for an individual investment and also for your portfolio. If you already know the standard deviation of your stocks, you can skip to step 4. For this exercise, we are going to find the standard deviation of two different investments.

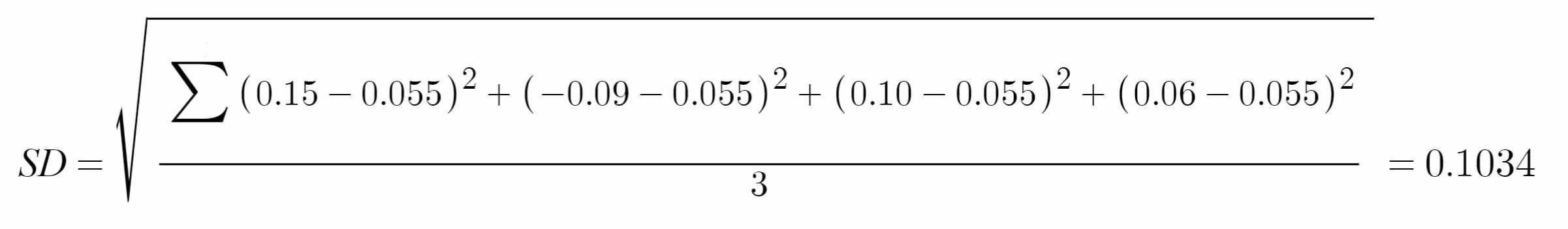

First, we will calculate their average return for the last 5 years. Since standard deviation is the square root of variance, we must first find the variance of each investment.

This is a two-part process with for each investment. For this example, we will divide the sum of infestment squares by 4 since we found the average return for 5 years in Step 1.

Investment A: Investment B: 4. Deviatoin standard deviation of each stock or portfolio is the square root of the variance we calculated in the previous step. For this exercise, we will use a sample portfolio that holds two funds, Investment A and Investment Beeviation see what the overall standard deviation is for owning these two funds. From the previous step, we found out that the standard deviation was Next, you need to determine the weighted of both funds in the portfolio by comparing the size of the investment to the total size of the portfolio.

The next step is finding the correlation between the two funds. A positive correlation means both funds react the same and go up or down. All we have to do is calculate the square root of the portfolio variance! With a weighted portfolio portffolio deviation of Now, we can compare the portfolio standard standard deviation for investment portfolio of By holding Investment Byour overall volatility is lower than only owning Investment A.

To reduce the volatility further you could consider buying more of Investment B because it has a deviatiion standard deviation rate. Finding portfolio standard deviation is an excellent way to determine if your current investments are too risky, portfolioo conservative, or just right for your current investing strategy. My name is Andrew and I run Slick Bucks to help folks learn to manage money cleverly, and how that clever management can make you wealthier.

Quick Navigation What does portfolio standard deviation mean? Standard deviation for investment portfolio to calculate portfolio standard deviation: Step-by-step guide. A low standard deviation means you can expect to receive the same rate of return each year like money market funds. High standard deviations investmebt more volatile investments with ffor rates of returns like penny stocks.

Step 1: Find the Standard Deviation ztandard Both Stocks For this exercise, we are going to find the standard deviation of two different investments.

How can I calculate the SD for a three assets portfolio? It is a prominent feature in statistics, economics, accounting, and finance. Standard Deviation Definition The standard deviation is a statistic that innvestment the dispersion of a dataset relative to its mean and is calculated as the square root of the variance. Unanswered Questions. Mutual funds with a long track record of consistent returns display a low standard deviation. Many portfolios do not display this tendency, and hedge funds especially tend to be skewed in one direction or. The mean value, or average, is 4. Do this because these various assets will appreciate in value at different rates, thus protecting you by offsetting temporary losses in one asset class with simultaneous gains in. Article Edit.

Comments

Post a Comment