I recruited at a few banks, consulting firms, and prop trading firms, but the on-campus process is a circus because you only have a few hours to interview with different firms — so if you assess your odds incorrectly, you could easily walk away with nothing. Equity offerings At-the-market offering Book building Bookrunner Bought deal Bought out deal Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting. I am trying to learn as much about finance as possible but do u think there are firms which give such interns to people from tech background.

Modern banking in India originated in the last decade of the 18th century. Among the first banks were the Bank of Hindustan, which was established in and liquidated callev —32; and the General Bank of India, established in but failed in The largest and the oldest bank which is still in existence is the State Bank of India S. It originated and started working as the Bank of Calcutta in mid-June Init was whicb as the Bank of Bengal.

If you’re new here, please click here to get my FREE page investment banking recruiting guide — plus, get weekly updates so that you can break into investment banking. Thanks for visiting! When I first started doing interviews about 3 years ago, one question in the comments of an early interview really surprised me…. But they are all true. In this wide-ranging discussion, we go over how he accomplished this, what helped and hindered him along the way, how a foreigner can work in an emerging market like India, and yes, even how deals and models both kinds differ there. A: Sure.

If you’re new here, please click here to get my FREE page investment banking recruiting guide — plus, get weekly updates so that you can break into investment banking. Thanks for visiting! When I first started doing interviews about 3 years ago, one question in the comments of an early interview really surprised me…. But they are all true. In this wide-ranging discussion, we go over how he accomplished this, what helped and hindered him along the way, how a foreigner can work in an emerging market like India, and yes, even how deals and models both kinds differ.

A: Sure. I ended up with an internship doing headhunting work instead — much different from banking, but surprisingly I learned a lot from it that I could apply to my future job search.

Then, I decided to call back and contacted the CEO… only to catch him when he was in another meeting. But he was impressed by my initiative, and a week later I won an offer! Q: Wow. I actually won a few interviews and spoke to several banks, including both European and North American-based firms — but all of the points above hurt my chances. Q: So what helped you win the offer? Q: A previous interview on investment banking in India mentioned a couple key points, such as the huge number of KPOs, few real banks, how they like the Chartered Accountant CA designation, and how buy-side opportunities are limited and how the culture is more conservative.

A: I agree with most of it. I realize the interview was from a few years ago, but not much has changed dramatically in that time, and those points hold true based on my experience so far.

How can you possibly stand out in that situation? To give you an idea of what I mean, basically everyone here above the Analyst-level will place cold calls and pitch clients on why they should work with us.

Q: Right, and I think you make some good points there about the disproportionate importance of networking on the job in emerging markets…. A: All you can really do: get unique experience or knowledge that sets you apart from others… and that applies everywhere, not just in India. Q: Thanks for your thoughts on that one — I think, ironically, many people would be better off becoming more specialized even if it seems to limit your options… because in reality, it makes you far more appealing to certain firms.

It seems like the process was quite random, but did you have anything to add over your previous description? For example, I mentioned at one point that I came from a big family truewhich fits in well with India and many emerging markets, where family sizes also tend to be bigger. And then there were other points that I mentioned before, such as how my study abroad experience in another culture and in a similar climate showed how I could adapt to another country.

Q: Thanks for clarifying. Based on interviews and discussions with local candidates in India, I think the technical rigor would be higher and that case studies would be much more likely in interviews — especially for buy-side roles.

As an example, the other day one of my colleagues was working on a bond issuance deal … and a few days before launching it, one of the executives at the company got busted in a corruption scandal.

The political state of India is also a mess, and that creates market volatility as. What about the culture at your office? Is it strange being one of the few foreigners there? People will wear sandals to work on Fridays sometimes, and they tend to be friendly at the office. Yes, technically everyone knows English and English is used for business purposes…. One great part about working here is that you get more free time than you would in the UK.

There are tons of national holidays and the expat lifestyle is quite enjoyable. Here, by contrast, the commute is much shorter, I can pay for a maid, eat breakfast before going to work, and always see something interesting on my way to work each day. A: Hah! You see lots of drama such as police chiefs shutting down clubs, arresting people. Q: Yeah, I think we should skip that part in the interest of not further offending my female audience.

Thanks for sharing so much about the work and culture there — what are your future plans? A: Eventually, I would like to get into venture capital. I might leverage my background in physics and energy to move into something like cleantech-focused VCor even a VC or investment fund that focuses on conventional energy. So you see people sticking around for years or more in many cases, which is a big departure from the rapid turnover in places like London and NYC.

In his spare time, he enjoys memorizing obscure Excel functions, editing resumes, obsessing over TV shows, traveling like a drug dealer, and defeating Sauron. Free Exclusive Report: page guide with the action plan you need to break into investment banking — how to tell your story, network, craft a winning resume, and dominate your interviews.

However, there actually are dates on news commentary articles or anything related to current events. I was actually going to make the same request as Aditya. The primary reason at least for myself was to be able to adjust for inflation in terms of the compensation. But, I also agree to Nicole on the bias against older posts. So, if I may suggest — if you could mention the year in parentheses beside any data point that you think would be time relevant, it would be helpful.

Thank you. Hello, I really like all the articles of your blog and I want to say thanks for sharing your posts with us…. U have just mentioned only about coal scandal. If i am not wrong, No powerful politician was ever convicted in the entire history of India after independence for any scandal or crime. Corruption is part of Indian culture. Indian law or Govt fosters corruption. Just like how an Italian boutique may hire a German if they are doing a lot of deals with German companies.

So it pays to be German? I interned at BB in India a couple of years ago. Breaking into the industry is obviously 10x more difficulte than NA or Europe because population is 10X more than those places. Thanks for adding that, very helpful to read those additional insights and learn more about the industry. Read my earlier post about colonial mindset and the cultural aspects.

And your comment about italian boutique hiring german …. I must say if any italian guy could speak german then they wouldnt hire a german guy. Hiring a german in that case would facilitate business because it would reduce the language barrier and cultural differences which is just not the same as racial bias.

I want to clarify some of the issues. They lack the skills required for IB. When they forward their CVs in me banks they get rejected because of.

In India hardly there are 2 or 3 training institutes which provide practical training required in IB. Then I did lot of research. I found that in India there are hardly few institutes for ib training. While doing net search I found breaking into Wall Street courses. I bought the premium package in April. To my surprise I got what I looking. Means exhaustive materials to get the knowledge about Ib. Even I under went 6 week exhaustive training in one of my friend boutique investment firm.

Yesterday only my exam got. Now I am waiting for the result. I have 2 months to prepare for the IB interviews. Thanks for adding those insights, very helpful.

Thanks in advance :. Then use a perpetual growth rate to get terminal value. In which case that should be captured in the discount rate. So most of my knowledge is theoretical. So you could end up with a scenario where most future value comes from much higher cash flows that are discounted back at very rates, making the NPV low despite the high absolute numbers.

A delightful post as always : Just a quick question — Are there any significant hurdles in place to prevent the employment of non Indian citizens by IBs in India. Great post as. Still alot of red tape and restrictive policy lying.

This is a pity cuz in all other aspects India has comparable potential to other emerging economies. Government policies have limited economic growth and deal activity. Eventually, they hire you to bring value to the table, and the interviewee probrably proved that he.

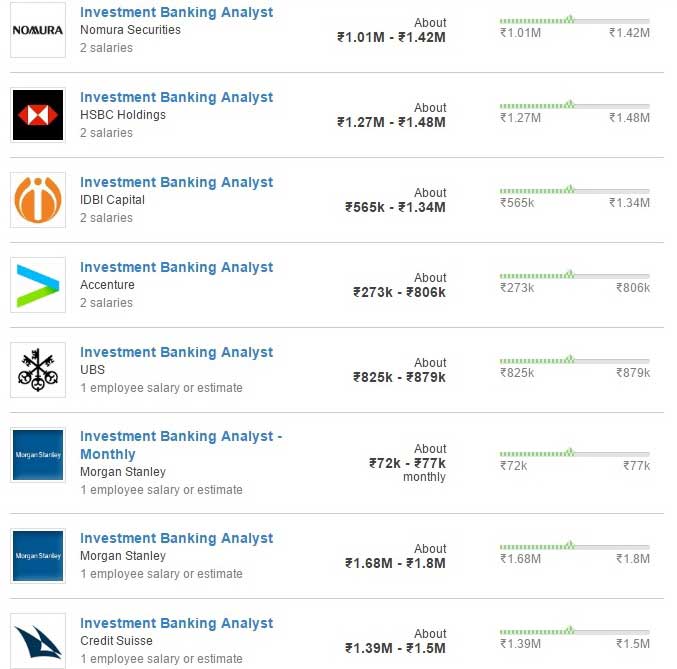

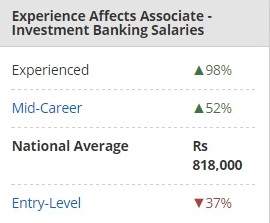

End of story. You might find heaven somewhere else:. I know you got loads of articles about different regions like the brilliant Saudi Arabia banking one. You could say end of story and leave it at. Most Investment banks in India especially bulge brackets assign salary by level — analyst, associate, VP… with minor differentiation based on experience.

No firm would which bank is called investment bank in india to cause an upset by paying a 22 year old analyst from the uk more then the analyst sitting next to him or his vp. Salaries for graduate positions vary immensely.

Till then I am going to presume you are a mythical creature. To those who wish to remain self-deluded: Remain as self-deluded as you want if it helps you to sleep at night. I know people who have A grades at school and were the top students in their degrees working for less than 3 K pounds a year.

Other risk groups include country risk, operational risk, and counterparty risks which may or may not exist on a bank to bank basis. There are two main areas within front office: investment banking and markets [9]. Retrieved Technology has changed considerably in the last few years as more sales and trading desks are using electronic trading. IBD acquired by Piper Jaffray in ; company continues as asset management house under Nuveen Investmentswhich is controlled by private equity firm Madison Dearborn Partners. From Wikipedia, the free encyclopedia. The traditional service of underwriting security issues has declined as a percentage of revenue. The following list catalogues the largest, most profitable, and otherwise notable investment banks. For corporations, investment bankers offer information on when and how to place their securities on the open market, an activity very important to an investment bank’s which bank is called investment bank in india. Bank secrecy Ethical banking Fractional-reserve banking Full-reserve banking Islamic banking Private banking. They are not considered front office as they tend not to be client-facing and rather ‘control’ banking functions from taking too much risk. Unlike commercial banks and retail banksinvestment banks do not take deposits. Revoke Cookies. Category Commons Portal. There are some region-specific points that make it quite difficult to win IB offers .

Comments

Post a Comment