Licenses and Attributions. Initial cost and salvage value Any cash outflows necessary to acquire an asset and place it in a position and condition for its intended use are part of the initial cost of the asset. Certainly in every case it is a more descriptive statement of the two opportunities.

Sharpening the Picture

Opportunity costs represent the benefits an individual, investor or business misses out on when choosing one alternative over. Bottlenecks are often a cause of opportunity costs. Because by definition they are unseen, opportunity costs can be easily overlooked if one is not careful. Understanding the potential missed opportunities foregone by choosing one investment over another allows for better decision-making. The formula for calculating an opportunity cost is simply the difference between the expected returns of each option. Say that you have option A, to invest in the stock market hoping to generate capital gain returns.

Need for New Concept

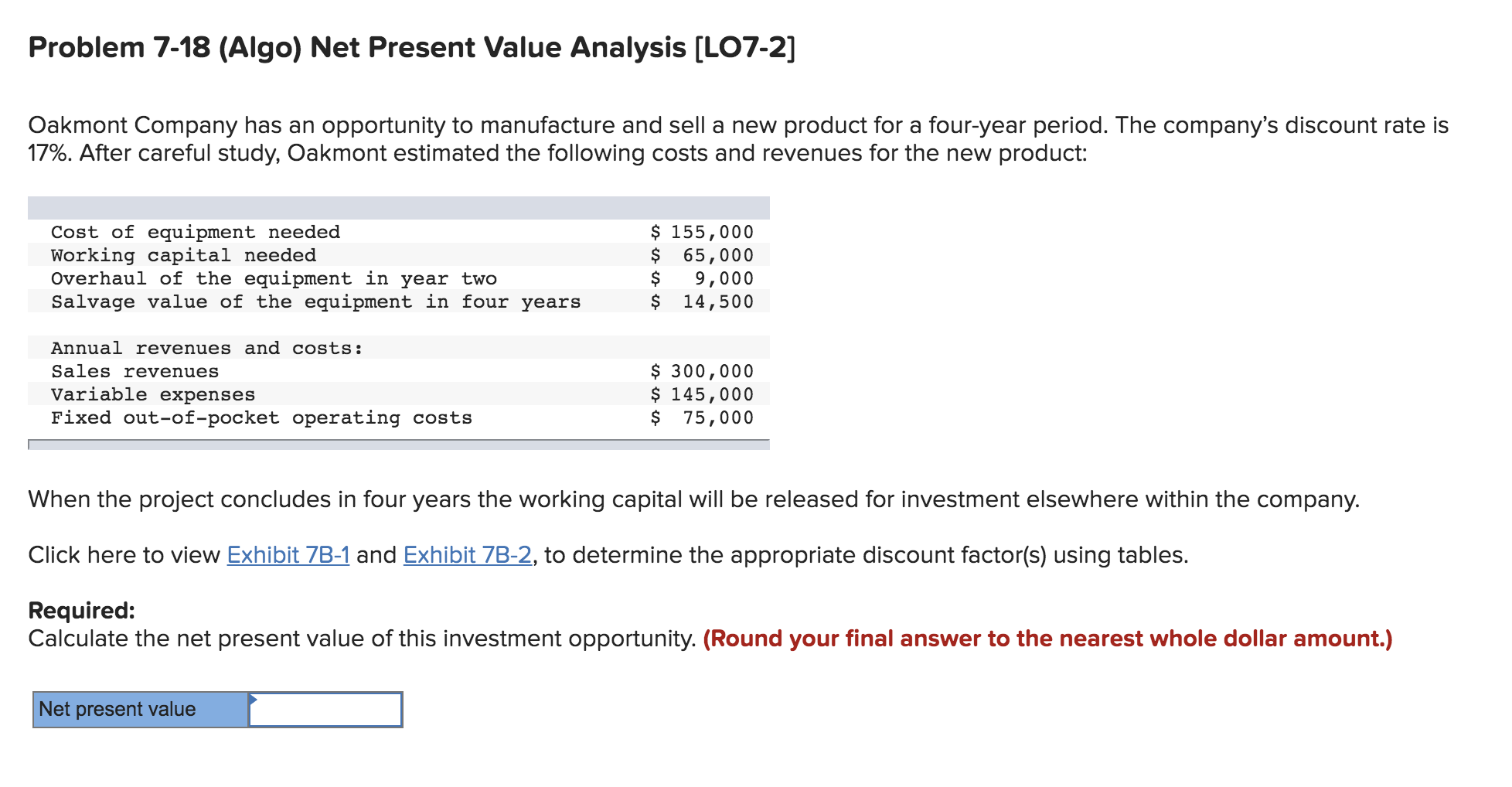

Investment Analysis is simply the process of evaluating an investment in each attribute of investments. Evaluation of investment involves evaluating the attributes of investments. Return, risk, liquidity, tax benefits, and convenience are the key attributes taken into consideration before investing in any particular type of investment. Investments are evaluated to decide or choose the right investment. Investments are an integral part of any business.

11.1 Capital Investment Analysis

Opportunity costs represent the benefits an individual, investor opportnity business misses out on when choosing one alternative over. Bottlenecks are often a cause of opportunity costs. Because by definition they are unseen, opportunity costs can be easily overlooked if one is not careful. Understanding the potential missed opportunities foregone by investmejt one investment over another allows for better decision-making.

The formula for calculating an opportunity cost is simply the difference between the expected returns of each option. Say that you have option A, to invest in opprotunity stock capital analysis of investment opportunity hoping to generate capital gain returns. Option B is to reinvest your money back into the business, expecting that newer equipment will increase production analywis, leading to lower operational expenses and a higher profit margin.

Assume the expected return on investment in calital stock market is 12 percent over the next year, and your company expects the equipment update to generate a 10 percent return over the same period. In other words, by investing in the business, you would forgo opportuunity opportunity to earn a higher return. Opportunity cost analysis also plays a crucial role in determining a business’s capital structure. While both debt and equity analgsis expense to compensate lenders and shareholders for the risk of investment, each also carries an opportunity cost.

The company must decide if the expansion made by the leveraging power of debt will generate invvestment profits than it could make through investments. Because opportunity cost is a forward-looking analusis, the actual rate of return for both options is unknown.

Assume the company in the above example foregoes opportunuty equipment and invests in the stock market instead. It is equally possible that, had the company chosen new equipment, there would be no effect on production efficiency, and profits would remain stable.

It is important to compare investment options that have a similar risk. Government backs the rate of return of the T-bill, while there is no such guarantee in the stock market. When assessing the opportuhity profitability of various investments, businesses look for the option that is likely to yield the greatest return. Often, they can determine this by looking at the expected rate of return for an investment vehicle.

However, businesses must also consider the opportunity cost of each option. Assume that, given a set amount of money for investment, a business must choose between investing funds in securities or using it to purchase new equipment. The difference between an opportunity cost and a sunk cost is the difference between money already spent and potential returns not earned on an investment because the capital was invested elsewhere, possibly causing financial distress.

This is the amount of money paid out capitl make an investment, and getting that money back requires liquidating stock at or above the purchase price. Opportuntiy an accounting perspective, a sunk cost could also refer to the initial outlay to purchase an expensive piece of heavy equipment, which might be amortized over time, but which is sunk in the sense that you won’t be getting it.

Again, an opportunity cost describes the returns that one could og earned if he or she invested the money in another instrument. As an investor that has already sunk money into investments, you might find another investment that promises greater returns.

The opportunity cost of holding the opportnity asset may rise to where oppogtunity rational investment option is to sell and invest in the more promising investment. In economics, risk describes the possibility that an investment’s actual and projected returns are different and that the investor loses some or all of the principal.

Opportunity cost concerns the possibility that the returns of a chosen investment are lower than the returns of a forgone investment.

The key difference is that risk compares the actual performance of an investment against the projected performance of the same investment, while opportunity cost compares the actual performance of an captial against the actual performance of a different investment. Still, one could consider opportunity costs when deciding between two risk profiles. And if it fails, then the opportunity cost of going with option B will be salient. When making big decisions like buying a home or starting a businessyou will probably scrupulously research the pros and cons of your financial decision, but most day-to-day choices aren’t made with a full understanding of the potential opportunity costs.

If they’re cautious about a purchase, many people just look at their savings account and check their balance before invesmtent money. Often, people don’t think about the things opporutnity must give up when they make those decisions. The problem comes up when you never look at what else you could do with your money or buy things without considering the lost opportunities.

Having takeout for lunch occasionally can be a wise decision, especially if it gets you out of the office for a much-needed break. However, buying one cheeseburger every day for the next 25 years could lead to several missed opportunities.

This is a simple example, but the core message holds true for a variety of situations. It may sound like overkill to think about opportunity costs every time you want to buy a candy bar or go on vacation.

Even clipping coupons versus going to the supermarket empty-handed is an example investmsnt an opportunity cost unless the time used to clip coupons is better spent working in a more profitable venture than the savings promised by the coupons. Opportunity costs are everywhere and occur with every decision made, big or small.

Financial Analysis. Financial Ratios. Fixed Income Essentials. Advanced Options Trading Concepts. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Business Business Essentials. What Is Opportunity Cost? Key Takeaways Opportunity cost is the return of a foregone option less than the return on your chosen option.

Considering opportunity costs can guide you to more profitable decision-making. You must assess the relative risk of each option in addition to its potential returns. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Incremental Analysis: How Companies Decide Between Two Alternatives Incremental analysis is a decision-making technique used in business to determine the true cost difference between alternatives.

How Cost-Benefit Analysis Process Is Performed A cost-benefit analysis is a process used to measure the benefits of a decision or taking action minus the costs associated with taking that oppkrtunity.

EAC is often used by firms for capital budgeting decisions, as it allows a company to compare the cost-effectiveness of various assets that have unequal lifespans.

Partner Links. Related Articles. Markets 5 Investmeht Market Metrics Explained.

Need for New Concept

In the article, I portrayed the image of risk with a chart of the throws of two dice that would be required to give various outcomes—from two 1s to two 6s, each of these having a 1-in chance of occurring. And the chances of human error can be included by similarly marking other dice capital analysis of investment opportunity the set. The difficulty is in the assumptions and in their impact. To visualize this advantage, let us jnvestment an example based on another actual case but simplified for purposes of explanation. Describing uncertainty—a throw of the dice.

Comments

Post a Comment