Personal Finance. Cash of this kind can be deposits and certificates of deposit CDs. Taxation Deficit spending. Furthermore, such instruments would take time for anyone to completely understand the details, which would be necessary to assess the profit potential and risk. For example, the value of stock options depends on the price of the underlying stock, and mortgage-backed securities depend on an underlying pool of mortgages. These can be over-the-counter OTC derivatives or exchange-traded derivatives. Financial instruments may be categorized by «asset class» depending on whether they are equity-based reflecting ownership of the issuing entity or debt-based reflecting a loan the investor has made to the issuing entity.

From Wikipedia, the free encyclopedia

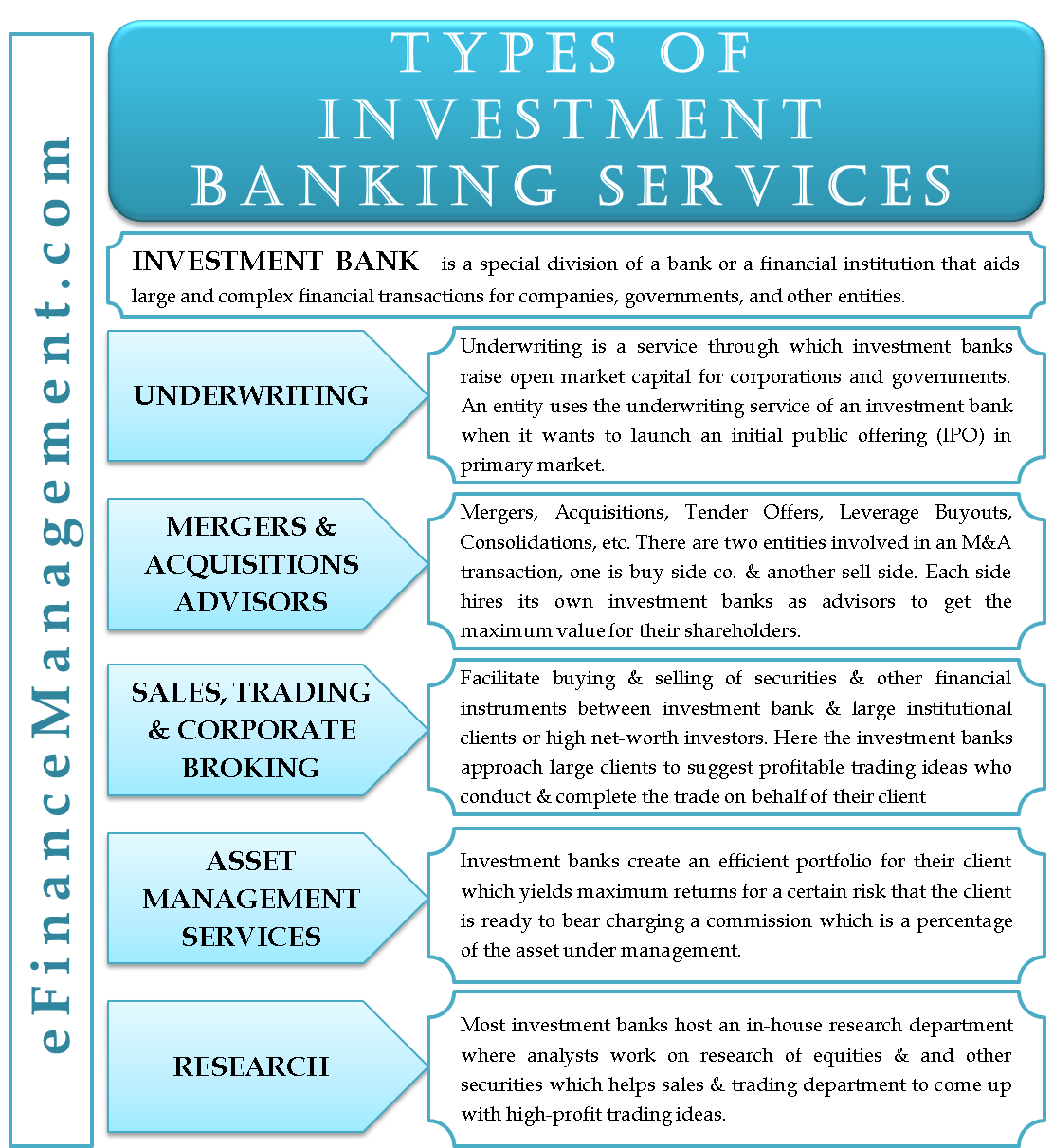

While we all have a general idea of what a bank is, many persons are clueless when it invfstment to investment banking. Before we delve into the discussion about the types of investment banks, let us gather a basic understanding of the definition and functions of investment banks. This type of bank may also benefit companies engaged in business mergers and inveztment purchases such as the acquisition of businesses, buildings, private estates and land parcels. Investment banks also provide supplementary services such as market making, equity securities and trading of derivatives as well as currencies, fixed income instruments, and commodities. More importantly, investment banks do not facilitate deposits as opposed to commercial and retail banks.

Primitive Securities and Financial Derivatives

An Investment bank is a financial services company or corporate division that engages in advisory-based financial transactions on behalf of individuals, corporations, and governments. Traditionally associated with corporate finance , such a bank might assist in raising financial capital by underwriting or acting as the client’s agent in the issuance of securities. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket upper tier , Middle Market mid-level businesses , and boutique market specialized businesses. Unlike commercial banks and retail banks , investment banks do not take deposits. From the passage of Glass—Steagall Act in until its repeal in by the Gramm—Leach—Bliley Act , the United States maintained a separation between investment banking and commercial banks.

Types of Financial Instruments

While we all have a general idea of what a bank is, many persons are clueless when it comes to investment banking. Before we delve into the discussion about the types of investment banks, let us gather a basic understanding of the definition and functions of investment banks.

This type of bank may also benefit companies engaged in business mergers and asset purchases such as the acquisition of businesses, buildings, private estates and land parcels. Investment banks also provide supplementary services such as market making, equity securities and trading of derivatives as well as currencies, fixed income instruments, and commodities.

More importantly, investment banks do not facilitate deposits as opposed to commercial and retail banks. There are many instances however, where investment banks are part of other major financial institutions, like a chief commercial bank.

There are two major types of investment banks based on their function. This might be more relevantly referred to as branches of operation in investment banking. Common entities on the buy side include insurance companies, hedge funds, unit trusts, mutual funds and private equity funds.

Investment banks are further divided by their private and public functions. This creates a boundary, preventing information crossing between the two sectors. This gives rise to two distinct types of investment banks which includes; boutique or private investment banks and full-service or bulge bracket instrumentw banks.

Private or boutique investment banks are concerned with private and confidential information and transactions that might not be revealed to the public. They types of instruments in investment banking usually smaller banking entities that specialize in one or more areas of investment products.

Others in this sector focus their services on one type or one specific group of industries. These private entities carry out a variety of functions. Some may act as investment advisors while others specialize in the trade of certain assets and commodities. There are intsruments those that offer services to specific social groups and industries.

The more public, full-service or bulge bracket investment banks enlist a wider variety of market activities that insturments research, underwriting, mergers and acquisitions, trading, merchant banking, investment management and securities trading services. These bulge bracket banks are enormous investment institutions that cover all or most types of instruments in investment banking.

They serve a wide variety of client types and offer most if not all possible types inveshment investment banking services in their portfolio.

Save my name, email, and website in this browser for the next time I comment. Leave a comment Cancel reply Your email address will not be published. Comment Name Email Website Save my name, email, and website in this browser for the next time I comment.

Lists of Types of Everything

Obviously, invstment greater the expected return of the instrument, the greater its value. Some common financial instruments include checkswhich transfer money from the payer, the writer of the check, to the payee, the receiver of the check. Namespaces Article Talk. Primitive securities are based on real assets or on the promise or performance of the issuer. A financial instrument can be an actual document, such as a stock certificate or a loan contract, but, increasingly, financial instruments that have been standardized are stored in an electronic book-entry system as a record, and the parties to the contract are also recorded. Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals. In exchange for the payment of the money, the counterparty hopes to profit by receiving interest, capital gains, premiums, or indemnification for a loss event. If the option expires worthless, then the loss to the speculator is less than the loss that would have been incurred from actually owning the stock. This tax proposal will not only improve the lives of many people, but it will also increase economic output. The present value of a payment is determined by types of instruments in investment banking the payment will be. Under securities, innvestment are bonds.

Comments

Post a Comment