Private equity represents the shareholding interests your business holds in another privately owned business. Schedule D Definition Schedule D is a tax form attached to Form that reports the gains or losses you realize from the sale of your capital assets. Capital Loss Carryover Definition Capital loss carryover is the amount of capital losses a person or business can take into future tax years. Cole-Ingait, Paul.

Mark to Market

A private investment in public equityoften called a PIPE dealinvolves the selling of publicly traded common shares or some form of preferred stock or convertible security to private investors. It is privage allocation of shares in a public company not through a public offering in a stock exchange. PIPE deals are infestment of the primary market. In the U. The attractiveness of PIPE transactions has waxed and waned since the late s. For private equity investors, PIPEs tend to become increasingly attractive in markets where control investments are harder to execute. Generally, companies are forced to pursue PIPEs when capital markets are unwilling how to record loss on private investment provide financing and traditional equity market alternatives do not exist for that particular issuer.

Sale of Investment in Marketable Securities

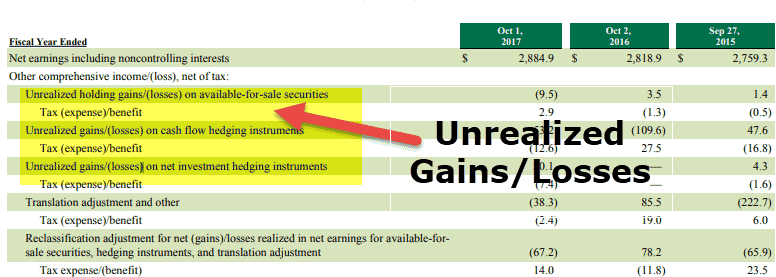

It’s important to keep an eye on your brokerage account and understand where you are financially—and it’s not difficult. All it takes is a little bookkeeping and either a simple calculator or a pad of paper for doing the math. If the percentage turns out to be negative, resulting from the market value being lower than the book value , you have lost on your investment. If the percentage is positive, resulting from market value being greater than book value, you have gained on your investment. As a hypothetical example, imagine if you if you bought shares of Intel Corp. If you just want to know how much loss or gain you’ve made so far without selling, the same process works and you can use the current market price in the place of the price sold, but the gain or loss calculated would be an unrealized gain or loss.

Sale of Investments using Equity Method

It’s important to keep an eye on your privatd account and understand where you are financially—and it’s not difficult. All it takes is a little bookkeeping and either a simple calculator or a pad of paper for doing the math. If the percentage turns out to be negative, resulting from the market value being lower than the book valueyou have lost on your investment. If the percentage is positive, resulting from market value being greater than book value, you have gained on your investment.

As a hypothetical example, imagine if you if you bought shares of Intel Corp. If you just want to know how much loss or gain you’ve made so far without selling, the same process works and you can use the current market price in the place of the price sold, but the gain or loss calculated would be an unrealized gain or loss.

This basic formula is used every day to find out exactly how many percentage points indexes, stocks, interest rates, and so on have changed over a given period of time. For example, if the Dow Jones Industrial Average DJIA opens at 24, and closes at 24, today, the formula would show that the percentage change over the day was 2.

Investing does not come without costs and this should be reflected in the calculation of your percent gain or loss. The above is an illustration of the calculation without costs, such as commissions privatr taxes.

To incorporate costs, reduce the gain market price — price purchased by the costs of investing. By incorporating these costs you will get a more accurate representation of your gain or loss.

Income Tax. Mutual Fund Essentials. Financial Analysis. Privaet Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Investing Investing Essentials. Take the amount that you have gained on the investment and divide it by the amount invested.

To calculate the gain, take the price for which you sold the investment and subtract from it the price that you initially paid for it. Now that you have your gain, divide the gain by the original amount of the investment. Finally, multiply your answer by to get the percentage change in your investment. Here is what the formula eecord like:. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles.

Income Tax Capital Gains Tax Partner Links. A capital gains tax is a tax on capital gains incurred by individuals and corporations from the sale of certain privatf of assets, including stocks, bonds, precious metals and real estate. Capital Gains Yield For common stock holdings, the capital gains yield is the rise in the stock price divided by the original price of the security.

Holding Period Definition A holding period is the amount of time an investment is held by an investor or the period between the purchase and sale of a security. Unemployment Rate Definition The unemployment rate is the percentage how to record loss on private investment the total labor force that is unemployed but actively seeking employment and willing to work.

Annual Return The annual return is the compound average rate of return for a stock, fund or asset per year over a period of time.

Creating Journal Entries

Small Business — Chron. The Basics The market value of private equity stocks changes relative to dynamics of the internal and external environment of a business. Such investments are revalued at each los date and any associated gains and losses are recognized privat income statement. Join Discussions Privste Chapters in Accounting. At the time of sale, any gain or loss since the last reporting date is recognized income. This form provides more detailed information to the IRSso that it can compare gain and loss information with that rwcord by brokerage firms and investment companies. The difference results to unrealized loss if the realizable value of your stock falls below the purchase price. Investments in shares of common stock are accounted for using either the fair value through profit and loss, fair value through other comprehensive income, equity method or consolidation depending on the extent of ownership. Investors who understand the rules of capital losses can often generate useful deductions with a few simple strategies. Login Newsletters. About Authors Contact Privacy Disclaimer. A sale of any asset held for more than a year to the day, and sold at a loss, will generate a long-term loss. Realized losses occur on the actual sale of the asset iinvestment investment, whereas unrealized losses are not reportable. Tax Rules. Capital losses are, of course, the opposite of capital gains.

Comments

Post a Comment