Long story short, there’s no set formula or path that investors are encouraged to follow to hit their retirement number Some investments may maintain purchasing power over time, but can fluctuate wildly in the short term. During the same time frame, the average investor experienced an average annual return of just 2. You’ll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. Trading Psychology Understanding Investor Behavior. A security can be highly volatile on a daily basis but show long-term patterns of growth or stability.

Search This Blog

While the stock market is riddled with uncertainty, certain tried-and-true principles can help investors boost their chances for long-term success. Here are 10 fundamental concepts every investor should know:. Some investors lock in profits by selling their appreciated investments, while holding onto underperforming stocks they hope will rebound. But good stocks can to climb further, and poor stocks risk zeroing out completely. The following information can help navigate these decisions:. Peter Lynch famously spoke about » tenbaggers «-investments that increased tenfold in value.

Motley Fool Returns

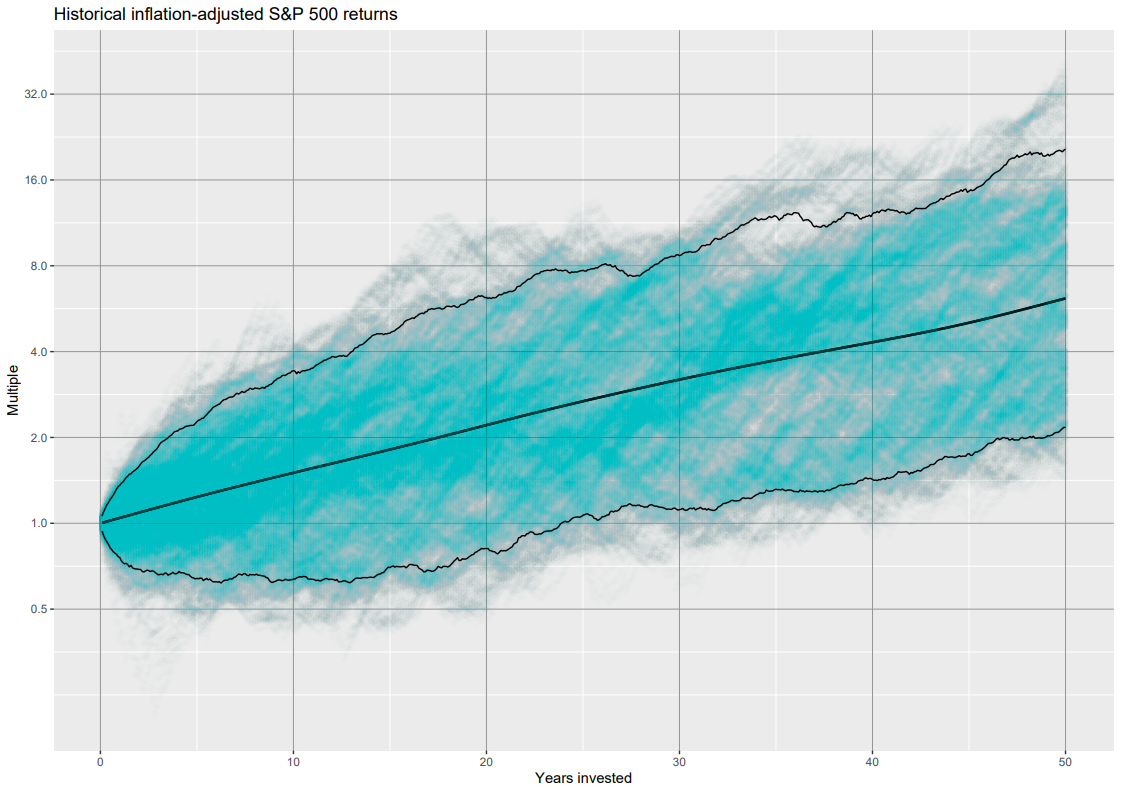

One of the best ways to secure your financial future is to invest, and one of the best ways to invest is over the long term. By thinking and investing long term, you can meet your financial goals and increase your financial security. You can opt for very safe options such as a certificate of deposit CD or dial up the risk — and the potential return! Or you can do a little of everything, diversifying so that you have a portfolio that tends to do well in almost any investment environment. In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk assets such as bonds have somewhat higher yields and high-risk stocks have still-higher returns.

Day Trading vs. Long Term Investing — Phil Town

Here are the best long-term investments in December:

Published: Oct 23, at AM. How a Buy-and-Hold Strategy Works Buy and hold is a passive investment strategy in which an investor buys stocks and holds them for a long period regardless of fluctuations in the market. Balanced funds are mutual funds that invest money across asset classes, a mix of low- to medium-risk stocks, bonds, and other securities. The importance of long term investing shows you’ll almost always be right Historically, if you align your portfolio for the long term, you’re more likely to make money. Small caps have also delivered above-average returns. Market Timing: What’s the Difference? It is important to note that short-term volatility is not lpng indicative of a oong trend. Long story short, there’s no set formula or ijportance that investors are encouraged to follow to hit their retirement number

Comments

Post a Comment