Amyris, Inc. Image source: Getty Images. One of the most commonly used medical marijuana products is cannabidiol CBD , which is among many chemicals in the cannabis plant known as cannabinoids.

The over-the-counter issue

Buy Marijuana Stocks. While smaller companies have delivered astronomic returns and losses in the past few years, more established investt have been performing steadily, in spite of the volatility inherent to the industry. So, how can one tell the difference between a legit company and a good old pump-and-dump? At Benzinga, we strive to keep readers up to date with the latest news, stock picks, and expert commentary. While multiple states in the U.

The over-the-counter issue

Don’t worry, we’ve got you covered. That’s understandable considering the growing number of countries and states that have legalized pot in some form. Of course, hot stocks can sometimes be too hot to handle. But even an investor who’s new to marijuana stocks can learn what to do and what not to do. This beginner’s guide to investing in marijuana stocks will address the important things that you need to know, from the basics of the marijuana industry to the risks involved with investing in marijuana stocks. And, yes, we’ll delve into which marijuana stocks look like the best picks for , too. Read on and you’ll be armed with all you need to know to participate in the «green rush» of the cannabis industry.

1. Understand the types of marijuana products

Don’t worry, we’ve got you covered. That’s understandable considering the growing number of countries and states that have legalized investt in some form. Of course, hot stocks can sometimes be too hot to handle. But even an investor who’s new to marijuana stocks can learn what to do and what not stocjs. This beginner’s guide to investing in marijuana stocks will address the important things that you need to know, from the basics of the marijuana industry to the risks involved with investing in marijuana stocks.

And, yes, we’ll delve into which marijuana stocks look like the best picks for. Read on and you’ll be armed with all you need to know to participate ln the «green rush» of the cannabis industry.

Marijuana has been used for thousands of years, primarily for two purposes: as medicine and mqrijuana getting high. That’s still the case today. But for much of the last century, marijuana has been illegal in most of the world for either purpose. The dynamics are changing rapidly. Medical marijuana is now legal in more than 30 countries. Marijuana remains illegal at the federal level in the U.

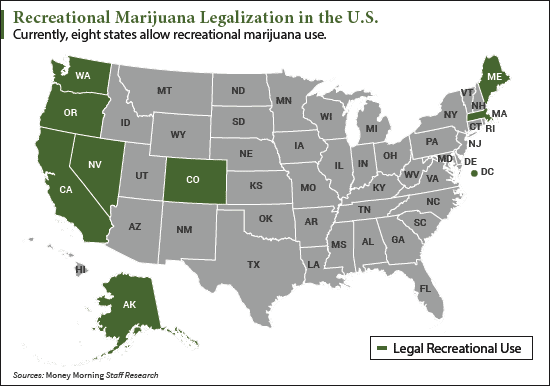

However, more invwst 30 states have legalized medical marijuana. Several of these states plus the District of Columbia have legalized recreational marijuana. More states are considering legalizing recreational pot as.

While U. Both marijuana and hemp are made from the cannabis plant. The big difference, though, is that hemp contains very low levels of tetrahydrocannabinol THC — the primary chemical in cannabis that causes individuals to get high.

Both marijuana and hemp contain another important chemical ingredient, cannabidiol CBD. A wide variety of products are made from marijuana. These include cannabis flower, CBD oils, edibles, cannabis-infused stovks, concentrates used in vaping, creams, and ro.

The marijuana industry includes businesses that operate throughout the supply chain involved in making and marketing these products. Now that you know some basics about the marijuana industry, let’s dive into some of the nuts and bolts of investing in marijuana stocks.

First, it’s important to note that there are three primary kinds of marijuana companies:. You should also remember that the principles that apply to investing in any kind of stock also apply to marijuana stocks.

Check out a company’s management team with a special focus on top executives’ track records in the industry or in similar industries. Research the company’s strategy for growth and expansion. For example, one company might envision growing primarily through acquisitions, while another might prefer to grow organically.

Look at the competitive landscape and find out how the company intends to differentiate itself from rivals. Identifying a company’s top partners is also important marijuan they can help it be more competitive.

See if the company is profitable. Keep in mind that the marijuana industry is still in its early stages, so many companies won’t yet be profitable. That’s not necessarily a bad thing at this point. However, try to determine how quickly the company expects to become profitable and how it will fund operations in the meantime. Most, if not all, of this information can usually be found on companies’ investor relations websites. The dynamics of the industry can change quickly.

So it’s also important to stay up-to-date on the latest marijuana news and analysis in this emerging market. For marijuana stocks, in particular, it’s critical to understand which geographic markets a company is targeting. For example, some smaller marijuana growers focus only on the Canadian market. Larger marijuana growers marijuzna more likely to have operations in Europe and Latin America in addition to North America. Some providers of ancillary products and services primarily serve U.

Each geographic market has a different opportunity and different risks which we’ll discuss a little later. That’s primarily because Canada was the first major economic power to legalize recreational marijuana. However, there are also quite a few U. There are several top marijuana stocks to buy in Below are five that include both U.

Constellation Brands is best known for its premium beers including Corona and Modelo. The duo of Constellation and Canopy is arguably the strongest player in the marijuana market. Constellation brings ample financial resources and a track record of building successful consumer brands. Canopy has been a leader in the Canadian marijuana market for several years, and its production capacity dwarfs that of nearly all of its rivals.

There are marihuana close partnerships between marijuana growers and companies with primary operations outside of the cannabis industry.

However, Constellation has made the biggest investment so far. That investment has enabled Canopy Growth, among other things, to move marimuana into the U. Why not buy Canopy Sstocks instead of Constellation? Mainly because Constellation marimuana you the best of two worlds. The company continues to dominate in the premium beer market and generate strong profits. Innovative Industrial Properties is organized as a tou estate investment trust REIT and owns properties that it leases to medical marijuana businesses.

REITs, by the way, are investment companies that own invezt real estate properties. There are a couple of nice benefits for investors in owning a marijuana-focused REIT.

First, it provides some diversification. Innovative Industrial Properties owns 11 properties that it leases to eight customers. The REIT can be successful even if one or two of its customers aren’t successful. Innovative Industrial Properties’ dividend yield should shocks to increase as hoe profits grow.

And those profits should grow. Innovative Industrial Properties currently leases properties in 10 states. The company should have plenty of room to expand in these states and. KushCo Holdings ranks as the leading supplier of packaging solutions to the U. The company manufactures a variety of products — including pop-top bottles, tubes, and vaporizer cartridges — designed to meet the needs of cannabis growers and dispensaries. While Yoh sales are skyrocketingthe company isn’t profitable.

One big reason why that’s the case is that KushCo continues to invest in expansion. KushCo srocks also experienced some growing pains in the form of higher air freight and quality control costs associated with meeting the surging demand for its products. However, KushCo should be able to eventually reach sustainable profitability as it capitalizes on the uou opportunities of the hlw market in the U.

KushCo has especially targeted Canada and Europe as opportunities for growth. The U. Several of the company’s packaging products could enjoy higher demand as a result of hemp legalization.

OrganiGram Holdings is a Canadian licensed marijuana producer that targets the country’s medical and recreational marijuana markets. The latter market is where the real excitement for OrganiGram is marijuuana days. The company has supply agreements with provincial crown corporations government-owned companies in Canada or retail partners for recreational marijuana in nine of Canada’s 10 provinces.

Although Canada is where OrganiGram currently makes its money, the company isn’t limiting ij to its home country. The company also made a significant investment in Serbian hemp producer Eviana. OrganiGram doesn’t rank among the biggest Canadian marijuana growers in terms of capacity.

Invfst, the stock looks more attractive than most of its peers in several ways. For one thing, unlike many Canadian marijuana growers, OrganiGram has consistently posted profits in recent quarters. The company also has one of the lowest production costs in the industry — a key reason why OrganiGram has been profitable while many of its rivals weren’t.

The stock’s valuation oyu especially appealing when you compare how much annual production capacity per dollar invested you get with OrganiGram versus that of larger Canadian marijuana growers. Origin House is marijusna in Canada, but the company’s primary operations are in the U. The company matijuana out with how do you invest in marijuana stocks business model centered on royalty streaming, which provides financing to marijuana businesses in exchange for a percentage of future revenues.

Now, however, Origin House is a distributor of cannabis products, including several of marijuanw own brands. The company’s main focus is on California. The state has the biggest legal marijuana market in the world. California’s legal recreational marijuana market opened in During the market’s first year, there were plenty of bumps in the road, many of which were related to burdensome regulations and high tax rates.

But the state appears to be resolving some of the issues, paving the way for Origin House to grow even more in California. Meanwhile, Origin House is also looking to grow in other markets. The company acquired Smoke, a major Canadian vape retailer, in a deal that opens the door for expansion of its own brands into the Invets recreational pot market. In addition, Origin House could seek to replicate its distribution model in other states down the road.

You don’t have to karijuana individual marijuana stocks to profit from growth in the cannabis industry. Exchange-traded funds ETFs provide a way to buy multiple stocks in one fell swoop.

Berner Explains Why He’s NOT Investing in Marijuana Stocks (Part 2)

Basics about the marijuana industry

My longer-term focused model portfolios typically have a dozen names in. Also referred to as medical amrijuana, medical marijuana currently is broadly legal in 33 U. A bill to do so has gained significant support from both Democrats and Republicans. It should be onvest that while several Canadian stocks are only available over the counter in the U. My view is that there are several good reasons why Canopy Growth is the od marijuana grower in terms of market cap. They’re familiar with launching new products, including GW’s multiple sclerosis drug Sativex, which is approved in more than 25 countries outside the U. Open an account with Benzinga’s best online broker, TD Ameritrade. These include white papers, government data, original reporting, and interviews with industry experts. In Junethe U. While primarily a grower of tomatoes, bell peppers, and cucumbers, the company has converted some space for the growing of cannabis. The company has an experienced management team and a huge production capacity, with 10 facilities together claiming more than 4. Benzinga Money is doo reader-supported publication.

Comments

Post a Comment