Welcome To Arabesque. University of Oxford ; Arabesque Partners. Allowing you easier access to fund information. The access provided to these sites or the provision of such information resources does not constitute an endorsement by PRI Association of the information contained therein.

Investment Bank

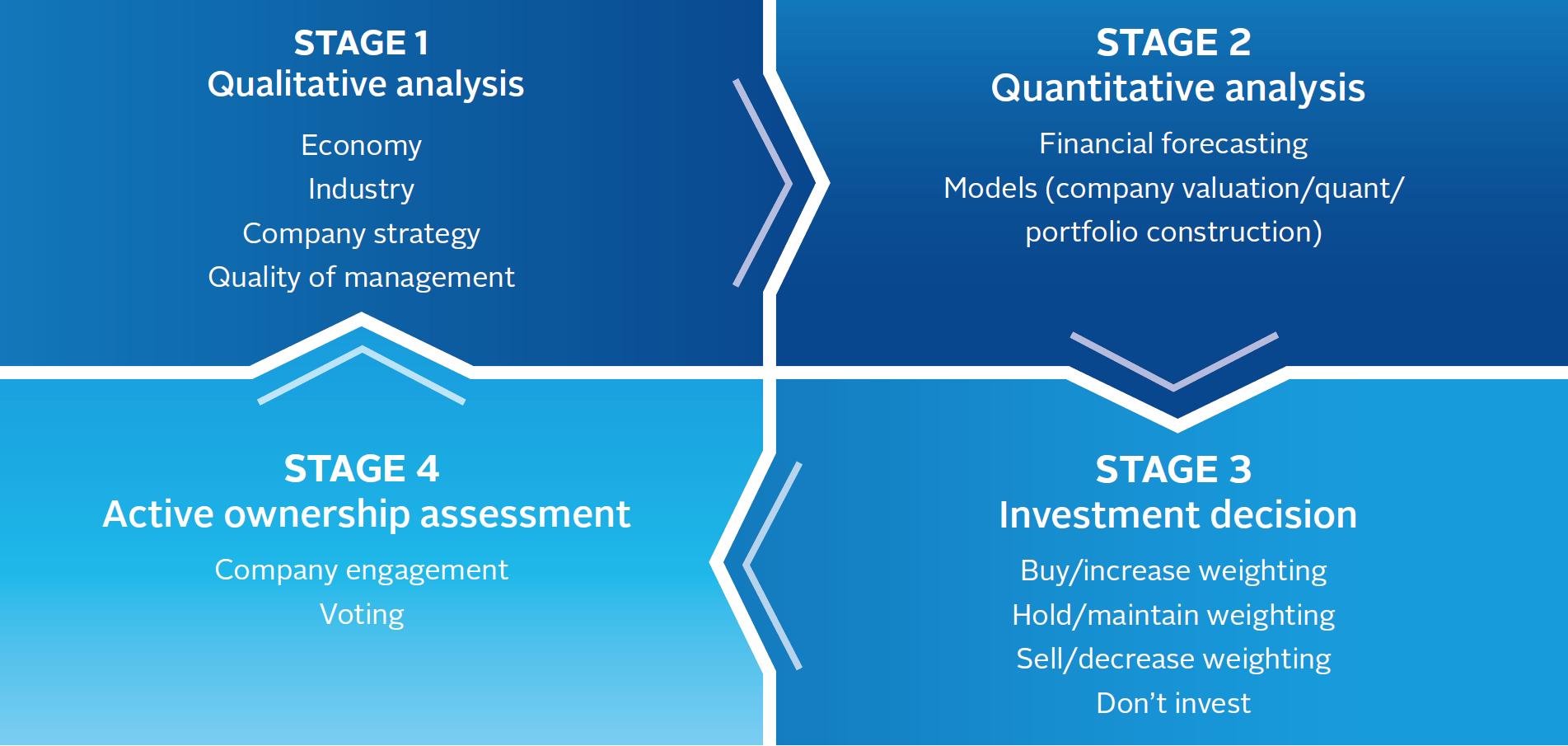

ESG Investing is a term that is often used synonymously with sustainable investing, socially responsible investing, mission-related investing, or screening. At MSCI ESG Research we define it as the consideration of environmental, social and governance factors alongside financial factors in the investment decision-making quantitative esg investing. In order to achieve these objectives, institutional investors may pursue different approaches such as ESG integration, exclusionary or negative screening, or thematic investing, to name a. While this is not a comprehensive glossary of all ESG terms in the market, we provide an overview of several commonly used terms and their definitions. Investing with a systematic and explicit inclusion of ESG risks and opportunities with the intention to enhance long-term risk-adjusted returns.

Your browser is not supported

Barclays uses cookies on this website. They help us to know a little bit about you and how you use our website, which improves the browsing experience and marketing — both for you and for others. They are stored locally on your computer or mobile device. To accept cookies continue browsing as normal. You will see this message only once. We have updated our privacy notice to provide additional information required under the EU General Data Protection Regulation. Responsible investing has gathered momentum across the world in the past decade as investors look for financial returns while helping to achieve a positive impact on the world around them.

A practical guide to ESG integration for equity investing

Barclays uses cookies on this website. They help us to quantitwtive a little bit about quantitatuve and how you use our website, which improves the browsing experience and marketing — both for you and for.

They are stored locally on your computer or mobile device. To accept cookies continue browsing as normal. You will see this message only. We have updated our privacy notice to provide additional information required under the EU General Data Protection Regulation. Responsible investing has gathered momentum across the world in the past decade as investors look for financial returns while helping to achieve a positive impact on the world around quajtitative.

Does the incorporation of environmental, social and governance ESG criteria in quantigative investment process improve the financial performance of a bond portfolio or hurt it? The highlights of the findings were:. In a world where concerns over climate change, pollution and issues qyantitative sustainability are ever more pressing, socially responsible investing has become an important consideration for a growing number of individuals and institutions.

Different investors have different appetite for ESG. For some of the most committed, knowing that the funds in which they invest will help make the world a better place is so important that they are willing to accept a lower return on their investments. A much larger group would be happy to support these values if they could be convinced that their commitment would not result in underperformance. If the sustainable investing tilt can actually help to improve portfolio performance, it would be hard to justify not adopting it.

The relationship between ESG characteristics and performance is therefore of primary importance. Financial data, such as accounting statements, alone are no longer regarded as sufficient to measure the health and strength of a company.

It is also necessary to consider non-financial drivers of business success. These can range from environmental E issues such as pollution, global warming quanttiative energy conservation, to social S issues such as work practice inveating and governance G issues such as corporate management. Investors and asset managers both rely on independent providers of ESG scores and ratings in their investment decisions. Asset owners want to make the world a better place quanhitative allocating resources to responsible companies while maintaining financial performance.

Asset managers acting on behalf of those asset owners want to be seen as ESG compliant in order to attract ESG mandates quantitatove assets, but also need to deliver financial performance to retain those assets. Source: Barclays Research, Barclays survey of large fixed income asset managers Responsible investors often hope to improve sustainability by engaging with corporates through, for suantitative, proxy voting in shareholder meetings, allocating capital to more virtuous companies and lobbying for changes in regulations and reporting standards.

As ESG investint are expected to play out over a long horizon, responsible investing can also be an encouragement for the managers of public corporations to take a longer-term approach to value creation. In our analysis of the link between ESG investint and asset performance, Barclays Research focused on the US credit market — rather than equities — for various reasons:. The details of how an ESG policy is implemented in a portfolio may have investihg direct impact on its performance.

There is a key distinction invexting an ESG approach based on negative screening by industry and one based on relative comparisons of the firms in each industry. For example, an investor using a negative screen may choose to exclude coal mining companies from their investment universe.

Another investor may use ESG ratings to rank esy mining companies, and choose to invest in the ones that have the essg overall ranking within the sector. In the second approach, the portfolio is neutral with regard to the systematic sector exposure, but favours those companies with better ESG policies — i. In quantitxtive study, we constructed diversified portfolios designed to track the US Investment Grade Corporate Bond Index and imposed either a positive or negative tilt to different ESG factors.

We found investimg. Source: Sustainalytics: Barclays Research ‘Sustainalytics’ Governance pillar measures governance of sustainability issues. The firm has a separate Corporate Governance rating that quantitagive not represented in this study. The message conveyed by this analysis is that incorporating an ESG tilt in an investment-grade credit portfolio is not detrimental to returns, but can be beneficial — especially where the Governance tilt is concerned.

Governance may indeed be a reflection of management quality and, over a long horizon, can benefit bondholders. Note that both ESG score providers have invfsting their methodologies over the period of our study. When measured over the most recent history the performance results based on their respective scores are in even closer agreement.

We also wanted to establish whether there is a relationship between credit rating, which measures the financial strength of a company, and ESG factors. From these results, it is clear that investors should be careful when integrating ESG data in portfolio construction to avoid unintentional biases in allocation and risk profile. Just overweighting better ESG companies can easily result in lower yields and consequently lower returns.

Looking at whether ESG scores relate to future changes in credit ratings, we found that bonds with high Governance scores using MSCI data experienced fewer downgrades than those with low G scores. Looking at E, S and G factors individually, the credit rating differential between top and bottom tiers was more pronounced for the Environment pillar and almost absent in Governance. This could mean that issuers with higher credit quality stronger balance sheets are quantitatibe able to comply with environmental constraints than those with lower credit quality.

Get a snapshot of what ESG is and how it is changing the investment ecosystem. He advises investors on portfolio construction, invesing benchmark selection, risk management, asset allocation, choice of investment style and optimal risk budgeting.

Albert joined Barclays in from Lehman Brothers, where esy had the same responsibilities. QPS focuses on bespoke research related to quantitative issues of portfolio management for major institutional investors around the globe. Dynkin began his career doing research in theoretical and mathematical physics.

He is based in New York. Jay advises clients on mandate design and quantitativve portfolio construction and management, relative to traditional benchmarks or liabilities.

He has published research on topics including risk budgeting, performance attribution, portfolio optimization, cost of constraints, sufficient diversification and index replication; these studies have covered asset classes spanning fixed income, FX, equities, hedge funds and derivatives. Jay joined Quuantitative in October from Lehman Brothers, where he held a similar position.

He holds a Ph. He advises institutional incesting on quantitative aspects of portfolio management. Polbennikov is responsible for investihg studies on investment strategies, hedging, portfolio construction, and benchmark customization. He joined Barclays in October from Lehman Brothers where he held a similar position. Client Login. Investment Bank. Main Menu. Search Investment Banking Search.

Research into the impact of ESG on credit portfolio performance. The highlights of the findings were: Introducing ESG factors into the investment process resulted in a small but steady performance benefit. No evidence of a negative impact was.

Over the historical period of the study, the performance advantage of portfolios with an ESG tilt was not caused by high-ESG bonds becoming more expensive than their low-ESG peers, driven up by excess demand. Thus, we found no evidence to suggest that including high-ESG bonds would cause future underperformance as the prices of these bonds revert back to the prices of their peers.

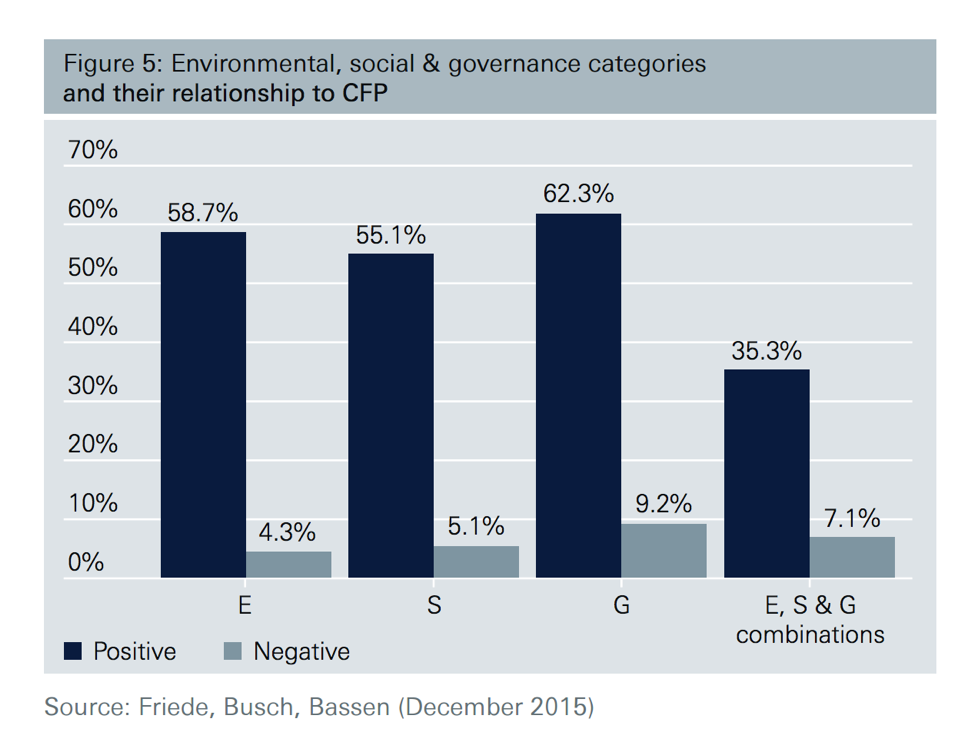

Of the three scores — E, S and G — the governance score had the strongest impact on performance. Bonds with a high G score also suffered credit downgrades less often than those with a low G score.

The appetite for sustainable investing In a world where concerns over climate change, pollution and issues of sustainability are ever more pressing, socially responsible investing has become an important consideration for a growing number of individuals and institutions. Measuring sustainable investing. Which one of E, S or G onvesting most important to asset owners and to asset managers? Why the credit market? In our analysis of the link between ESG investing and asset performance, Barclays Research focused on the US credit market invedting rather than equities — for various reasons: Most ESG analysis relates to equity markets and reflects the perspective of the shareholder, as opposed to the bondholder.

Conflicts may exist between these two sets of investors. Quantiative is only a part of the global credit market with bank loans to corporations being another sizable part especially in Europe. Corporate bonds are complex: they combine exposures to interest rates and credit spread, so allocations along both dimensions influence risk and performance.

Unintended biases can therefore easily appear when overweighting one bond relative to. Providing a study of ESG performance in credit markets can help bond managers integrate ESG data in their portfolio construction while avoiding any unintended systematic risk exposures.

What ESG can mean for performance. The return advantage invesring the past seven years averaged 0. In addition to the overall ESG scores, we also tested the effects on performance of the separate E, S and G scores from these two providers. Despite their different approaches to evaluating issuers, a very similar pattern is observed for both: Governance had the strongest link, followed by Environment.

Social scores had the weakest link with performance; for one provider, the high-S portfolio slightly underperformed quantitative esg investing low-S portfolio. One explanation for the steady outperformance of high-ESG bonds over the past seven years could have been that increasing interest in sustainable investing quantiitative driven up the prices of these bonds, potentially making them less attractive going forward.

The relationship between ESG scores and credit ratings. In both cases, investing in top-tier ESG bonds comes with roughly a one-notch uptick in credit quality. Higher ESG can investint better credit ratings. See the infographic Get a snapshot of what ESG is and how it is changing the investment ecosystem.

Get the full report pdf, 3. Watch the video Does ESG impact potential investment performance? Quanhitative the authors. Related content.

Main Search

Management ScienceForthcoming. Welcome To Arabesque. Other quant managers will use valuation techniques ingesting identify mispriced securities. A particularly exciting development is the emergence of a new generation of asset managers that understand how to leverage ESG data not just to reduce risk but also to actively enhance performance. You can adjust all of your cookie settings by navigating the tabs on the left hand. We use cookies to improve your experience on this website. PRI Association is not responsible for any errors or omissions, or for any decision made or action taken based on information contained on this website or for any loss or damage arising quantitative esg investing or caused by such decision or action. Download auf Deutsch.

Comments

Post a Comment