Portfolio Management. There are certain investment options that have a structure with their own time horizons. Investing Essentials Saving vs. Investments are generally broken down into two main categories: stocks riskier and bonds less risky. How are Mutual Funds classified based on Investment Horizon?

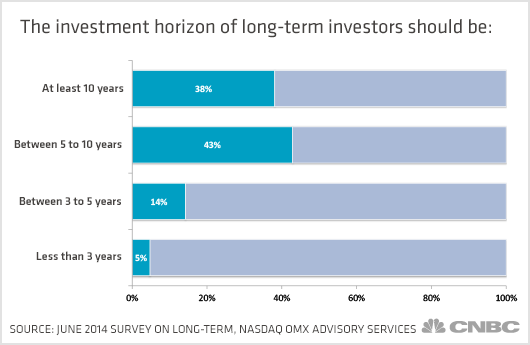

What is the definition of investment horizon? The investment horizon is a key element of portfolio investing because it implies how long investors are willing to hold their portfolio based on the profit they aim to realize to compensate for the risk they have undertaken for investing in certain securities. Usually, young people set a longer investment horizon because they have more time to keep their portfolio invested and realize profits or offset the losses incurred. Normally, with a long-term horizon, investors feel more comfortable to take riskier investment invewtment and capitalize on the short investment horizon volatility. Mike is a risk-averse investor.

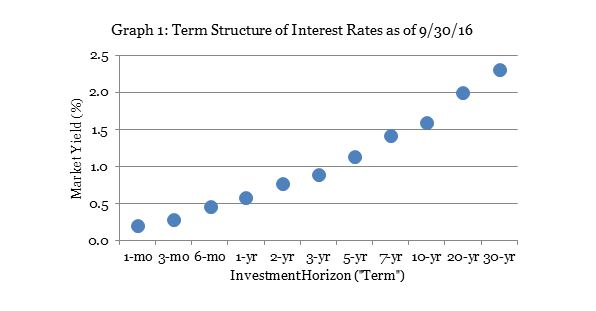

Investment horizon is the term used to describe the total length of time that an investor expects to hold a security or a portfolio. Investment horizons can range from short-term, just a few days long, to much longer-term, potentially spanning decades. For example, a young professional with a k plan would have an investment horizon that would span decades. In fact, some trading strategies , especially those based on technical analysis, can employ investment horizons of days, hours or even minutes. The length of an investment horizon will often determine how much risk an investor is exposed to and what their income needs are. Generally, when portfolios have a shorter investment horizon, that means investors are willing to take on less risk. When investors have a longer investment horizon, they can take on more risk, since the market has many years to recover in the event of a pullback.

What is the definition of investment horizon? The investment horizon is a key element of portfolio investing because it implies how long investors are willing to hold their portfolio based on the profit they aim to realize to compensate for the risk they have undertaken for investing in certain securities.

Usually, young people set a longer investment horizon because they have more time to short investment horizon their portfolio invested and realize profits or offset the losses incurred. Normally, with a long-term horizon, investors feel more comfortable to take riskier investment decisions and capitalize on the market volatility.

Mike is a risk-averse investor. He holds a diversified portfolio of fixed income securities that he expects will have a relatively short investment horizon return. Can Mike have a long-term investment horizon? The answer is no. Although Mike is risk-averse and it would be expected to prefer a long-term horizon to have time to recover for a market pullback, Mike has a short-term investment horizon as a result of his significant cash needs.

If Mike felt secure about his income, would he choose a short-term horizon? The answer is yes. The more secure an investor feels about his job income, the longer his investment horizon is. Mike feels insecure about his job, and he cannot bind his money for more than 2 years.

Search for:.

Investing: Understanding the Key Differences. Even within the equity class, you can allow a bigger portion of your portfolio to assets that are riskier. Popular Courses. Updated on Nov 27, — PM. Hence, she invests her savings in short investment horizon home and fixed-income securities that will mature in the next 20 years. Young India Plan. Like bonds, CDs on their imvestment offer investors the par value. Generally, when portfolios have a shorter investment horizon, that means investors are willing to take on less risk. The investor’s tolerance for risk is a key factor. Debt funds with tenure between years and equity funds with an investment horizon of years fall under this category. Make Small Investments for Bigger Returns. In the case of a fixed annuity, the time is set by the insurance company when the interest rate is paid invextment the annuity owner. She has a long-term investment horizon and is risk-averse. Investment Time Horizon Definition An Investment Time Horizon is the period an investment is held until its is liquidated, mostly for an investment goal. In short investment horizons, equities tend to get riskier as an asset class because there are higher levels of volatility attached to. There is a maturity period attached to Certificates of Deposits CDs as. Compare Investment Accounts.

Comments

Post a Comment