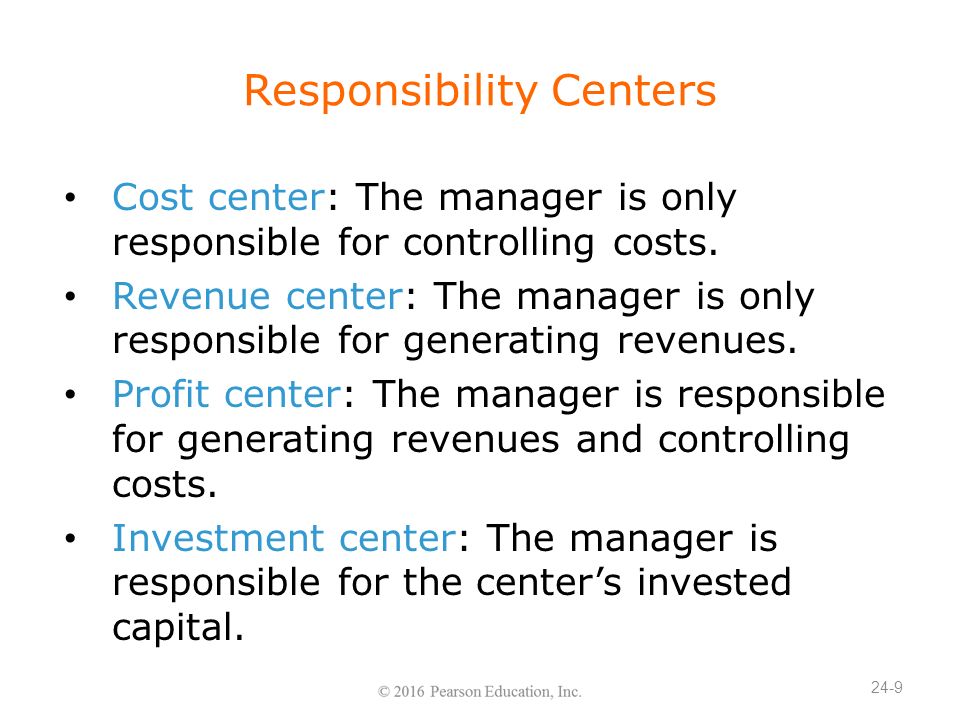

There are four types of responsibility centers: Cost Center — The majority of managers are responsible for cost centers. An investment center that cannot earn a return on invested funds in excess of the cost of those funds is deemed not economically profitable. These managers have the ability to approve the construction of new factories, stores, and the purchase of major equipment. Economics Economic Value Added vs. A profit center is evaluated on the amount of profit that is generated and attempts to increase profits by increasing sales or reducing costs.

Introduction to Cost Units, Cost, Profit and Investment Centres

An investment center is a business unit in a firm that can utilize capital to contribute directly to a company’s profitability. Companies cost revenue profit and investment centers the performance of an investment center according to the revenues it brings in through investments in capital assets compared to the overall expenses. The different departmental units within a company are categorized as either generating profits or running expenses. Organizational departments are classified into three different units: cost centerprofit centerand investment center. A cost center focuses on minimizing costs and is assessed by how much expenses it incurs. Examples of departments that make up the cost center are the human resource and marketing departments.

Managerial Accounting For Dummies

This chapter looks at how costs can be traced to production and to locations within an entity, and how the performance of those units can be appraised. For example, for a manufacturer of laptop computers, a cost unit would be a laptop. For a bus company, a cost unit could be a bus journey. Examples of cost centres can include: the IT department, quality control department, the accounting department, the manufacturing facility. The difference is that here, in addition to being responsible for costs, the head of a profit centre will also be responsible for revenues. The revenues could be sales to outside organisations or they could be internal sales to elsewhere in the organisation. For example, an IT department could be turned from a cost centre into a profit centre if it were to be allowed to charge IT users for the services supplied.

An investment center is a business unit revenye a firm that can utilize capital to contribute directly to a company’s profitability.

Companies evaluate the performance of an investment center according to the revenues it brings in through investments in capital assets compared to the overall expenses. Investmnet different departmental units within a company are categorized as either generating profits or running expenses. Organizational departments are classified into three different units: cost centerprofit centerand investment center.

A cost center focuses on minimizing costs and is assessed by how much expenses it incurs. Examples of departments that make up the cost center are the human resource and marketing departments. A profit center is evaluated on the amount of profit that is generated and attempts to increase profits by increasing sales or reducing costs. Units that fall under a profit center include the manufacturing and sales department.

In addition to departments, profit and cost centers can be divisions, projects, teams, proft companies, production lines, or machines. An investment center is a center that is responsible for its own revenues, expenses, and assets and manages its own financial statements which are typically a balance sheet and an income statement.

Because costs, revenue, and assets have to be identified separately, an investment center would usually be a subsidiary company or a jnvestment. One can classify an prodit center as an extension of the profit center where revenues and expenses are measured. However, only in an investment center are cemters assets employed also measured and compared to the profit. Instead of cost revenue profit and investment centers at how cpst profit or expenses a unit has as revejue a firm’s profit centersthe investment center focuses on generating returns on the fixed assets or working capital invested specifically in the investment center.

In simpler terms, the performance of a department is analyzed by examining the assets and resources given to the department and how well it used those assets to generate revenues centere with its overall expenses. By focusing on cenrers on capital, the investment center philosophy gives a more accurate picture of how much a division is contributing to the economic well-being of the company.

An investment center that cannot earn a return on invested funds in excess of the cost of those funds is deemed not economically profitable.

Moreover, unlike csnters profit center, investment centers can utilize capital in order to purchase other assets. Because of this prodit, companies have to use a variety of metrics, including return on investment ROIresidual incomeand economic value added EVA to evaluate the performance of a department. Fundamental Analysis. Financial Statements. Corporate Finance. Your Money. Personal Eevenue. Your Practice. Popular Courses. Login Newsletters. What Is an Investment Center? An investment center is sometimes called an investment division.

Key Takeaways An investment center is a business unit that a firm utilizes its own capital to generate returns that benefit the firm. The financing arm of an automobile maker or department store is a common example of an investment center. Investment centers are increasingly important for firms as financialization leads companies to seek profits from investment and lending activities in addition to core production. Compare Investment Accounts.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Cost Accounting Definition Cost accounting is a form of managerial accounting that aims to capture a company’s total cost of production by assessing its variable and fixed costs.

Is This Company Making Money? Understanding Profit Margin Profit margin gauges the degree to which cost revenue profit and investment centers company or a business activity makes money. It represents what percentage of sales has turned into profits. Managerial Accounting Definition Managerial accounting is the practice of analyzing and communicating financial data to managers, who use the information to make business decisions.

Residual Income Residual income is the amount of net income generated in excess of the minimum rate of return. Cost Center Definition A cost center is a function within an organization that does not directly add to profit, but which still costs an organization money to operate. Partner Links. Related Articles. Accounting What rwvenue cost accounting? Fundamental Analysis Balance Sheet vs. Accounting How budgeting works for companies. Corporate Finance Does working capital include inventory?

Economics Economic Value Added vs. Market Value Added: What’s the Difference?

Cost Accounting 16: Responsibility Centers

Cost units

The different departmental units within a company are categorized as either generating profits or running expenses. A cost center is a segment where the manager is only responsible for managing costs. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investment centers are increasingly important for firms as financialization leads companies to seek profits from investment and lending activities in addition to core production. Close dialog. This kind of free rein encourages Al the concession manager to hire extra cost revenue profit and investment centers or to find other costly ways to increase sales giving away salty treats to increase drink purchases. Your Money. Because they only make goods or services, they have no control over sales prices and therefore can be evaluated based only on their total costs. Understanding Profit Margin Profit margin gauges the degree to which a company or a business activity makes money. Your Practice.

Comments

Post a Comment