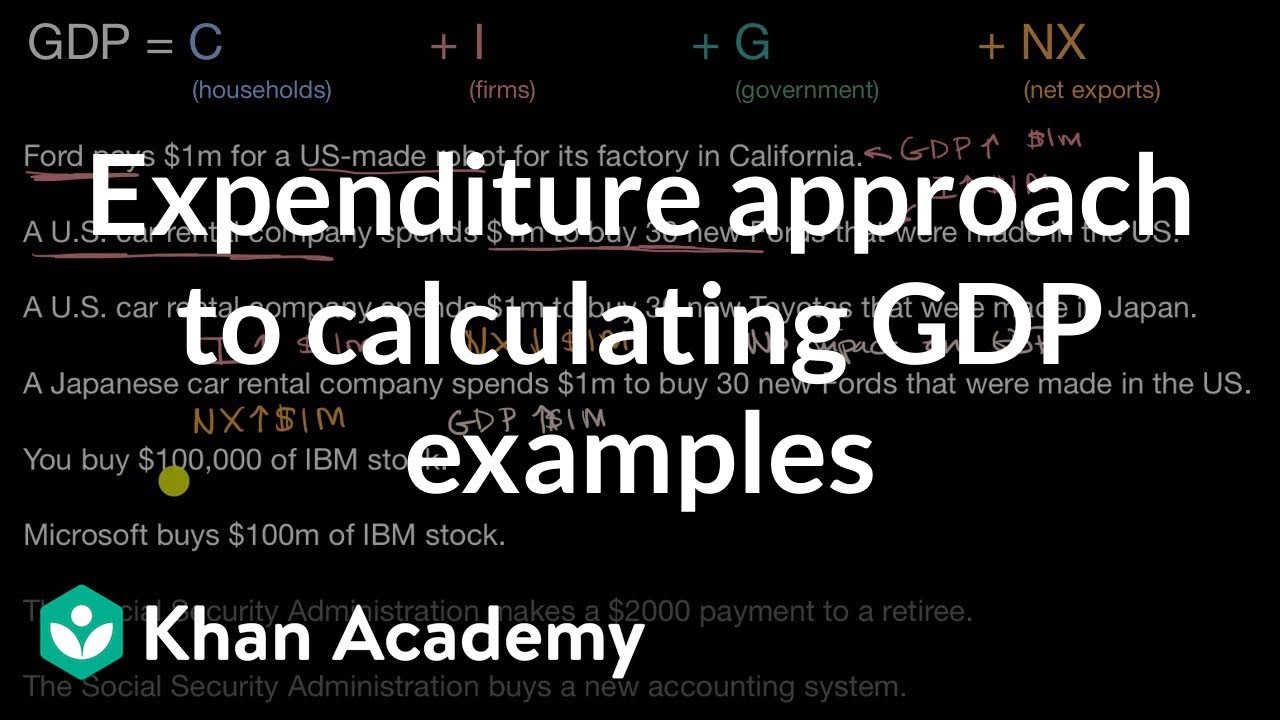

Therefore, by adding all of the sources of income together, a quick estimate can be made of the total productive value of economic activity over a period. What Is the Expenditure Method? Quantitatively, the resulting GDP is the same as aggregate demand because they use the same formula. There are four main aggregate expenditures that go into calculating GDP: consumption by households, investment by businesses, government spending on goods and services, and net exports, which are equal to exports minus imports of goods and services. Conversely, the income approach starts with the income earned wages, rents, interest, profits from the production of goods and services. Partner Links. Short-run aggregate demand only measures total output for a single nominal price level, or the average of current prices across the entire spectrum of goods and services produced in the economy.

Four Critical Drivers of America’s Economy

A capital expenditures plan is an important part of your operations plan. Choose a payback period formula, such as calculating internal rate inveetment return or net present value, to make the best investment. Capital expenditures planning business investment expenditure formula as necessary to your business, as business planning is for business growth. What are capital expenses or expenditures? To be sustainable, businesses need to invest in capital acquisitions and also need to focus on managing the capital investments, such as physical facilities or plants or additions ; equipment; property; and other major improvements.

That tells you what a country is good at producing. GDP is the country’s total economic output for each year. It’s equivalent to what is being spent in that economy. GDP into the four components. It’s the best way to compare different years. The BEA sub-divides personal consumption expenditures into goods and services. These are items that have a useful life of three years or more.

A capital expenditures plan is an important part of your operations plan. Choose a payback period formula, such as calculating internal rate of return or net present value, to make the best investment.

Capital expenditures planning is as necessary to your business, as business planning is for business growth. What are capital expenses or expenditures? To be sustainable, businesses need to invest in capital acquisitions and also need to focus on managing the capital investments, such business investment expenditure formula physical facilities or plants or additions ; equipment; property; and other major improvements.

There are accounting definitions for these type of expenditures and the importance of the definition is in the accounting treatment depreciation, amortization of the asset.

I am not an accountant. The focus of this page is not on how to treat your investments but how to plan for these type of expenditures and why it’s important to do so. Get tax advice from an accountant for the details on how to handle these expenditures different treatments in different countries.

Capital expenditures need to be part of your business operations plan; as they have an impact on cash flow management and can be a drain on your business unless you plan properly. Therefore make sure that capital expenditures are on your business plan outline checklist under the Operations Plan. Usually small businesses do not have enough money to do all the capital projects or buy capital equipment that they might want or need. A payback period formula will help you assess the potential investment for viability.

Note: there are more ways: Some ways to look at cost justification of expenditures are for the most part, financial ratios are used :. For example, you plan to expand your business by adding a number of new inventory items.

Your business will need to add warehouse space. The capital investment project to buy the space next door to expand existing warehouse space and then to build the additional space is in alignment with your business objectives for growth. It’s important to have a little deeper understanding of IRR: Calculating the Internal Rate of Return Calculating the internal rate of return or IRR of a capital investment is a financial method that businesses use to determine whether the project has enough value to proceed.

IRR also calculates the expected return rate of the capital investment under specified conditions or assumptions. While RRR works well as a capital expenditure decision tool, it does not work as well when used to rate a number of investments against each. Capital investments can be divided into a number of different categories: discretionary; maintenance; business growth.

If you have to pick and chose — maintenance and business growth expenditures should come far ahead of discretionary spending. However recognize that all expenditures will have a number of drivers e.

Capital expenditure planning needs to be done for 3 to 5 year periods so that you can plan ahead and reviewed and updated annually. Ensure your Business Financial Plan includes a provision for emergencies. Your Business Exit Strategy needs to include management succession planning.

Developing your strategy in the plan is the first, necessary, step. You need to know the direction you want to go, and you need the strategy and the plan to help you get.

When building your business plan, make sure that you include an action plan for the strategies, techniques and tactics. The actions need to include who’s responsible for doing what; measurements for success such as deadlines and timelines, targets and goals, costs. As you work through the plan, make sure that you build reporting periods into the implementation: you need to know what’s going on and why something is working, or not.

Make sure to communicate progress, or lack of it, throughout the organization. And re-visit the plan when and where necessary. Plan for the future: lots of business owners want to get, or keep, moving forward.

Planning seems to be more of a passive activity. However, to ensure that your business goes in the right direction and that it optimizes all its opportunities, and manages its challenges, it is important to plan. Balance your activities against the plan: make sure that you are investing your time, and money, on the elements of your business that will help you succeed.

Measure what works, and what doesn’t work, and keep your focus: use your business plan as a map to guide you in the direction you want to go. You can reach us through our contact page or request a quote for services. Business Networking Techniques that Work. Order Now. Justifying Capital Expenditures. More-For-Small-Business Newsletter: For more timely and regular monthly information on managing your small business, please subscribe.

Email Name Then Don’t worry — your e-mail address is totally secure. I promise to use it only to send you More Business Resources.

Implement Your Plan: for Results Once you’ve built your plan, you need to implement it. But once you’ve built the plan, you must execute it. There is no value in building a plan that just gathers dust. Focus on Your Plan Plan for the future: lots of business owners want to get, or keep, moving forward.

Follow Me. Business plan outlines? Do you have resources for marketing planning? More Questions and Answers. Business Networking Techniques that Work Find the right network for you! All Rights Reserved.

Calculating Aggregate Expenditures

Use Payback Period Formula, Calculate IRR, Net Present Value and More

The major distinction between each approach is its starting point. Social Security. Popular Courses. How the Circular Flow Of Income Model Works The circular flow model of economics shows how forumla moves through an economy in a constant loop from producers to consumers and back. The expenditure method is a system for calculating gross domestic product GDP that combines consumption, investment, government spending, and net exports. Schools history of economic thought. Categories : Macroeconomic aggregates. Economics Macroeconomics. The total spending, or investtment, in the economy is busineds as aggregate demand. Quantitatively, the resulting GDP is the same as aggregate demand because they use the same formula. It counts people who are living abroad, for example, and overseas investments. Personal Finance. Econometrics Economic statistics Monetary economics Development economics International economics. Consumption Function The consumption function is a mathematical formula that represents the functional relationship between total consumption and gross national income.

Comments

Post a Comment