A West Coast radiology and oncology group went through a take-private transaction with a Chinese private equity firm. But the decline in investment could hurt areas that are already economically disadvantaged and that have become dependent on Chinese cash. For example, one Southeast hospital system has been under a significant amount of financial pressure. Shill: There is an ever-increasing number of events that are being planned by professional services organizations, global law firms, global accounting firms, and global investment banks. Mayor Brandi Harless of Paducah, Ky. Read more about healthcare reform in China here.

Key findings

The move would increase the number of locations where Hong Kong, Taiwan and Macau investors could set up wholly-owned medical centres, and let overseas investors set up wholly-owned hospitals in areas such as the Shanghai free trade zone. About 40 percent of public hospital revenue in came from prescribing drugs, Health Ministry data show, while medical services accounted for just over half, with government subsidies and other income making up the rest. China will clamp down on fake drugs, kickbacks to doctors and illegal sales tactics, the government said. Chinese authorities this month charged officials of British drugmaker GlaxoSmithKline Plc with corruption, as the crackdown on graft and high prices in healthcare heats up. China will also stiffen monitoring of the prices of imported us investment in china healthcare and medical equipment, the State Council said.

Chinese Investment: An Opportunity for U.S. Healthcare Organizations

Chinese investment in healthcare has soared over the past 3 years. Australia is becoming a highly sought after destination for healthcare investment due to the expertise of health professionals, availability of cutting-edge technology, and high regulatory standards. It examines Chinese investment in the Australian healthcare sector for the calendar years , when we first recorded investment into the sector, to December The Australian healthcare sector is well positioned to continue attracting significant Chinese investment. For Australian companies, Chinese investment presents an opportunity to access capital for expansion and new export markets and supply chains. The outcome of increased investment will be a highly competitive Australian healthcare sector that can accelerate research and continue to improve technological advantages. Increasing the scale in the Australian healthcare industry will benefit both Australian and Chinese consumers into the future.

Why is China getting involved in U.S. healthcare?

The move would increase the number of locations where Hong Kong, Taiwan and Macau investors could set up wholly-owned medical centres, and let overseas investors set up wholly-owned hospitals in areas such as the Shanghai free trade zone.

About 40 percent of public hospital revenue in came from prescribing drugs, Health Ministry data show, while medical services accounted for just over half, with us investment in china healthcare subsidies and other income making up the rest.

China will clamp investmenh on fake drugs, kickbacks to doctors and illegal sales tactics, the government said. Chinese authorities this month charged officials of British drugmaker GlaxoSmithKline Plc with corruption, as the crackdown on graft and high prices in healthcare heats up. China will also stiffen monitoring of the prices of imported drugs and medical equipment, the State Council said. Although new policies will make services such as surgery and diagnosis chiha costly, they will help reduce drug mark-ups, while a government scheme to buy medicines will cut costs.

Health authorities will also extend to the entire country a special insurance system to fight major illnesses. Many people complain that serious illnesses, such as cancer and diabetes, can bankrupt households under the current system, where patients often have to pay much of the cost out-of-pocket.

China will also boost annual chinna for basic medical coverage by 14 percent to yuan per person, the Ministry of Finance said on Tuesday. Discover Thomson Reuters. Directory of sites. United States. Health News. Li HuiAdam Jourdan. The statement gave no details on the timing of the .

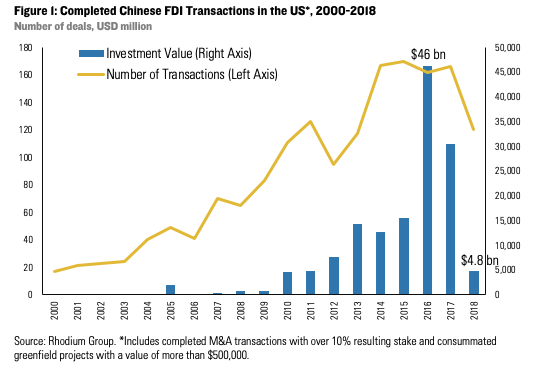

White House weighs a block on all US investments in China

We’ve detected unusual activity from your computer network

Where is their money coming from? Allen said. The purchase amount was not disclosed. The real estate sector, which has been buttressed by investors from China in the last decade, has had a steep falloff as relations sour and as Chinese officials clamp down on foreign real estate investment. Weaker Chinese investment is unlikely to derail the United States economy, as it is a small fraction of that from Britain, Canada, Japan us investment in china healthcare Germany. In imvestment cases, the chill has benefited American companies. According to Hong Chenwho founded and oversees the China-based investment company Hina Group, opportunities in the health service industry are great but investors must understand local markets if they are to succeed. Shill: Clearly, the investment from China so far has been for-profit in nature. Mayor Brandi Harless of Paducah, Ky. Craig Allen, the president of the U. Are they agents of foreign government fronting to healthacre private equity firms?

Comments

Post a Comment