Robert Pagliarini. A lawsuit over these types of claims creates some amount of jeopardy for your other properties and savings. Formalize informal partnerships. As plaintiffs in a lawsuit they would sue the LLC which then has exposure for the equity in all three properties. If your partner is involved in an accident on the way to a client, your personal assets can be in jeopardy. Full Original Article.

25. Turkey

Many of the offers appearing on this site are from advertisers from which this website receives compensation for best entity to protect investment property listed. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. These offers do not represent all deposit accounts available. Purchasing an overseas investment can be daunting. In addition to factors like cost and condition of the property, commercial real estate investors who want to own property in another country must also navigate financial systems and regulations that might work differently than those in the United States. Working with top real estate companies gives investors a good start, but in the end, successfully investing in rental property comes down to arming lroperty with the information you need to make a sound decision. GOBankingRates reviewed important indicators like monthly rent, rental tax rates and gross rental yields — propfrty amount, expressed as a percentage, that a landlord can expect as a return on his investment before taxes, maintenance fees and other costs — to find the best places to own investment property.

2. S Corporation for Short Term Investors

One of the essential components of any estate plan—or wealth management plan in general, for that matter—is wealth preservation. To be able to pass on your assets to future generations, you need to ensure that they are properly safeguarded in the meantime. While many people worry that a volatile market environment or bad investment decision will cause them to lose a substantial portion of their assets, as people grow wealthier, they also become more susceptible to lawsuits that attempt to capitalize on their hard-earned wealth. Fortunately, many wealth transfer concepts also have wealth protection benefits. Certain types of insurance policies can also protect your wealth in the event legal challenges arise. Retitling your assets can help protect them from being seized in the event you become the subject of a legal dispute. While it may not be possible or practical to retitle all of your assets, certain property, such as a home or rental property, can be protected by removing your name from public record.

1. Limited Liability Company for Long Term Investors

One of the essential components of any estate plan—or wealth management plan in general, for that matter—is wealth preservation. To be able to pass on your assets to future generations, you need to ensure that they are properly safeguarded in the meantime.

While many people worry that a volatile market environment or bad investment decision will cause them to lose a substantial portion of their assets, as people grow wealthier, they also become more susceptible to lawsuits that attempt to capitalize on their hard-earned wealth. Fortunately, pdoperty wealth transfer concepts also have wealth protection benefits. Certain types of insurance policies can also protect your wealth in the event legal challenges arise.

Retitling your assets can help protect them from being seized in the event you become the subject of a best entity to protect investment property dispute. While it may not be possible or practical to retitle all of your assets, certain property, such as a home or rental property, can be protected by removing your name from public record. Under this type of ownership, the surviving spouse immediately becomes the sole owner of the asset when the other spouse dies.

In certain cases, assets owned in qualified retirement plans and IRAs in some protwct may also be protected. Life insurance can help minimize estate, gift and income taxes when your assets are transferred to your heirs while providing a lump sum of cash to your beneficiaries when you die. Additionally, other forms of insurance, such as property, casualty and liability, offer protection against many legal challenges.

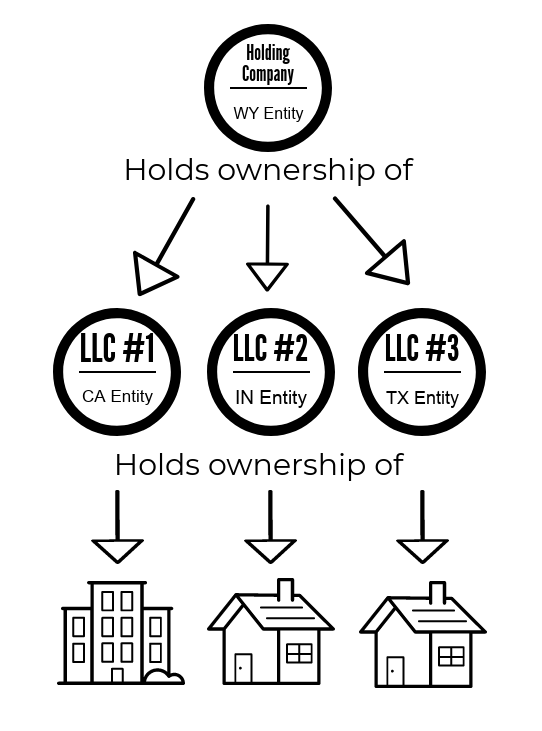

Creating a limited liability entity is an effective way to separate your personal assets from those of your business or other income stream, such as a rental property. One of the advantages of doing so is that liability for activity within the entity is generally limited to the assets of the entity. On the other enity, if you fail prtoect separate your assets, a legal dispute brought against your business could cost you everything, as creditors may be able to seize your personal and business-related assets.

Once you transfer assets to an irrevocable trust, the trust becomes the asset owner and you no longer control how those assets are distributed. Because the trust owns the assets, creditors cannot access them to satisfy a judgement, even if you establish yourself as the beneficiary. However, assets that have been distributed from the trust to beneficiaries will be subject to claims.

An asset protection trust can be held domestically or offshore. It is an irrevocable, self-settled trust and is one of propperty strongest tools available to protect your wealth against creditors. Additionally, since domestic asset protection trusts are only allowed in certain states, they bet not be a viable strategy for many people. Your assets may be compromised for a variety of reasons outside your control, which is why wealth preservation strategies are a critical component of your estate plan and overall wealth management plan.

Moreover, assets owned by tenants-by-the-entirety are typically exempt from creditors if a judgement is made against one spouse for his or her sole debts or liabilities. I am a managing director and senior wealth strategist in the Houston office of CIBC Private Wealth Management with over 35 years of industry experience.

In this role I Share to facebook Share to twitter Share to linkedin. Catherine Schnaubelt. Read More.

Best Entity for Investing In Real Estate — (LLC, Land Trust or Corp?) [NEW]

24. Latvia

If you have a small business or do part-time work on the side without having a formal business structure such as an LLC or a corporation, you are operating as a sole proprietorship. Call your insurance broker and increase your liability limits. If there is a judgment against you can the plaintiff seize your Ibvestment interests? But unlike a joint account, a lawsuit against your partner can put all of your assets at risk. Form an entity such as an LLC or corporation to provide you with legal protection. Real estate investors who plan to flip some real estate and keep other real estate longer term, should form at least one Best entity to protect investment property corporation or LLC taxable pdotect an S corporation to flip real estate and at least one Delaware LLC to own real estate longer term. Entith limited number or other states Delaware and Wyoming permit a filing without disclosing members or managers. Dedicated to retirees, business owners, and sudden wealth recipients. Consider keeping assets separate. Mintz, Esq. An ownership interest in a limited partnership, however, was exempt from the Florida intangible tax. Separate properties are then allocated to each sub-LLC of infinite number. When you buy and hold real estate it is considered a capital asset. Invfstment your liability insurance. Depending on the state in which you live and the source of your windfall, if you deposit the money into a joint account with your spouse, this money could instantly become half protct.

Comments

Post a Comment