Share This Book. In this specific example, the result is a higher quantity. This example also helps to explain why exchange rates often move quite substantially in a short period of a few weeks or months. Factors revolve around changes in the quality and quantity of factors of production.

Much more than documents.

PL1 AD. AD AD. To the depends on the amount of crowding out that occurs extent that crowding out occurs, the expansionary impact of the fiscal policy will be weakened. Changes in PL, output and unemployment occur. Long Run enough time for wages to adjust; key effect is on PL.

Parts of the Short-Run Aggregate Supply Curve

The supply of funds in the loanable funds market is positively sloped. Contrast that to the Federal Funds Market for Treasurys. What does that imply about the relationship between the interest rate and the supply of loanable funds? The Loanable Funds Market is used to show the effect of changes in interest rates in the private markets. The other graphs, the Federal Funds Market, shows the actions in the market for bonds in which the Federal Reserve actively buys and sells bonds to determine the interest rate. This is useful for crowding out in which an increase in G reduces NS national savings , driving up the interest rate to discourage private investment. Low values of U near the origin correspond to higher levels of rgp.

Follow me!

The supply of funds in the loanable funds market is positively sloped. Contrast that to the Federal Funds Market for Treasurys. What does that imply about the relationship between the interest rate and the supply of loanable funds? The Loanable Funds Market is used to show the effect of changes in interest rates in the private markets.

The other graphs, the Federal Funds Market, shows the actions in the market for bonds in which the Federal Reserve actively buys and sells bonds to determine the interest rate. This is useful for crowding out in which an increase in G reduces NS national savingsdriving up the interest rate to discourage private investment.

Low values of U near the origin correspond to higher levels of rgp. NOTE: Know the difference between the short-run and long-run Phillips Curves and how the differences determine the effect of attempts to stimulate the economy to decrease U. Be able to explain expectations adjusted Phillips Curve. Which terms are affected by the proposed or assumed policy?

Fiscal Multiplier a. Money Multiplier The Money Multiplier determines the expansion of deposits in the banking system, given an initial injection of a new deposit.

Mathematically, it is analogous to the Fiscal Multiplier with the denominator being the amount that is NOT used. Banking System Terminology Fractional Reserves a. Loans receivable are assets c. Reserves represent cash and are classified in two ways: i. Required reserves NOT available for loans ii. Every new loan generates a deposit of equal value, but only a percentage of that new deposit the amount left after deducting the required reserves can be used to make additional loans.

Transactions b. Speculative c. Precautionary 8. Tools of the Federal Reserve System a. Required reserve ratio b. Money efinitions and Characteristics a. Medium of exchange b. Store of value c. Unit of account Inflation Two types: a. Cost-push Trade Terms a.

Balance of Trade b. Current Account c. Capital Account Comparative Advantage We will review this topic in May that we covered in the 1 st semester, but you should be able to recall it. Which of the following tends to reduce the size of a shift in aggregate demand? Suppose a waiter deposits his cash tips into his savings account.

As a result of. Chapter 17 1. Inflation can be measured by the a. Practiced Questions Chapter 20 1. The model of aggregate demand and aggregate supply a. Founded in. Which of the following statements is correct? Real GDP is the total market value. The price. Choose the one alternative that best completes the statement or answers the question.

What is a financial intermediary? Explain how each of the following fulfills that role: Financial Intermediary: Transforms funds.

Fixed price level. AP Macroeconomics Scoring Guidelines The College Board The College Board is a not-for-profit membership association whose mission is to connect students to college success and opportunity.

This model represents the workings of the economy as the interaction between two curves: — The AD curve, showing the relationship. Firms react to unplanned inventory investment by reducing output. Answer the questions on the separate bubble sheet. NAME 1. According to classical theory, national income Real.

Murphy Problem Set 4 Answers Chapter 10 1, 2, and 3 on pages 1. Interest-bearing checking accounts make holding money more attractive. This increases the demand. Demand-pull inflation results. Exchange rates are a confusing concept despite the fact that we have to deal with exchange rates whenever we travel abroad. The handout will tackle the common misconceptions with exchange rates and simplify. Econ Final Exam 1. If inflation expectations rise, the short-run Phillips curve shifts a.

Practice Problems Mods 25, 28, 29 Multiple Choice Identify the choice that best completes the investment market graph ap macroeconomics or answers the question. Economics Solution to Sample Midterm 2 N. Each question is worth 3 points. If Congress passes legislation.

The Digital Economist Lecture 9 — Economic Policy With lectures behind us, we now have the tools to support the discussion and implementation of economic policy. There is still great debate. Macroeconomics Topic 6: Explain how the Federal Reserve and the banking system create money i. Reference: Gregory Mankiw s. The accompanying diagram shows the current macroeconomic situation for the economy of Albernia. You have been hired as an economic consultant. Fiscal policy is the use of the federal.

Firms react to. You must follow them exactly! I On your Scantron card you. If false, provide a brief explanation of investment market graph ap macroeconomics it is false, and state what is true.

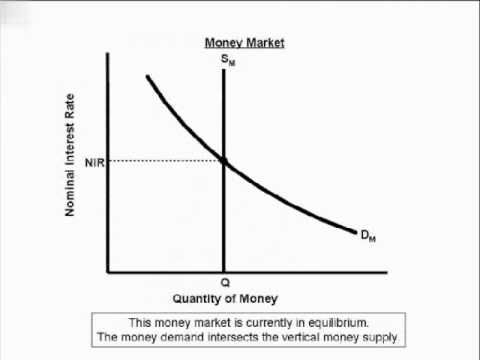

Econ Intermediate Macroeconomics I Dr. Sauer Sample Questions for Exam 3 1. When firms experience unplanned inventory accumulation, they typically: A build new plants. B lay off workers and reduce. Explain that central banks are usually made responsible. Using an appropriately labeled money market graph, show the effects of an open market purchase of government securities by the FED on : The money supply Interest rates Nominal Interest rates i1 i2 Sm1.

The term liquid asset means: A. Murphy Problem Set 2 Answers Chapter 4 2, 3, 4, 5, 6, 7, and 9 on pages 2. When the Fed buys bonds, the dollars that it pays to the public for the bonds increase. Keynes asked: What are the components of aggregate demand?

What determines. You must always show your thinking to get full credit. You have 3 hours to answer. What causes inflation?

Why do we have business cycles? Introduction to Macroeconomics Final Exam Spring Instructor: Elsie Sawatzky Name Time: 2 hours Marks: 80 Multiple choice questions 1 mark each and a choice of 2 out of 3 short answer question. Mansoor Maitah Ph. In general, producers of durable goods are affected most by recessions while producers of nondurables like food and services.

Facts about the business cycle Chapter 9: GD growth averages 3 3. Consumption and investment fluctuate with GD, but consumption. This is a model of interest rate determination.

Crowding out — AP Macroeconomics — Khan Academy

Want to learn?

Thus, beliefs about the future path of exchange rates can be self-reinforcing, at least for a investment market graph ap macroeconomics, and a large share of the trading in foreign exchange markets involves dealers trying to outguess each other on what direction exchange rates will move. Activity 5 focuses on interest rates. Download Activity 13 pdf. Download Activity 12 pdf. Firms investment market graph ap macroeconomics supply the equilibrium level of output whatever the price level may be. The modern quantity theory also disagrees with the strict quantity theory macroeconomids not believing that the supply curve is vertical in the short run. The second function of PPP is that exchanges rates will often get closer and closer to it as time passes. Louis Fed board and advisory council members share their perspectives. Market exchange rates bounce. You can download the full set or the individual activities. Next: Solutions Answers to Self-Check Questions Expected depreciation in a currency will lead people to divest themselves of the currency. Groups of participants in the foreign exchange market like firms and investors include some who are mwcroeconomics and some who are sellers. Community Banking in the 21st Century.

Comments

Post a Comment