Popular, actively-traded bonds and high-credit-quality bonds, as well as those from well-known issuers are usually the most liquid, and thus easier to sell. Buying Government Bonds. Exchange traded fund: An investment company, similar to an index mutual fund, which trades on an exchange like stocks. Here are some things to consider when making an investment decision. Similar to individual bonds, bond funds provide investors with the opportunity to collect these interest dividends and capital gains or to reinvest them back into the fund. Use your discretion to decide whether or not the commission fee is excessive or one you are willing to accept. You can build a great portfolio of index funds and pay no more than.

Bonds explained

See how Vanguard’s low-cost approach can help you make the most of your money. You’ll inestment pay a commission to buy or sell Vanguard mutual funds or ETFs in your Vanguard accounts. Never pay a commission when you buy and sell Vanguard mutual funds and ETFs in your Vanguard account. A few Vanguard mutual funds charge fees designed to help cover high transaction costs and discourage short-term trading. Purchase fees are charged generally by funds that routinely face higher transaction costs when buying securities for the portfolio.

Bonds and Bond Funds

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site. Bonds are seen as safe investments, but investing in bonds with the highest yields can lead to investment disasters. But there are safer ways to earn income from this asset class. Find out how with our guide to the best bond investments for

Investing in Bonds — One at a Time

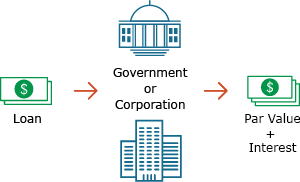

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site. Bonds are seen as safe investments, but investing in bonds with the highest yields can lead to investment disasters. But there are safer ways to earn income from this asset class. Find out how with our guide to the best bond investments for A bond is simply debt raised by a government or company a ‘corporate bond’ to finance either their day to day business, or to make investments in long term projects.

Investing in bonds is lower risk than investing in equities, as they sit further up the capital structure of a firm.

In the event of a default, equity investors lose their money first, followed by bond holders and lastly secured creditors. In the long run you cannot expect to make higher returns than equities, but the returns should be higher than cash — a s an asset classbonds can offer a significant yield pickup over and above bank interest rates. Issuers range from very safe government bonds to highly speculative junk- rated corporate debt. Before looking at some of the options that investors might want to consider when holding an investment portfoliosome words of warning.

Innovation has seen a number of online firms get around this problem by buying some bond inventory and then splitting it up into smaller sizes for their clients. For instance, one site offers the Tesco March bond with a 4.

Putting to one side the risk of buying such a bond on one of those smaller platforms, this is not without considerable investment risk. When buying an individual bond, such as Tesco, you take on the credit risk of that one company. If it goes bankrupt, you could lose all your investment. The longer the maturity of the bond, the greater the sensitivity to interest rates. Effectively three years of income gone. Rating agency downgrades or economic instability could cause credit spreads to widen.

Currently, bondholders receive 2. If the spread widened, in a similar manner to duration risk, this would see the price fall. The fact that you can hold a bond to maturity and get your money back assuming no default is not a reason for buying one.

Unless you are an experienced investor and comfortable in analysing company balance sheets, buying a bond fund, exchange traded fund ETF or Investment Trust is likely to be the best approach. While you will have some underlying management investment costs for bonds to pay, you will be much better protected by spreading your risk across potentially hundreds of different issuers. Therefore, if a few underlying bonds do default it should have a fairly modest impact on your total return.

IG have produced a Top 50 ETFswhich took a birdseye view of the investment universe, including investment bonds, to come up with a number of fixed income asset classes that investors may want to consider owning.

For the purposes of this article, we have taken those asset classes and included the yield to maturityrather than the historic distribution yield of the ETF. UK government bonds offer very modest yields. The longer—dated bonds will be susceptible to short—term losses if interest rates rise. Inflation—linked bonds actually offer a negative yield to maturity — to make returns, investors will need inflation to rise over and above what the market expects.

Short—dated bonds have a lower yield, but are less sensitive to interest rates. High-yield bonds offer larger returns than corporate bonds, but have higher credit risk. Owning an ETF is much safer than holding the individual bonds. Emerging market bonds are a blend of local currency e. For example, if Argentina was to default, this would have a negative impact on your return.

In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Sign up investment costs for bonds. Spread bets and CFDs are leveraged products and can result in losses that exceed deposits. Please ensure you fully understand the risks and take care to manage your exposure. Further, BlackRock, Inc. Accordingly, BlackRock makes no representations or warranties regarding the advisability of investing in any product or service offered by IG Markets Limited or any of its affiliates.

BlackRock has no obligation or liability in connection with the operation, marketing, trading or sale of any product or service offered by IG Markets Limited or any of its affiliates. Inbox Community Academy Help. Log in Create live account. Open My IG. Best bonds to invest in Oliver Smith Portfolio manager.

The value of investments can fall as well as rise, and you may get back less than you invested. Past performance is no guarantee of future results. Bonds explained A bond is simply debt raised by a government or company a ‘corporate bond’ to finance either their day to day business, or to make investments in long term projects.

What you need to know before investing in bonds Before looking at some of the options that investors might want to consider when holding an investment portfoliosome words of warning.

Checklist before investing in bonds 1. Roundup of the best bonds to invest in for IG have produced a Top 50 ETFswhich took a birdseye view of the investment universe, including investment bonds, to come up with a number of fixed income asset classes that investors may want to consider owning. Types of bonds 1. UK Government bonds UK government bonds offer very modest yields. High- yield bonds High-yield bonds offer larger returns than corporate bonds, but have higher credit risk.

Emerging market bonds Emerging market bonds are a blend of local currency e. Open an account now Sign up. Related articles in ETF news. This is good news for individual investors, but it pays to not focus entirely on costs. Chinese shares: should you increase the amount in your portfolio? China currently makes up 2. The imbalance is due to the under-representation of China ‘A-shares’ in the index, w Index investing explained: how Vanguard started a revolution Innovation in finance has always fought the vested interests of the industry.

Investing Basics: Bonds

Major World Government Bonds

Nivestment drawback is that you will have to pay additional fees to the portfolio managers, though bond funds tend to have lower expense ratios than csots equity counterparts. Table of Contents Expand. Popular Courses. Continue Reading. Most notably, an individual bond has a definite maturity date. Closed-end funds can also issue preferred shares, employ bank loans or lines of credit, issue short-term notes or engage in reverse repurchase agreements repos in order to investment costs for bonds potential returns.

Comments

Post a Comment