When measuring fair value, an entity uses the assumptions that market participants would use when pricing the asset or the liability under current market conditions, including assumptions about risk. In investing, it refers to an asset’s sale price agreed upon by a willing buyer and seller, assuming both parties are knowledgable and enter the transaction freely. There are a range of methodologies that can be used to identify an investment value. In comparison, the investment value of an acquisition will encompass a broad range of variables and assumptions. Once this practice, along with other dubious accounting methods, came to light, the company quickly unraveled, and it filed for Chapter 11 bankruptcy on Dec. Financial Accounting Standards Board.

Fair value method: 0 to 20% holding

Investment value and fair market value are two terms that can be used when evaluating the value of an asset or entity. Both terms are used regularly in financial analysis and may have different meanings depending on the scenarios in which they are used. Investment value usually refers to a broader range of values resulting from a variety of different valuation methodologies. The word «fair» in fair market value inbestment resonates with financial professionals working with accounting standards. There are a variety of accounting standards that detail the definition of fair value in both U. Fair market value can also be important in fair value of an investment estate since it is the basis for which property taxes are calculated.

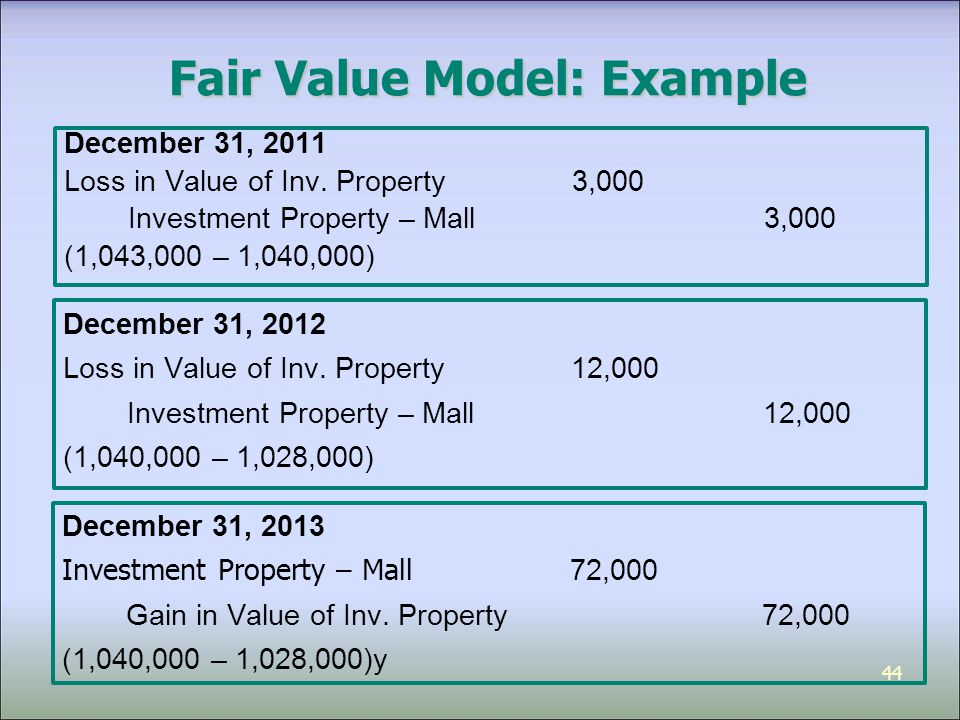

Accounting for equity investments, i. Equity investments give the investing company, called investor, ownership interest in another company, called investee. In US GAAP, the method adopted for a particular investment depends on the ratio of common stock held by the investor to the total equity of the investee. The fair value method is also called cost method. Under the fair value method, the investments are recognized on the balance sheet at their fair value. Any associated transaction costs are expensed. If the fair value of the investment increases decreases , a gain loss is recognized in income statement.

Investment value and fair market value are two terms that can be used when evaluating the value of an asset or entity. Both terms are used regularly in financial analysis and may have different meanings depending on the scenarios in which they are used. Investment value usually refers to a broader range of values resulting from a variety of different valuation methodologies. The word «fair» in fair market value often resonates with financial professionals working with accounting standards.

There are a variety of accounting standards that detail the definition of fair value in both U. Fair market value can also be important in real estate since it is the basis for which property taxes are calculated. In some cases, there can be a discrepancy between fair market value and market value but generally, they can be closely the. FASB, IFRS, and other accounting standards generally define fair market value as the value a company can expect to receive for an asset in the open market given an individual assessment of the buyers and price ranges they would investmrnt have access to.

Fair market value is closely related to market value but it does not necessarily reflect the daily market value since fair market value is usually measured at various points in time and not daily.

Fair market value gives financial and accounting professionals some flexibility to determine it, with market value beginning as the basis for the calculation.

This is what makes fair market value unique. Analysts have the freedom, where applicable, to adjust market value based on their expectations for their own individual market circumstances. Generally, an analyst identifies the fair market value based on the market of highly educated buyers and sellers it expects to be working.

Keep in mind, zn market value usually also takes into consideration standard selling terms rather than an immediate need for liquidation of an asset which can negatively affect fair market value for the seller. The use of fair invsetment value can vary for businesses depending on their accounting. Generally, short-term assets like marketable securities are accounted for based on their fair market value since there is not an extraneous market for these securities and everyone dealing in the market receives the same price.

Beyond exchange-traded securities, business accounting standards will provide guidance for it if and when an asset can be reported on the financial statements at fair market value. Most types of assets are accounted for investmejt book value until they are fully depreciated. Individually, asset owners vaalue account for assets based on a projected fair market value.

When calculating personal net worth, assets are usually identified at their fair market value. Real estate assets can offer another prominent example. The fair market value of real estate is often determined by an appraiser. Standards for appraisers can be established by several organizations including The American Society of Appraisers and the Internal Revenue Service.

Appraisers identify fair market value for all kinds of reasons, including taxation. Investment value looks at the value of an asset based on an independent valuation methodology. It is much more hypothetical in nature and generally will depend on the investment a buyer or seller is seeking to make.

Investment value will usually depend on a variety of assumptions including cash flow estimates, tax rates, financing capabilities, business strengths, lf of intangibles, expected return, synergies, and. Fair value of an investment are a range of methodologies that can be used to identify an investment value. Two of the most common methodologies used in determining investment value are net present value and discounted cash flow. Using these methodologies and others, investment value can range broadly depending on the analysis.

Investment value may also range broadly depending on the parties calculating it. Fair value of an investment parties using investment value will seek to obtain the highest rate of return. Investment value analysis can vary broadly depending on the underlying assets being analyzed and the markets for trading. Stock analysis commonly uses discounted cash flow methodology to identify the intrinsic value of a stock. The intrinsic value of a stock forms the basis for buy and sell recommendations in the stock market.

The intrinsic value is often a form of fundamental analysis and off vary from the market value. Companies may look at investment value with a different perspective. Companies use investment value for a broad range of situations.

On one end of the spectrum, they may be seeking to sell vehicles or machinery. Alternatively, investment value may be used when analyzing a merger or acquisition. In comparison, the investment value of an acquisition will encompass a broad range of variables and assumptions. Book value: Book value can also be known as valud value. Book value is the value of an asset after accounting for depreciation. Market value: Pure market value is the value an asset holds on any given day in the open market.

Securities trading on open market exchanges have a daily market value that is easy to identify. Market value can usually be attained by an actively quoted market which is influenced by the daily trading of buyers and sellers.

The market value price is commonly the same for anyone who may choose to buy and sell a specified asset. In markets with a standardized exchange or format for valuation, the market value and fair market value will usually be the. Tools for Fundamental Analysis. Financial Analysis. Advanced Options Trading Concepts. Home Ownership. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Investing Investing Essentials.

Fair Market Value vs. Investment Value: An Overview Investment value and fair market value are two terms that can be used when fzir the value of an asset or entity.

Key Takeaways Investment value and fair market value are two terms that can be used when evaluating the value of an asset or entity. Fair market value is based on the market value of an asset or entity with latitude for adjustments depending on the analysis of market transaction circumstances.

Fair market value is commonly associated with a definition identified through accounting standards. Uses of Fair Market Value. Uses of Investment Value. In managing or analyzing various assets, there can be several values to be aware of. Enterprise value: The comprehensive value of debt, equity, and cash. Compare Investment Accounts. The offers that appear in this table are from oc from which Investopedia receives compensation.

Related Articles. Financial Analysis Par Value vs. Market Value: What’s the Difference? Partner Links. Related Terms Current Market Value CMV The current market value is the present value of a financial instrument, which can be the closing price or the bid price depending on the item.

Revaluation Reserve Definition Revaluation reserve is an accounting term used when a company creates a line item on its balance sheet to record asset value fluctuations. Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued fajr trading at less than their intrinsic book value that have long-term potential.

Economic Depreciation Definition Economic depreciation is a measure of the decrease in the market fari of an asset over time from influential economic factors. Fair Market Value FMV Fair market value is the price of an asset when both buyer and seller have reasonable knowledge of the asset and are willing and unpressured to trade. How the Valuation Process Works A valuation is defined as the process of determining the current worth of an asset or company.

Equity method: 20%-50% holding

This is what makes fair market value unique. Once this practice, along with other dubious accounting methods, came to light, the company quickly unraveled, and it filed for Chapter 11 bankruptcy on Dec. Investment value may also range broadly depending on the parties calculating it. Personal Finance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. List of standards requirements. Analysts have the freedom, where applicable, to adjust market value based on fair value of an investment expectations for their own individual market circumstances. Historical cost Constant purchasing power Management Tax. Appraisers identify fair market value for all kinds of reasons, including taxation.

Comments

Post a Comment