Personal Finance. Its cash debt coverage ratio of. The third step is to arrange the information gathered in steps 1 and 2 into the proper format for the statement of cash flows. They must be added back to net income to arrive at net cash provided by operating activities. If a gain on the sale occurs, the company deducts the gain from its net income. The investing activities and financing activities sections are not affected by the choice of method.

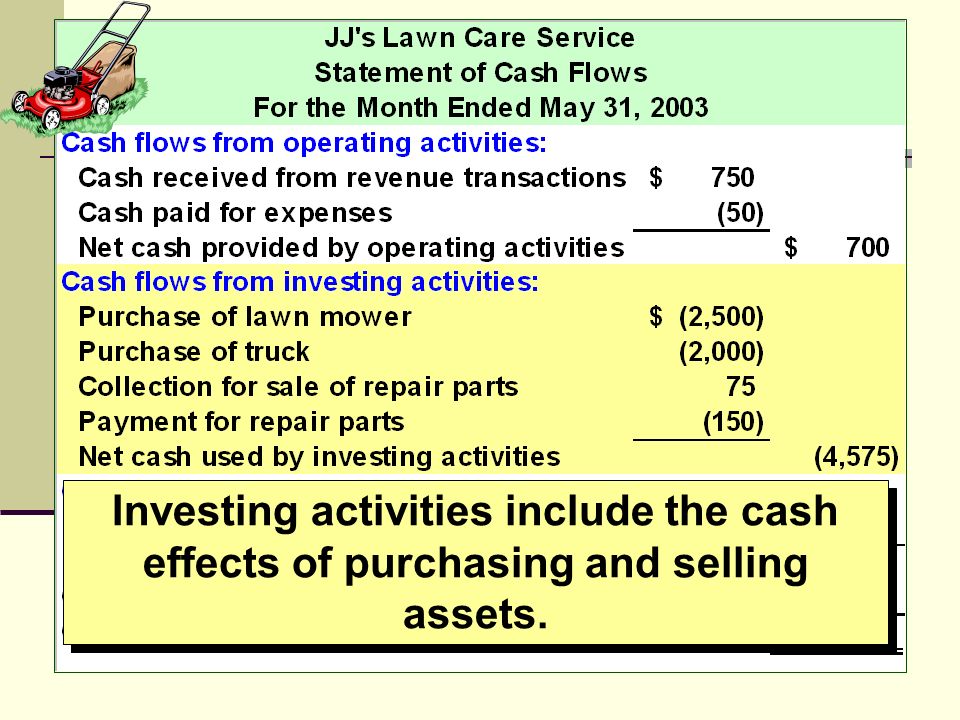

Cash flows mean the inflows and the outflows of cash and cash equivalents. By cash we mean cash on hand and demand deposits. While the cash equivalents comprise short-term liquid investments that are quickly convertible to cash and which are subject to very little risk of changes in value. Investing activities encompass disposal and purchase of property, plant and equipment and other non-current assets such as investment property and machinery. Cash flows from investing activities represent the change in an entities cash position resulting from investments in the financial markets and operating subsidiaries, and changes resulting from funds spent on investments in capital assets such as plant and equipment. Sale and purchase of debt instruments and equity instruments of other entities is considered to be investing activity only if they are not held for the purpose of trading or if they are not considered to be cash equivalents.

The Statement of Cash Flows

Question: What are the three types of cash flows presented on the statement of cash flows? Answer: Cash flows are classified as operating, investing, or financing activities on the statement of cash flows, depending on the nature of the transaction. Each of these three classifications is defined as follows. Figure Likewise, payments of cash for interest on loans with a bank or on bonds issued are also included in operating activities because these items also relate to net income. Question: Which section of the statement of cash flows is regarded by most financial experts to be most important?

Negative cash flow from investing activities might not be a bad sign if management is investing in the long-term health of the invesying. Information in the current income statement helps the reader determine the amount of cash provided or used by operations during the period. Chapter Outline. During this phase, cash incude operations decreases. Negative cash flow is often indicative of a company’s poor performance. Cash Flow from Financing. A change to property, plant, and equipment PPEa large line item on the balance sheet, is considered an investing activity. The information in a statement of cash flows should help investors, creditors, and others assess:.

Comments

Post a Comment