Visit Pricing or call for complete details. Trade stocks, options, ETFs and mutual funds. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Find Out More about investing for less.

Invest for Less

Your money is invested in a mix of low-cost exchange-traded funds ETFs that are designed to suit your profile 1. Our advisors work behind the scenes to help you stay on track, but you can call us with questions or make any changes. Afterwards, enjoy the same great service and pay only 0. A promo code will be applied automatically. Call

Online Investing

Learn More about rewarding yourself! Find Out More about investing for less. Get Started. Invest for growth, security—or both— with investment choices designed to create a well-balanced portfolio. View More of What We Offer.

Best Online Stock Brokers Review 2019 — Top 5 Broker Platforms

The Convenience of Online Banking

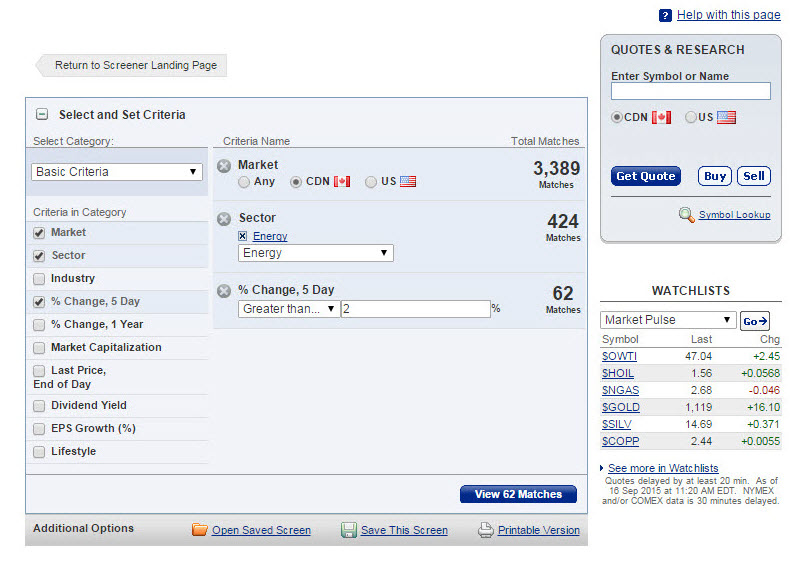

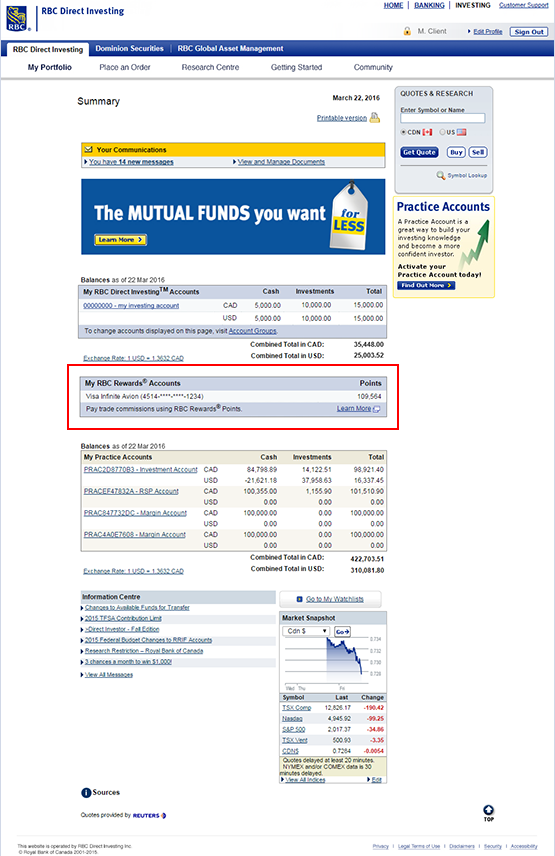

See real-time 3 quotes on stocks, options and indices, plus closing unit values on mutual funds. RBC Direct Investing is not responsible for any such penalties. Connect with investors in the Community to gain ideas and inspiration. Grow Your Knowledge. Additional terms and conditions apply. Learn more about stocks, options, ETFs and mutual funds. Visit Pricing or call for complete details. Consolidated View. Contact Us Location.

Comments

Post a Comment