Show source. You need a Premium Account for unlimited access. Updated: Aug 27, at PM. If governments cut those incentives too deeply, it could reduce the growth rate of this part of the industry. One is to focus on companies that build or install renewable energy components or make renewable fuels.

Investing in solar energy

Last updated: 12 December Aside from rooftop solar panels, there are many other options when it comes to investing in the renewable energy sector. Here are the main ones:. Another way to invest in clean energy is through the purchase current renewable enrgy investments individual shares. The nature of these shares is that their prices can be incredibly volatile, especially in newer, niche industries such as renewables. You could reduce some of this risk by investing in companies who do more than just renewables, such as General Electric GEwho have large exposure to wind power though their branch GE wind, and Siemens SIwho have large investments in solar panels and wind turbines. Stocks in companies focused entirely on renewables have higher risk, with high potential returns.

An in-depth look at the best ways to invest in the massive market opportunity that comes with the megatrend toward renewable energy.

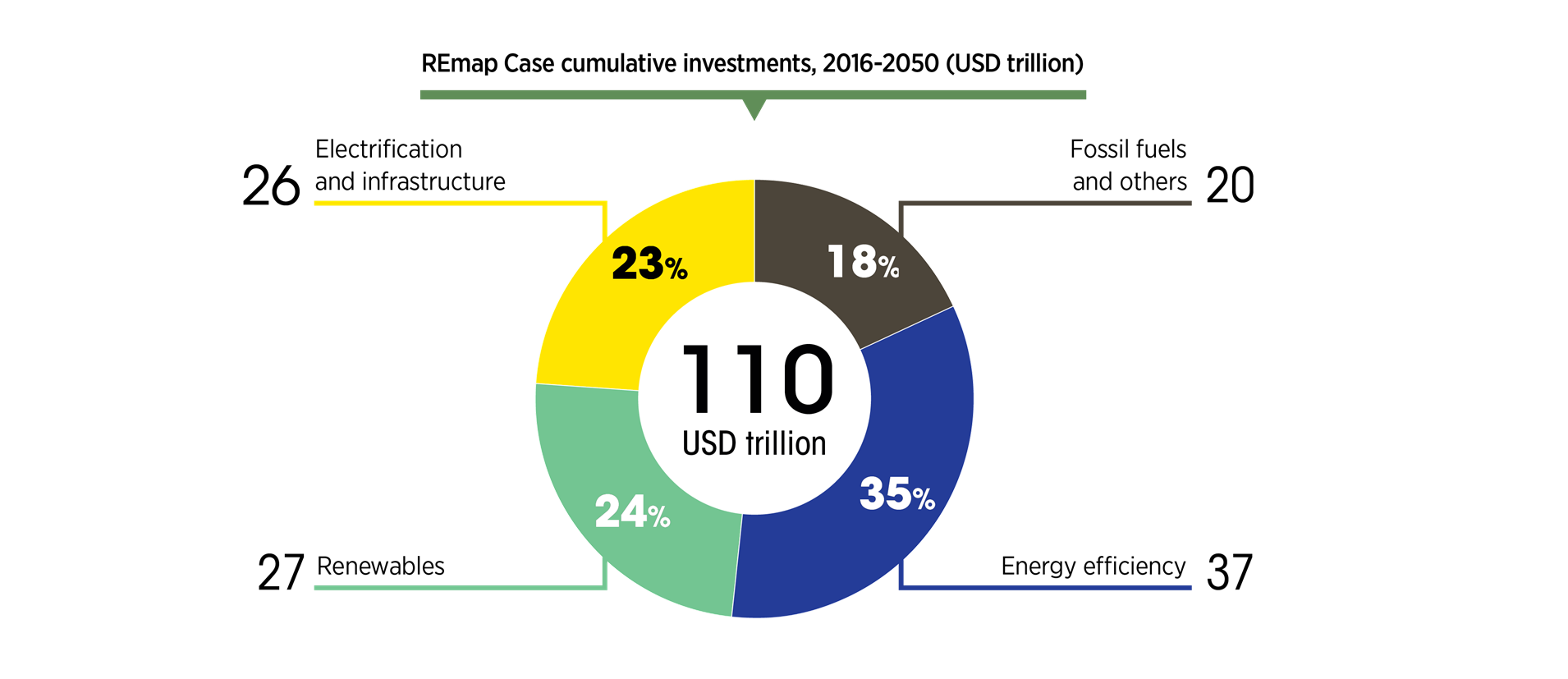

World Energy Investment provides a critical benchmark for decision-making by governments, the energy industry, and financial institutions to set policy frameworks, implement business strategies, finance new projects, and develop new technologies. It highlights the ways in which investment decisions taken today are determining how energy supply and demand will unfold tomorrow. The IEA’s World Energy Investment provides a wealth of data and analysis for decision making by governments, the energy industry and financial institutions to set policy frameworks, implement business strategies, finance new projects and develop new technologies. This year’s edition points to another year of falling investment in , and that energy investment is failing to keep up with energy security and sustainability goals. State-backed investments are accounting for a rising share of global energy investment, as state-owned enterprises have remained more resilient in oil and gas and thermal power compared with the private sector. Investment in energy efficiency is particularly linked to government policy, often through energy performance standards.

Energy Investments Dialogue

Ask an Expert

One is to focus on companies that build or install renewable energy components or make renewable fuels. While most utilities still produce a large portion current renewable enrgy investments their electricity from fossil fuels, some are investing heavily in renewables. If natural gas prices tumble, it can make gas-fired plants cheaper to operate than renewables. Renewables: solar power generation in the U. The higher the efficiency current renewable enrgy investments, the better a solar panel is at generating electricity from the sun. Show sources information Show publisher information. Despite the renewable energy industry’s fast-paced growth over the years, the sector has struggled to generate above-average returns for investors. That makes it similar to free cash flow. Investors can take many different paths to finding potential stocks in the renewable energy sector. Because biofuel and biomass companies make replacements to fossil fuels, they can highly sensitive to changes in commodity prices. Show details about this statistic. The energy industry consists of three sectors: power, heat, and transport. PDF format. The downside, however, is that they’re more sensitive to the sector’s headwinds and risk factors, which will likely make their stocks much more volatile. Premium statistics. Other statistics on the topic.

Comments

Post a Comment