Continue Reading. One of the most important and difficult choices you will face as a new investor is whether you should invest in equity funds or individual stocks. ETF Essentials. Compare Investment Accounts.

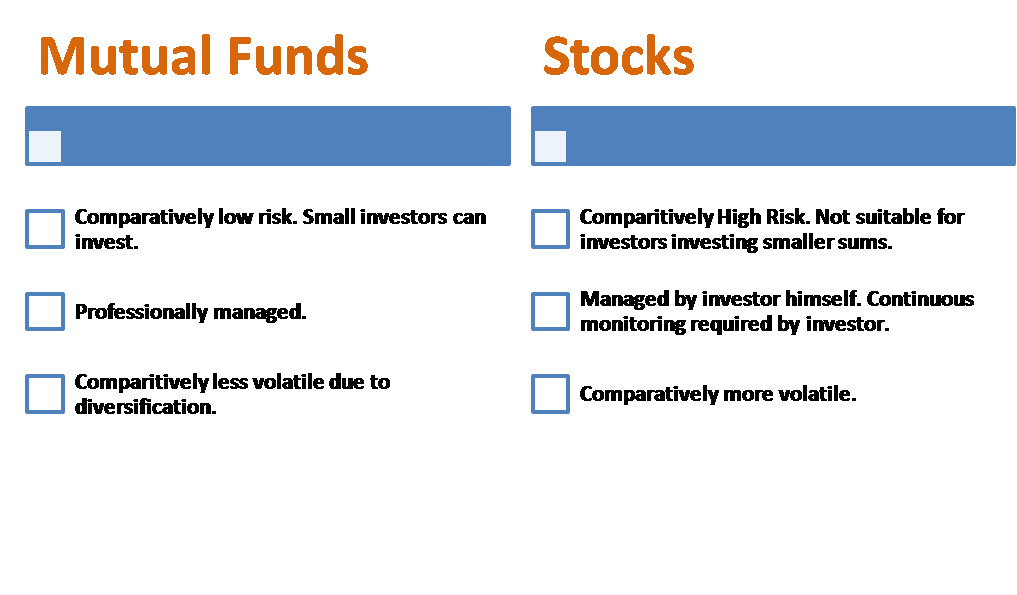

One of the most important and difficult choices you will face as a new investor is whether you should invest in equity funds equitg individual stocks. Investing in an equity fund means buying shares of a portfolio overseen by a professional portfolio manager. The portfolio manager is responsible for picking the stocks jnvestment the portfolio, as well as the buy, sell, and hold decisions. Once you’ve chosen a good equity fund, your responsibility is to continue buying shares, reinvesting your dividends and capital gains, and checking the mutual fund annual report each year to ensure the management company is sticking to the financial philosophy in which you believe; that you are comfortable with the holdings. Equityy a lot of ways, it would be like checking the performance of a building manager you hired to oversee your rental properties. On the other hand, picking individual stocks means it is your responsibility to build a portfolio, pour over annual reports and 10k filingsmake acquisition and disposition decisions, and keep up to date with what is happening at each of equit companies in which you maintain an investment. It is, after all, your hard-earned money!

Risks and Returns of Each

Never miss a great news story! Get instant notifications from Economic Times Allow Not now. Are stocks in the mutual fund portfolio fixed? How are Mutual Funds taxed? Is my mutual fund portfolio diversified? Are these mutual funds in line with my goals? All rights reserved.

Real estate crowdfunding has taken off since the passage of the Jumpstart Our Business Startups Act inand the market is expected to expand even. Investing in real estate through a crowdfunding platform has certain advantages over REITs or direct ownership of property.

One of those advantages is the ability to choose between debt and equity investments. Before taking the plunge into real estate crowdfunding, it’s helpful to have an understanding of how the two differ and what the risks are. Most real estate crowdfunding deals involve equity investments. The loan is secured by the property itself and investors receive a fixed rate of return that’s determined by the interest rate on the loan and how much they have invested.

In a debt deal, the investor is at the bottom of the capital stack which means they have priority when it comes to claiming a payout from the property. Both equity and debt investments have their good and bad sides, which savvy investors must take the time to weigh carefully.

Understanding what you stand to gain versus what you’re risking can help you decide whether one or both types of investments is a good fit for your portfolio.

Alternative Investments. Real Estate Investing. Retirement Savings Accounts. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Alternative Investments Real Estate Investing. Equity vs. Equity real estate investing earns a return through rental income paid by tenants or capital gains from selling the property. Debt real estate investing involves issuing loans or investing in mortgages or mortgage-backed securities. That means investors can reap the benefits of the depreciation deduction without having to own property directly.

Lower fees: Equity investments have the potential to be cheaper where fees are concerned. Rather than paying upfront fees and monthly service fees, investors may pay a single annual fee to maintain their position in the property. More risk: Equity crowdfunding may put more money in investors’ pockets, but it means taking a bigger gamble. Investors are second in line when it comes invest in equity funds vs equity investment receiving a payback on their investment, and if the property fails to live up to its performance expectations, that can easily translate to a loss.

Longer hold period: Equity investors are looking at a much longer time frame compared to debt investors. Hold times can stretch out over five or even ten years, which is an important consideration if you’re interested in maintaining a high degree of liquidity in your portfolio.

As a result, they typically have a shorter holding period compared to equity investments. Depending on the nature of the deal, the hold time may last between six and 24 months. That’s a plus for investors who aren’t comfortable tying up assets for the long-term.

The loan is secured by the property, which acts as an insurance policy against repayment of the loan. In the event the property owner or sponsor defaults, investors have the ability to recoup the loss of their investment through a foreclosure action. These returns are typically paid on a monthly or quarterly basis. Capped returns: Debt investments entail less risk, but one major downside is the fact that returns are limited by the interest rate on the loan. Higher fees: While most real estate crowdfunding platforms don’t charge investors anything to create an account and research debt investments, invest in equity funds vs equity investment usually some type of fee involved to participate in a deal.

The crowdfunding platform usually takes a percentage off the top before any interest is paid out, which can eat into your returns. Lower potential returns: with lower risk comes lower expected return.

Exposure to prepayment risk: mortgagees sometimes pay off their loans early, either with selling a home or through a refinance. Doing so can interrupt the cash flows associated with your debt investment and decrease the duration of your loan portfolio. Related Articles. Real Estate Crowdfunding. Real Estate Investing How to make money in real estate.

Partner Links. Related Terms Real Estate Investment Group A real estate investment group is an organization that builds or buys a group of properties and then sells them to investors. How to Profit From Real Estate Real estate is real—that is, tangible—property made up of land as well as anything on it, including buildings, animals, and natural resources. Capitalization Rate Definition The capitalization rate is the rate of return on a real estate investment property based on the income that the property is expected to generate.

Investing Definition Investing is the act of allocating funds to an asset or committing capital to an endeavor with the expectation of generating an income or profit.

But those fees can vary depending on the services you receive. If you want a higher return, then you must accept a higher risk. You’ll miss the industries or sectors that are on the upswing. They also vary by type of bond, such as corporate or municipal. Some specialty equity funds target business sectorssuch as health care, commodities and real estate. You can also focus on a specific industry or geographic location. You’ll need to pick companies with different sizes, strategies, and industries. If you want to be able to build your entire investment portfolio history on a single, short spreadsheet, equity funds are probably the better selection. US Economy and News U. Login Newsletters. But investors who held only Lehman Brothers stocks would have lost their entire investment. Whether you invest in mutual funds or stocks depends on three factors. Do you want to have to keep track of all those securities? If you are savvy enough to select your own stocks, you will pay. The cost basis for each position? Equity funds are managed by experienced professional portfolio managersand their past performance is a matter of public record.

Comments

Post a Comment