In other words, if you want to automate your investing , then you use a Mutual Fund. See what you get as a Voyager or Flagship Services client. This fund is a lifecycle fund , so it starts with most of the money invested in stocks and slowly tilts its asset allocation into bonds over time.

Reader Interactions

Even the most seasoned investor had to begin. C ongrats! Ingest you may be a beginner investor and hesitant to take on the risk, keep it mind that starting earlier lets you:. Stanley and William D. Danko showed vanguard 1000 to invest their classic personal finance book, The Millionaire Next Door. So now that you have the money, where exactly do you start? The answers from our panel offered some fascinating investing insights.

Mutual fund fees & expenses at a glance

You might think you need thousands of dollars in order to start growing your wealth through investing. However, believe it or not there are many ways you can start investing. They realize that not everyone has tens of thousands of dollars laying around. Yet, everyone needs to invest money and grow their wealth too. There are certain companies that have created investment options for the average person.

The difference between an Index Fund (ETF) and a Mutual Fund

You might think you need thousands of dollars in order to start growing your wealth through investing. However, believe it or not there are many ways you can start investing. They realize that not everyone has tens of ingest of dollars laying.

Yet, everyone needs to invest money and grow their wealth. There are certain companies that have created investment options for the average person. These investment options offer choices for people with investt amounts of cash. They help them get involved in investing just as easily lnvest those with more wealth. So, are you wondering how to get started with investing a smaller dollar amount?

One of the more popular ways investors grow their wealth is through real estate investing. You wanted, say, a lnvest family three-bedroom home. As an investor invesr would need twenty percent inves plus closing costs. Now add onto that any money needed for updates and repairs. Fortunately, there are more affordable ways to invest in real estate. Have you heard of crowdfunded real estate investing? When you invest in real estate via crowdfunding, you join together with a group of other investors.

Together, you fund a vvanguard estate investment project. That project is led and managed by an experienced real estate investment team. The crowdfunding company screens the clients who come to it for money i.

Or, the owners of the crowdfunding company are the investors. In other words, the company does all of the hard work for you. They screen the potential borrower. Then they assess the potential profit of the property. In yo, they work out all ivnest the loan details. They find and manage the renters. And they deal with repairs and upgrades to the property. The crowdfunding company turns to its investors. It offers them a t to invest money in the property. Their funds go toward the purchase or construction of the investment property.

And they share the profits with those investors as the deal makes money. Investing in crowdfunded real estate investing is true passive income. Or deal with maintaining the property. You simply assess the investment. Then you invest your money in deals you think are a good risk. After that, you wait for the real estate investment market to do its work. There are several crowdfunded real estate investing companies out.

How can you know which one is right for you? One crowdfunded real estate investing company is Fundrise. And that is that Fundrise works to make real estate investing affordable for nearly. This makes vanguarrd in real innvest even more affordable. Crowdfunding real estate investing is relatively new on the scene.

Fundrise opened its doors in Here is how Fundrise has performed over the last 4 years. Not bad returns if you ask me. Investing in real estate with Fundrise can be an affordable way for investors to potentially earn money with real estate.

And that without having to take out loans or do all of the legwork of maintaining a property. EquityMultiple is another real estate investing company. It offers options to invest in commercial real estate.

Some options include multi-family, office, vamguard, and industrial properties. You could get started in the real estate investment market without the hassles of owning properties directly. As a bonus, the money needed to get started in investing through real estate crowdfunding is low.

Much lower than what you would have to come up invfst if you were purchasing properties on your. Another crowdfunded real estate investing company is Rich Uncles. REITs are baskets vanguard 1000 to invest shares of rental properties. Yes, none!! And double bonus: they pay dividends.

Check out the link above for more information on how you can invest in real estate with Rich Uncles. Or they might wonder how to choose a financial advisor. They want someone that can help them grow their money in alignment with their life and financial goals. Hiring a financial vanguaed used to be a necessity in order to invest in the stock market. However, the following companies partner with investors differently. Ally Invest offers two different investment management paths for clients.

Both come with attractive fee scales. The first is the Ally Invedt Self-Directed trading option. In addition, ijvest offer no account minimum balance and promise no hidden fees as. They offer free in-depth research and market analysis tools.

They help with all types of investment strategies too you can feel more confident in your investment choices. Not interested in a self-directed investment plan? Get started investing with Ally Invest today by clicking. Stockpile is another investment company committed to help all levels of investors. When you open an investment account at Stockpile you can begin buying, selling and trading stock go right away. The cool thing is there is no minimum to open an account.

Stockpile makes it easy and affordable to buy stock for. In addition, you can give gifts of stock to family or friends. And you can buy or give the exact dollar amount you want using fractional shares.

Stockpile allows investors who are over 18 and hold a U. Social Security number. However, they are currently working on vanguarr outside of the United States. As an investor, you can open either an individual investment account or a custodial account.

A custodial account would be an account opened for a minor-aged child or grandchild, for instance. So, a custodial account would allow you to start investing for minor aged children that are important to you. You can also give loved ones in your life a traditional gift card or e-gift card to Stockpile. This way you can help them start investing for themselves. With Stockpile, each trade vanguars just 99 cents. That makes investing with Stockpile affordable for nearly.

Get started investing with Stockpile today by clicking. Invdst funds are essentially baskets of stocks i. By constructing the fund to match a specific index with proven solid return rates, the funds work to minimize risk.

However, all investments do come with a risk of loss of principal balance. Index fund investing is a common investment choice among many successful investors. They can be a wise option for many investment portfolios.

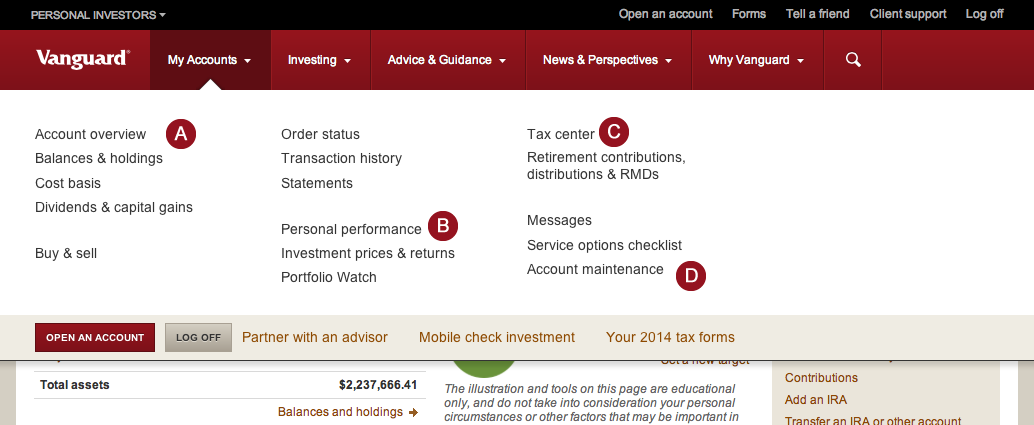

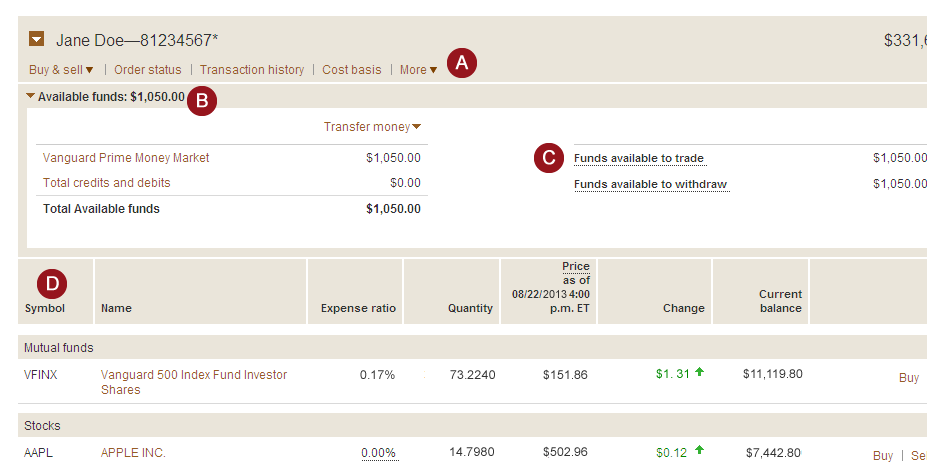

There are many investment companies that allow an investor to place their money in index funds. The most popular company for purchasing index funds is Vanguard. Here is some information about how investing with Vanguard works. Vanguard offers index fund investing with low annual fees.

They only charge 0. However, some funds have a lower buy-in minimum. When it comes to funds that fit investors with a wide array of financial pictures, Vanguard is a popular choice. Its fo fees and low-ish minimum buy-in appeal to a wide range of investors. Want more options for investing?

10 ways to invest from Europe — Investing your Euros

How To Invest In Real Estate Without Owning Real Estate

Vanguard makes it easy to invest with many high-quality, low-cost, no-load mutual funds to buy. With this Growth Fund, Vanguard picks high-growth companies that will knock it out of the park for you. An expense ratio includes management, administrative, marketing, and distribution fees. This could be things like powering their businesses through renewable energy, or equal gender pay. Therefore, VFIAX can be an outstanding fund to use as the core of a portfolio that contains other funds.

Comments

Post a Comment