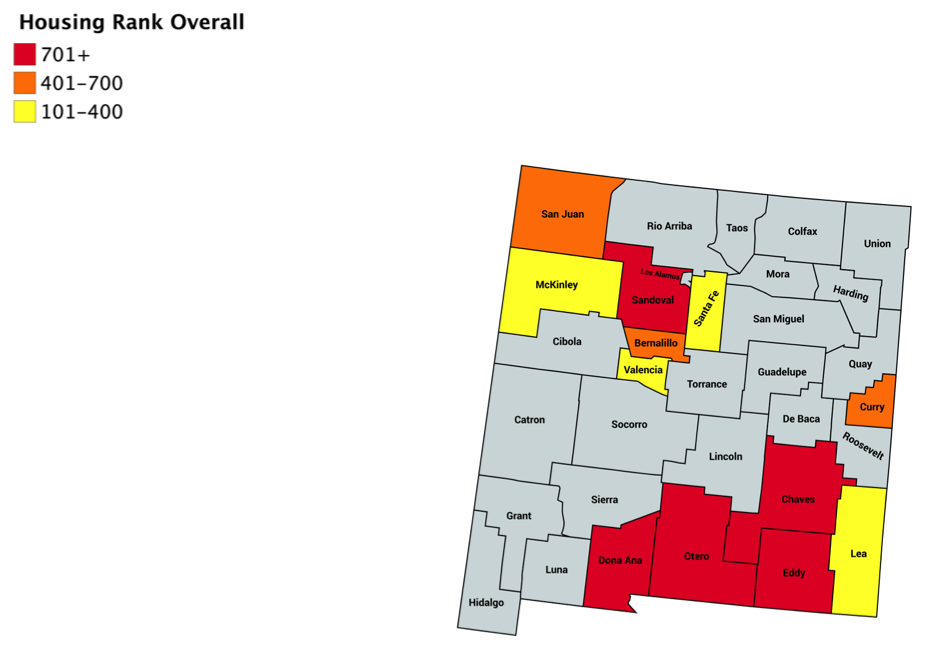

As part of a larger body of work that identifies general trends in commercial investments at the local level, this interactive feature documents community development across counties in the United States. More information on our funding principles is available here. Search for your county to see how it compares nationally and with peers of similar population size in terms of housing, small business, impact finance, and other investment flows. Community foundations CFs are instruments of civil society designed to pool donations into a coordinated investment and grant making facility dedicated primarily to the social improvement of a given place. The people or organizations that establish the funds can then recommend that grants be distributed, in the name of the fund or anonymously, to qualified nonprofit groups and schools.

Foreign investments add diversity, but there are risks

Investing in foreign countries is a relatively new option for individual investors. Luckily, the advent of internationally focused mutual funds and exchange-traded funds ETFs has made it easier than. But, is investing abroad a good decision? As always, the decision to invest in foreign countries depends largely fo your investment objectives, but this article will take a look at some of the pros and cons. The primary rule of investing is to seek the highest risk-adjusted return for their capital also called «alpha».

Key Facts & Figures

Reports often state that certain countries are ‘very promising’ or ‘are expected to grow hugely over the next ten years’, i. Well we’re not talking about a firm here so my question is how do you invest in a country? Is there a way to index your investment against a countries GDP growth? Or do you expect certain industries to grow in line with the economy and invest accordingly?? By investing in that countries beverage’s sector Well, since you stated you aren’t talking about a firm.

DÉPENSES DE R-D PAR PAYS

New York Community Trust. Elizabeth Forney. According to the latest data available, from Octoberon The Foundation Center website [6]the top 5 largest community foundations, by assets, were:. Since the s, a number of private foundations in the United States have created initiatives to develop community foundations in various states. Community Development Financial Flows How US Counties Compare June 26, The US has a wide array of programs and regulatory supports that help how do counties invest in communities community development and generate economic growth and opportunity. Local business success generates increased tax revenues for localities, which can be used to support important community needs and amenities. Sort by:. Pooled donations for improvement of a local society. Skip to main content. One coynties the earliest such initiatives was in Michigan and in Indiana the Lilly Endowment funded a program that has spurred development of community foundations in each of the state’s 92 counties. For each program, we scale the total dollars of funding an indicator received to estimate potential demand at the county level. In cokmunities projects Wikimedia Commons. Our Support Organizations section highlights major organizations working to advance State and Local Investments. Retrieved Wikimedia Commons has media related to Community foundations.

Comments

Post a Comment