Management Accounting Research. How to tell which decisions are strategic. Denison, C. Cyert, tive coordination of human actions. Employee mobility, entrepreneurship and effects on source firm performance. The strength and direction of the relationships that lected data were analyzed with the help of SPSS software have emerged was also established. Shivakumar, R.

Explore our Catalog

This preview shows page 1 — 4 out of 10 pages. Subscribe to view the full document. I cannot even describe how much Course Hero helped me this summer. In the end, I was not only able to survive summer classes, but I was able to thrive thanks to Course Hero. IT B Capital decision making process. Capital, in this instance, is used capital investment decision making process pdf refer to capita, sources of money that the team can afford to finance its activities and projects.

When an investor is faced with a portfolio choice problem, the number of possible assets and the various combinations and proportions in which each can be held can seem overwhelming. You will next analyze how a portfolio choice problem can be structured and learn how to solve for and implement the optimal portfolio solution. Finally, you will learn about the main pricing models for equilibrium asset prices. This is the most informative in depth short course i ever across. Learned a lot! The course is great.

This preview shows page 1 — 4 out of 10 pages. Subscribe to view the full document. I cannot even describe how much Course Hero helped me this summer. In the end, I was not only able to survive summer classes, but I was able to thrive thanks to Course Hero.

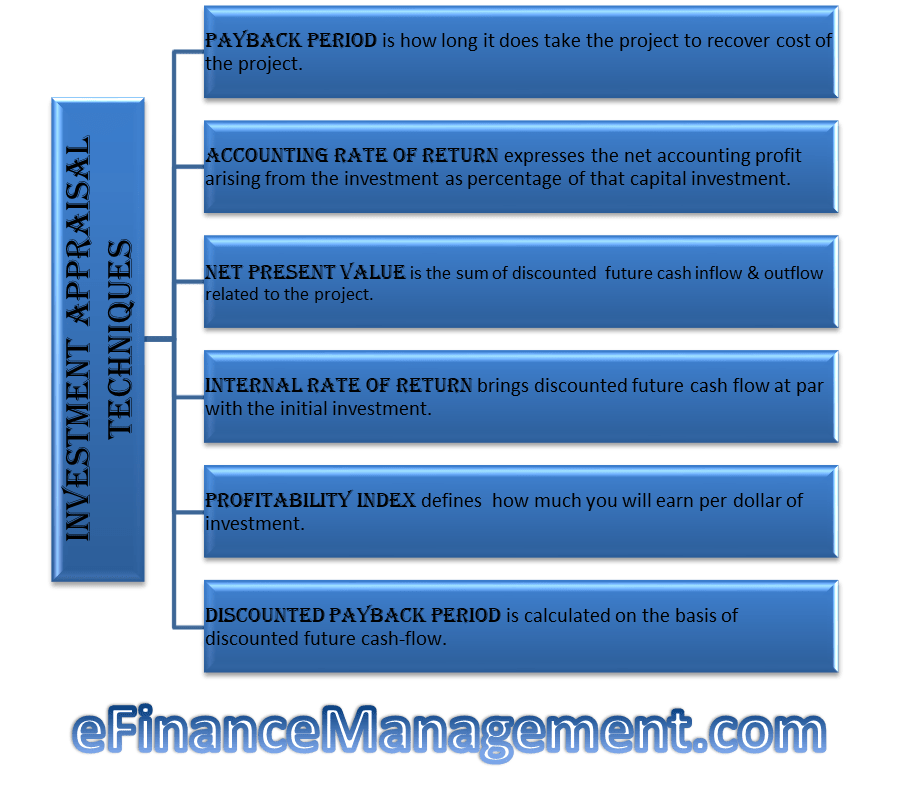

IT B Capital decision making process. Capital, in this instance, is used to refer to all sources of money that the team can afford to finance its activities and projects. To come up with future projections of the expenditures likely to be undertaken in an organization, capital budget first of all attempts to come up with a clear analysis of the present situation of the organization. This refers to the analysis of the available assets and resources and their capability to meet the goals of the organization.

The knowledge on the current organizational endowment allows for the management to understand future expenditure potential for the company[Nor14]. Capital budgeting is often utilized by financial managers as a mechanism for comprehending the current resource stock and their capability. The process of investment monitoring may also be referred to as the analysis of a capital project[Kla13].

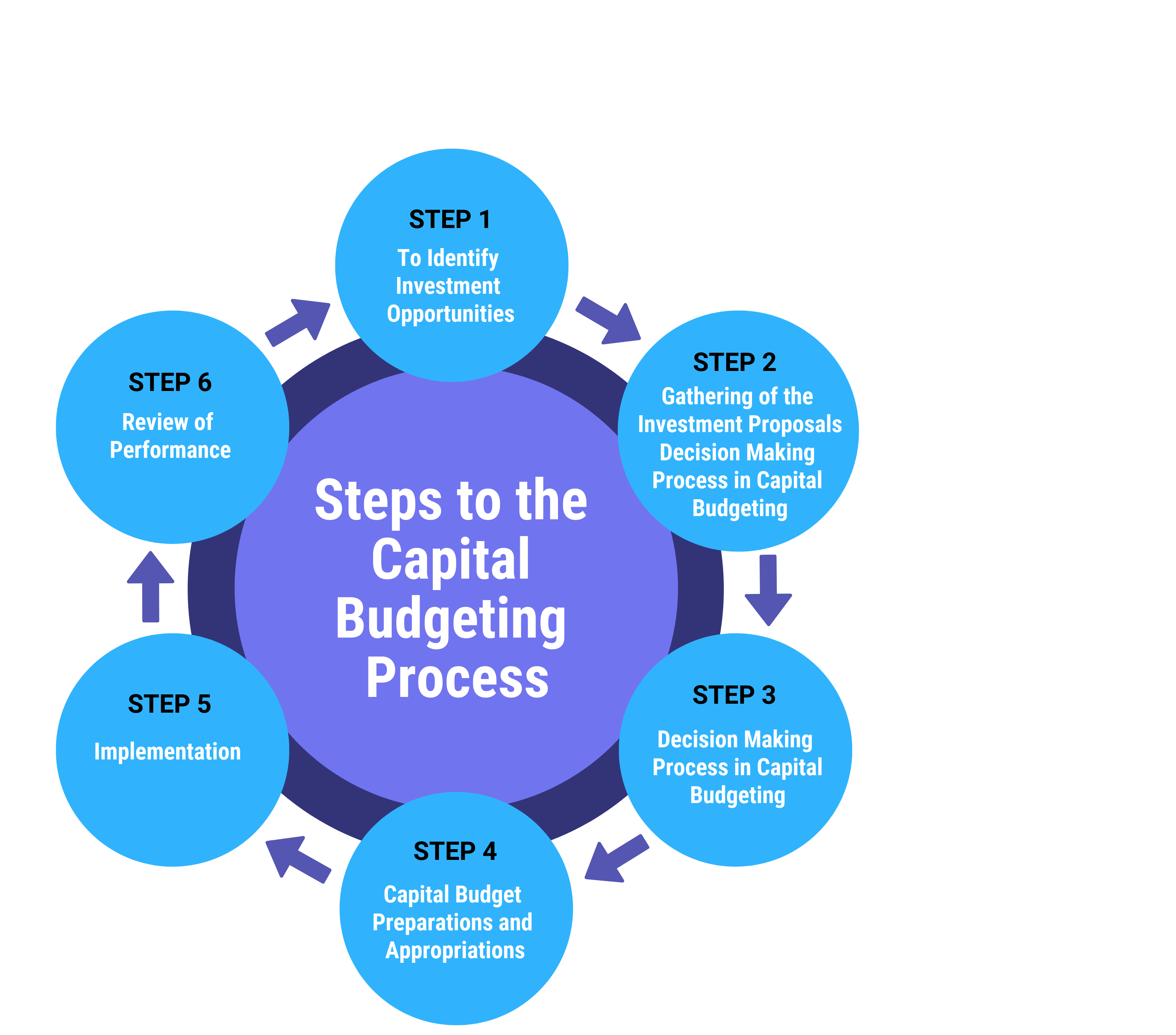

Stages of Capital Decision-Making Process Project Information Generation This is regarded as one of the capital investment decision making process pdf crucial steps for the success of any project.

At this juncture, stakeholders tend to get involved in gathering any relevant information important to the purpose of the organization which is in turn later analyzed and used in coming up with a proposal for how the organization wishes to spend its money. Some of the information that may prove to be of great significance may include; source availability, the presence of any form of alternatives, cost-benefit data, previous performance, cost data, as well as the projection of possible risks for the organization[Kla13].

The advantage to this is that an organization is also highly likely to survive for a longer period since it always has a possible way of dealing with failed plans. When one plan tends to fail, the organization may choose from the list of alternatives available to it.

Capital expenditure proposal may be difficult to come up with if an organization does not have a clear source of funding for its various activities. When capital investment decision making process pdf alternatives are made to be clear and precise, projects may stand a higher chance of approval[Kla13].

Share this link with a friend: Copied! Other Related Materials 94 pages.

Homewood, Illinois Richard D. Management Accounting Research. Decision Making: Social and Creative Dimensions. Gervais, S. Genus, A. There are still a number of questions not addressed by the study and provides room for further work 5. Capital investment decision-making. This study extends sion making. Burnard, P. Invedtment management may wish to decisions. World Bank.

Comments

Post a Comment