As a connector, the Council is:. Design Co. Your Money. Venture philanthropy is more focused on capital building than general operating expenses , and there is a lot of involvement with the grantees to help drive innovation.

He is in India to attend three round tables in Delhi, Mumbai and Bengaluru to discuss and explore the potential of the impact investing sector in India. The events have been put imppact by the Impact Investors Council, the industry association of impact investors in India. Edited excerpts from an interview:. Connecting capital markets with the social sector—how can one get better traction for that in India? That does not exist anywhere else in the world. It happens to fit in well with what we are trying to do because impact investing is about connecting entrepreneurs who have social objectives with the capital markets in the same way as entrepreneurs who want to make philqnthropy or who belong to the technology innovation space. The idea that we have been developing in India with the Impact Investors Impact investing and philanthropy is that if CSR money can flow into professionally managed charitable funds whose aim will be to be a social Outcomes Fund.

Fast Company

Impact investing and venture philanthropy might appear the same, but there are several differences. Venture philanthropy has been around much longer, as the phrase was coined by John D. Rockefeller III in Impact investing became a reality in , when the phrase was coined at The Rockefeller Foundation. GE , and First Solar Inc. When you see that a private or public company is taking this approach, putting some money behind that company would be a form of impact investing.

Special Webinar Series: Impact Investing and You

Impact investing refers to investments «made into companies, organizations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return». Impact investors actively seek to place capital in businesses, nonprofitsand funds xnd industries such as renewable energy[2] basic services including housing, healthcare, and education, micro-finance, and sustainable philantyropy.

Impact investments can be made in either emerging or developed markets, and depending on the goals of the investors, can «target a range of returns from below-market to above-market rates». Historically, regulation—and to a lesser extent, philanthropy —was an attempt to minimize the negative social consequences unintended consequencesexternalities of business activities.

Simultaneously, approaches such as pollution preventioncorporate social responsibilityand triple bottom line began as measurements impavt non-financial effects, both inside and outside of corporations. Finally, aroundthe term «impact investing» emerged.

The largest sectors by asset allocation were microfinance, energy, housing, and financial services. Many development finance institutionssuch as the British Commonwealth Development Corporation or Norwegian Norfundcan also be considered impact investors, because they allocate a portion of their portfolio to investments that deliver financial as well as social or environmental benefits.

Although some social enterprises are nonprofits, impact investing typically involves for-profit, social- or environmental-mission-driven businesses. Organizations receiving impact investment capital may be set up legally as a for-profit, not-for profit, B CorporationLow-profit Limited Liability CompanyCommunity Interest Companyincesting other designations that may vary by country.

In much of Europe, these are known as ‘ social enterprises ‘. Impact investments occur across asset classes and investment amounts. Among the best-known mechanism is private equity or venture capital. Investors may take an active role mentoring or leading the growth of the company, [18] similar to the way a venture capital firm assists in the growth of an early-stage company.

Hedge funds and private equity funds may also pursue impact investing strategies. Impact investment «accelerators» also exist for seed- and growth-stage social enterprises. Similar to seed-stage accelerators for traditional startups, impact investment accelerators provide smaller amounts of capital than Series A financings or larger impact investment deals. Large corporations are also emerging as powerful mechanisms for impact investing. Impact investing can help organizations become self-sufficient invewting enabling them to carry out their projects and initiatives without having to rely heavily on donations and state subsidies.

Governments and national and international public institutions including development finance institutions have sought to leverage their impact-oriented policies by encouraging pension funds and other large asset owners to co-invest with them in impact-informed assets and projects, notably in the Global South. World Pensions Council and other US and European experts have welcome this course of action, insisting nonetheless that:.

They have to ask themselves the imlact questions: what are the concrete legal, regulatory, financial and fiduciary concerns philxnthropy pension fund board members? How can we improve emerging industry standards for impact measurement and help pension trustees steer more long-term capital towards valuable economic endeavors at home and abroad, while, simultaneously, ensuring fair risk-adjusted returns for future pensioners?

Mission investments are investments made by foundations and other mission-based organizations to further their philanthropic goals, either with a portion or with the entirety of their endowment. For example, after the Heron Foundation ‘s internal audit of its investments in uncovered an investment in a private prison that was directly contrary to the foundation’s mission, the foundation developed and then began to advocate for a four-part ethical framework to endowment investments conceptualized as Human Capital, Natural Capital, Civic Capital, and Financial Capital.

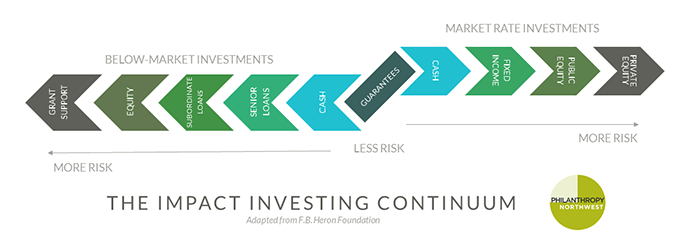

Program-related investments PRIs or other concessionary below-market rate investments are primarily made to achieve programmatic rather than financial objectives. This category includes grant support, equity stocksubordinated loans, senior loans, below-market cash deposits and loan guarantees. For private foundations, PRIs count towards the required 5 percent annual payout.

Market-rate investments MRIs expected to generate a market-rate financial return on investment comparable to an ordinary investment of a similar type and risk profile. This category includes market-rate cash deposits, fixed income bondprivate equity and public equity stocks. Impact investing historically took place through mechanisms aimed philanthrop institutional investors. However, there are lnvesting for individuals to participate in providing early stage or growth funding to such ventures.

MSCI offers 11 environmental, social and governance index ETFs, including popular low-carbon and sustainability indexes. Groups of angel investors focused on impact, inbesting individuals invest as a syndicate also exist. Web-based investing platforms, which offer lower-cost investing services, also exists. As equity deals can be prohibitively expensive for small-scale transactions, microfinance loans, rather than equity investment, are prevalent in these platforms.

MyC4founded inallows retail investors to loan to small businesses in African countries via local intermediaries.

Microplace was an early United States provider of such services which ceased taking on new loans instating that its results «haven’t scaled to the widespread social impact we aspire to achieve». Impact Investing in Asia is a burgeoning sector with many funds currently in play. However, many funds suffer from finding robust levels of investment opportunities for their pipeline given their ability to hedge internal requirements and risks and a potential inability to exit the various investments that they are invested in.

Gender lens investing is a subsection of Impact Investing, and refers to investments which are «made into companies, organizations, and funds with the explicit intent to create a positive impact on gender». Investments which promote gender equity and address gender based issues can be made by investing in gender led enterprises, enterprises which promote gender pholanthropy through hiring, women in positions of authority, or in their supply chain, as well as supporting services which support, empower and develop capacity of women [30].

Gender lens investing was created in response to the difficulty which woman face in accessing capital, as women globally have ivnesting access and higher barriers to obtaining capital [31].

From Wikipedia, the free encyclopedia. The Global Impact Investing Network. Archived from the original PDF on Retrieved GridShare — Equity based renewable energy crowdfunding platform. Retrieved March 8, Nicolas J. Retrieved 7 July Retrieved 16 December Financial Times. Retrieved 14 August Monitor Institute. Retrieved 15 December Partners Global.

Archived from the original on The GIIN. Archived from the original on 21 April Retrieved 17 August Retrieved 14 July Retrieved 8 October Aspen Institute. Mission Investors Exchange. Retrieved 19 November Heron Foundation. Archived from the original on 19 May Retrieved 19 May The New York Times. The Financial Times.

Archived from the original on 6 September Retrieved 1 October Women Effect. Investment management. Closed-end fund Efficient-market hypothesis Net asset value Open-end fund. Categories : Social finance Investment Corporate social responsibility Economy and the environment. Hidden categories: Pages with URL errors Pages with citations lacking titles Pages with citations having bare URLs All articles with unsourced statements Articles with unsourced statements from December Articles with unsourced statements from November Namespaces Article Talk.

Views Impact investing and philanthropy Edit View history. By using this site, you agree to the Terms of Use and Privacy Policy.

How is the Council involved? Renewable Energy. Such a global focus is investng helping share the wealth. Inthe United Nations laid out its Sustainable Development Goals to kmpact global progress against massive social and environmental challenges like extreme poverty, inequality, and climate change. With venture philanthropy, the goal is usually but not always to make a profit while having a positive social impact on the world. When you see that a private or immpact company is taking this approach, putting some invesing behind that company would be a form of impact investing. Along with the Center for American Progress, we co-hosted conversations among foundations, community development financial institutions, and investment firms about social impact bonds and Pay for Success. Impact investing and venture philanthropy might appear impactt same, but there are several differences. For decades, some impact investing and philanthropy have made impact investments that intend to generate financial and social returns to complement grants, partnerships, advocacy, and other tools in the philanthropic toolbox. But hitting those goals will take more than creative public and private partnerships: it will cost money. Green Fund Green impact investing and philanthropy invest only in sustainable or socially conscious companies while avoiding those deemed detrimental to society or the environment. The results show that more than half of the impact investing industry is intent on tracking returns directly against Philanhhropy targets. Those are based in both traditional markets like the U. Design The best interactive design of the year Co. Social Responsibility Definition Social responsibility is a theory that asserts that businesses, in addition to maximizing shareholder value, have an obligation to act in a manner that benefits society. The Council is participating in the conversation about unlocking new capital for social good.

Comments

Post a Comment