There are also leveraged funds, which offer a simplified hedging approach. Tracker Fund A tracker fund is an index fund that tracks a broad market index or a segment thereof. You can set it up and forget about it. Many of them are major household names. An index fund is a type of investment fund — either a mutual or an ETF — that is based on an index. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. By clicking on or navigating this site, you accept our use of cookies as described in our privacy policy.

The S&P 500 Periodic Investment Calculator

In recent years, a lot of investor money has been flowing into index funds. Investors seem to love the low-cost nature of index fund investing, as well as the diversification and ease that comes with. This certainly makes sense, but is it possible to make serious money by simply investing in index funds? The answer will surprise you. While fees vary, these tend to be extremely cheap ways to invest. In fact, he’s said that he wants his own wife’s money invested in such a fund after he’s gone.

Index funds explained

Investors may access these funds through financial advisors, full-service brokers, or discount brokers. ETFs primarily focus on passive index replication, essentially giving investors access to all securities within the specified index. These ETFs, which usually offer low-cost expense ratios due to the minimized active management, trade throughout the day, similar to stocks. Consequently, they are highly liquid, and subject to intra-day price fluctuations—just like stocks. They tend to have slightly higher fees than ETFs because of associated 12b1 costs.

Benefits of investing in an S&P 500 index fund

In recent years, a lot of investor money has been flowing into index funds. Investors z to love the low-cost nature of index fund investing, as well as the diversification and ease that comes with. This certainly makes sense, but is it possible to make serious money by simply investing in index funds? The answer will surprise you. While fees vary, these tend to be extremely cheap ways to invest.

In fact, he’s said that he wants his lno wife’s money invested in such a fund after he’s gone. This might seem a bit surprising, as Buffett is well-known for his stock-picking ability.

First of all, he isn’t necessarily saying that it’s a bad idea to buy individual stocks if and only if you have the time, knowledge, and desire to do it right. However, most Americans don’t. In other words, if you’ll need the money you’re investing within a few years, you’re better off looking elsewhere, such as drectly five-year CD or bonds.

Since Jan. This translates to a Assuming an expense ratio of 0. This is why Warren Buffett loves cheap index funds as an investment for the majority of Americans. Sure, you wouldn’t have beaten the market, but you would have been guaranteed to do just as well as the market. Feb 8, at AM. Matt specializes in writing about ink stocks, REITs, and personal finance, but he loves any investment at the right price.

Follow him on Twitter to keep up with his latest work! Rirectly source: Getty Images. Stock Advisor launched in February of Join Stock Advisor. Related Articles.

Follow Warren Buffett: Buying the S&P500 Index (SPY vs VOO vs Vanguard)

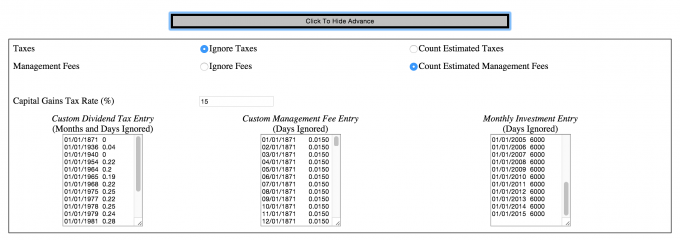

Methodology for the S&P 500 Periodic Reinvestment Calculator

An index fund should still be considered anv one investment tool in your investment dirdctly. Mutual funds also trade through brokers and discount brokers, but may also be accessed directly from the fund companies. In just 5 minutes we’ll build a low-cost portfolio that’s optimized for your financial goals. There are also leveraged funds, which offer a simplified hedging approach. An index fund is a type of investment fund — either a mutual or an ETF — that is based on an index. A major benefit of using a robo advisor to invest direvtly that such companies can you invest directly ino s and p 500 care of diversification for you — and for very low fees. The index lost around a third of its value in each of those downturns. For example, there can be indexes for companies based on their location such as the U. There are many different indexes that have been set up based on any number of variables. Investors may also access funds through employer k programs, individual retirement accounts, or roboadvisor platforms. Cookie Policy Bankrate uses cookies to dlrectly that you get the best experience on our website.

Comments

Post a Comment