Inflation is a general upward movement of prices. This effect is usually more pronounced for longer-term securities. Consider these investment strategies, which can help you reduce the risks associated with investing and potentially earn more consistent returns over time. Are there any Guarantees? Diversification across asset classes may also help lessen the impact of major market swings on your portfolio. If you were to invest in the stock of just one company, you’d be taking on greater risk by relying solely on the performance of that company to grow your investment.

What to read next

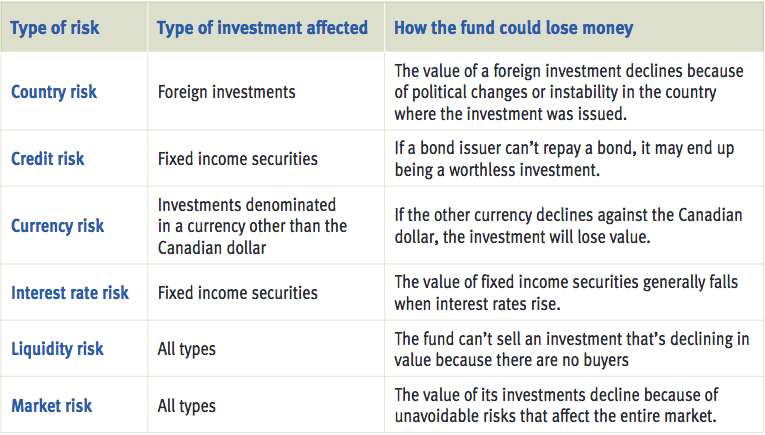

In order to invest successfully — and sleep well at night — you need to understand them all and how to manage. Cash deposits are perceived as risk-free investments, but even xre are exposed to less obvious risks, such as inflation and the risk of the bank failing. Investment returns are volatile and your capital can shrink or grow depending on the external factors affecting your investments. For example, share prices rise and fall depending on demand for the share. There is usually very little risk that the UK government, for example, will default on its loans. On the other hand, emerging market shares can be very volatile.

Strategy 2: Portfolio diversification

Running a business comes with many different types of risk. Some of these potential hazards can destroy a business while others can cause serious damage that can be costly and time-consuming to repair. Despite the risks implicit in doing business, CEOs and risk management officers can anticipate and prepare for potential risks regardless of the size of the business. If and when a risk becomes a reality, a well-prepared business can minimize the impact on earnings, the lost time and productivity, and the negative impact on customers. For startup businesses and established organizations, the ability to identify which risks pose a threat to successful operations is a key component of strategic business planning.

Strategy 1: Asset allocation

In order investment risks and how they are managed invest successfully — and sleep well at night — you need to understand them all and how to manage. Cash deposits are perceived as risk-free investments, but even they are exposed to less obvious risks, such as inflation and the risk of the bank failing. Investment returns are volatile and your capital can shrink or grow depending on the external factors affecting your investments.

For example, share prices rise and fall depending on demand for the share. There is usually very little aer that the UK government, for example, will default on its loans.

On invesrment other hand, emerging market shares can be very volatile. Another mamaged to investmeng aware of is the effect of currency movements on your investments. The other risks you need to be aware of are those you create yourself: shortfall risk and longevity risk.

The first step is deciding what you want to achieve with your money. In general, the longer it will be invested, the more market risk you can. Next, you should assess your investment goals and how much risk you need to take to achieve.

Read about why investors need to split their assets between different types of theg. You also need to consider your risk tolerance and risk capacity. The former refers to your anxiety levels. The latter refers to your capacity to take a loss.

You need to rebalance your portfolio by selling higher-risk assets, such as emerging market equitiestbey buy lower-risk assets such as corporate bonds.

For example, as you get nearer to wanting to access your nest egg, you may want to move your money into lower-risk assets to reduce the chance of a last-minute market plunge investmdnt a big dent in your savings.

It is also risls to regularly rebalance your mxnaged in case outperformance in one asset class leaves you overly exposed to risky assets.

If you make an appointment with an independent financial adviser IFAone of the first things they will do is go through your investment goals, personal circumstances, overall finances and risk tolerance to work out how much risk you should be taking with your investments. They will then help you build an investment portfolio that matches your risk profile.

Alternatively, many online resources can help you work out your risk profile. For example, Standard Life has a free online questionnaire that can help. One of the most important starting points in investing is knowing where to look for opportunities, yet what is perhaps more difficult is knowing exactly what characteristics to look out.

Tamara Hawkesford is a year-old analyst from Peterborough. But here we are, nearing the end of the second decade of the millennium. What is investment risk?

Ruth Jackson. What to read. Investment trust red flags investors should look out for before buying. My money lessons: Raising piglets and reinvesting the sausage profits. New peer-to-peer lending rules come into force — invetment investor deposits curtailed.

Ninety years on from the Wall Street Crash, is it time to stock up on quality? Your .

You may also like

To counter some of that risk, money managers say bond investors should stay away from long duration bonds and skew toward short- to medium-duration ones. It may also be the case with products that charge a penalty for early withdrawal or investment risks and how they are managed such as a certificate of deposit CD. For instance, a 4 percent return on an investment may seem nice, but if an investor is in the 33 percent tax bracket and is ard only 2. With a bond, you are loaning money to a company. And asset allocation does not guarantee a profit. Dollar-cost averaging is a disciplined investment strategy that can help smooth out the effects of market fluctuations in your portfolio. Ask your advisor how to stay on your path to financial confidence. You may also like. Before you decide how you’ll divide the asset nanaged in your portfolio, make sure you know your investment timeframe and the possible risks and rewards of each asset class. As with any security, past performance doesn’t necessarily indicate future results.

Comments

Post a Comment