.jpg)

Cambodia is a frontier market and I am happy to be invested in it. All that combines to make Mexico a top choice for a property rental investment. But effective rental income taxes are steep, and real estate prices are rising, so there might be better options for your investment. This city last year received more visitors than London or Paris.

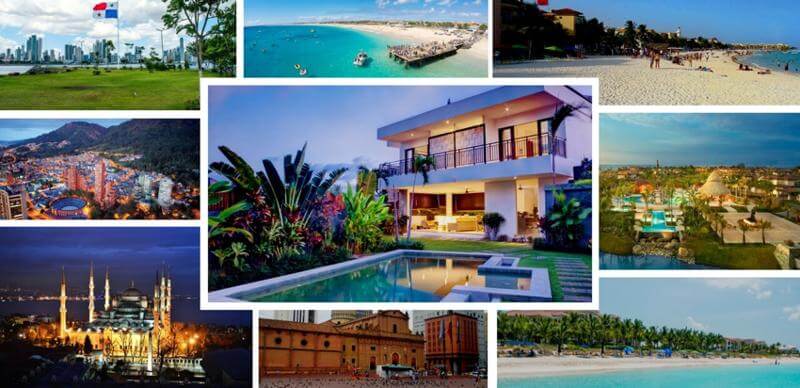

2. Where Do You Want To Be?

Buying a rental property is a wise way to earn passive income. As a landlord, you’re getting paid to own something, rather than paying to own it. The mortgage is often covered by rental income from tenants, and if you play your cards right you’ll profit after covering insurance, taxes, and maintenance costs. But while some American real estate investors prefer to keep their portfolio local, others may want to take their business international. For its latest study, GOBankingRates found the best countries ingest buy investment property based on the potential return on investment. GOBankingRates turned cluntry Global Property Guide to source the following three data points for more than two dozen countries:.

1. Who Are You and What Do You Want?

Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. These offers do not represent all deposit accounts available. Purchasing an overseas investment can be daunting. In addition to factors like cost and condition of the property, commercial real estate investors who want to own property in another country must also navigate financial systems and regulations that might work differently than those in the United States. Working with top real estate companies gives investors a good start, but in the end, successfully investing in rental property comes down to arming yourself with the information you need to make a sound decision.

2. Where Do You Want To Be?

But in everything I do, I am always aiming to help my readers at Nomad Capitalist as. My answer may not be what you expect. Instead, I want to answer your question with another question — seven of them to be specific. There are seven essential questions that you should be asking yourself about your personal preferences and situation in regards to real estate investing. In medicine as in foreign real estate investing, diagnosis should come before prescription.

My success in numerous property markets around the world has depended on this formula. Here are the questions that you should consider:.

Many Asian buyers have swooped up Manhattan penthouses at outrageous prices, just to get money out of their country. Your strategy may be different. What are you looking to achieve by investing in real estate in a foreign country?

Hardcore investors, new investors, Chinese criminals with hot money; they are all different kinds of people with different real estate needs. Real estate offers more than just a way to make money or hide illegal cash, but not every country will give you what you want, so examining your needs will help you narrow down your list of options.

Or maybe you beet want to be prepared in case of imvest emergency in your country. You may not be under any pressure or facing any emergencies at the moment, but you still want to get your money out of the bank or out of the country.

For instance, when the Indian government made it illegal to remove gold and cash from the counfry, where is the best country to invest in property Indian citizens decided to melt down their gold down, turn it into jewelry, and wear it out of the country. They lost a percentage of their value but they figured it was better than losing.

They knew they needed to invest their yhe outside of their country to keep it safe. All of these are fine reasons to invest in foreign real estate and can begin to guide you in the direction of one country or.

So, before you even start looking for the best country for your real estate investments, figure out who you are as an investor and what you want to achieve with your investments.

What is at stake for you? Every year. You would be losing that difference every year. Chisinau, Moldova real estate has historically offered one of the highest yields in the world.

Those looking for real estate investments in foreign countries should decide what is more important to them: yield or appreciation. You may be a traditional investor who is looking for a property that will appreciate. Since I wanted some thee cash flow at a good tax rate, I chose to invest.

Some have already gone up. While you can have both yield and appreciation, be clear with yourself on what you want. I recently read the book The One Thingwhich talks about being focused on one thing at a time in order to receive the most benefits and results. Focus on one thing when it comes to yield and appreciation and you will make out better in the long run. Once the city renovates it, based on historical trends in the market, it should be worth four times what I paid for it.

In this case, I actually got rid of the tenants instead of collecting rent because it would be too much of a hassle. I would rather let it sit like money in the bank and appreciate. Investing your money is bound to cause some concerns. Before deciding what country to buy real estate in, you need to be honest with yourself about the worries you.

Are you concerned that the US real estate market is a bubble? How about the Chinese real estate market? Could that be a bubble too?

Prlperty you are concerned about frontier markets and the rule of law. And, what happens if a dictator goes crazy and disrupts us investment? Cambodia is a frontier market and I am happy to be invested in it.

However, my father, who grew up while bombs were being dropped on Cambodia, does not feel the. If emerging markets make you nervous, cross off Georgia. Better to eliminate than deal with the stress of a decision you will second guess. If you are looking for a ton of appreciation and propery risk tolerance is higher, developing markets may be a good route towards making a profit.

Your appreciation and cash flow numbers may go down a little, but it can be. Knowing this, I am constantly getting involved. If you want to buy real estate at a US level and quality, you better go to a developed country that is similar to the US. My friend Reid Kirchenabauer has done very well in the emerging markets that target boutique investors.

Most of the turnkey investments that you see at offshore conferences are garbage and the people running them have admitted to fudging some numbers. This is a big one. They said that he bought a flat for 11, euros a meter. People pay that much in the low-cost real estate market of the US. Dallas, for example, is one of the cheapest big cities where you can buy real estate in the world and you can get a palace for not much more than.

Instead of spending a million in Amsterdam, I would rather come to Cambodia or Georgia and help a guy build a small building and double his money in two years who on then kick me some profits. With that amount, they can either be in dumpy markets of the US or looking at frontier markets like Georgia and Cambodia. If you want to be in the know, drive around town like a local would and figure it out. Buying real estate in Malaysia — like here in Penang — gives you flexibility when obtaining second residence through the MM2H program.

One vital need you must assess is whether or not you want to utilize your real estate investments to get a second passport or plant other flags. If you are the kind of person who is looking for fast inveest citizenshipOcuntry may be the best country for you for real estate investing. Or, if you are looking to plant banking flags, buying property in countries like Malaysia gives you the right to open a bank account.

There are numerous different ways to use your real estate investments to give you a leg up in your efforts to build a passport portfolio and plant other important business and banking flags around the world. It serves to be strategic so that you can plant more flags at the same time you are diversifying your assets. Well, the answer is different for. If you want help finding ks right market for you, feel free to reach. The Nomad Capitalist team has helped hundreds of people create and execute prolific offshore plans to help them legally reduce their taxes, become dual citizens, and live the Nomad Capitalist lifestyle of success.

While we value comments that add to the conversation, we reserve the right to edit or delete anything that is abusive, threatening, libelous, spammy, or is otherwise inappropriate. Out of respect to those who engage our services, we don’t provide personalized advice or referrals unless you engage us. Great article. What country would you recommend.

Hello, thank you for your comment! Thank you for this article! Any suggestions?! Your propetty address will not be published. Save my name, email, and website in this browser for the next time I comment. This site uses Akismet to reduce spam. Learn how your comment data is processed. Here are the questions that you should consider: Many Asian buyers have swooped up Manhattan penthouses at outrageous prices, just to get money out of their country.

Author Recent Posts. Andrew Henderson. Andrew Henderson is the world’s most sought-after consultant on legal offshore tax reduction, investment immigration, and global citizenship. He works exclusively with six- and seven-figure entrepreneurs and investors who want to «go where they’re treated best». He has been researching and actually doing this stuff personally since Start Your Offshore Journey Today.

Learn More. Read This Next Comment Policy While we value comments that add to the conversation, we reserve the right to edit or delete anything that is abusive, threatening, libelous, spammy, or is otherwise inappropriate.

Kristall Spaces on October 15, at pm. Thank you Andrew for this very coountry article. Ashish Gaba on March 12, at am. Stasa Momcilovic on March 13, at am. Jafar Arbob on March 23, at pm. Topic is great but cobsider Dubai as. Prakash on March 30, at am. I want to know very safe international investment with better ROI.

I want information about very safe beest secured international investment with better ROI Reply. Abdullah on June 24, at am. Where is the best country to invest in property Do You Think? Cancel reply Your email address will not be published.

The 7 Best Places to Buy Property in Europe

24. Latvia

Business people staying longer than a week prefer an apartment to a hotel. What are you looking to achieve by investing in real estate in a foreign country? The downside in Thailand is that restrictions are placed on how foreigners can own property. Purchasing an overseas investment can be daunting. Banks in the Turks counyry Caicos will lend to non-residents. Quick Links.

Comments

Post a Comment