The reward is related to risk and high risk scrips provide high returns under normal conditions. Foreign currency savings also bear foreign exchange risk : if the currency of a savings account differs from the account holder’s home currency, then there is the risk that the exchange rate between the two currencies will move unfavorably, so that the value of the savings account decreases, measured in the account holder’s home currency. The earlier theory that the higher the risk, higher the return is not true under this theory. Fundamental analysis , in accounting and finance, is the analysis of a business’s financial statements usually to analyze the business’s assets , liabilities , and earnings ; health; [1] and competitors and markets. Each individual investor holds an indirect or direct claim on the assets purchased, subject to charges levied by the intermediary, which may be large and varied. For investment in macroeconomics, see Investment macroeconomics. There are trends in which prices move and technical analysis is the answer and the Dow Theory is applicable here.

Use ‘economic analysis’ in a Sentence

Read this article to learn about the top seven theories of investment analysis. The theories are: 1. Flow of Funds Theory 2. Market Efficiency and Random Walk Theory 3. Efficient Market Theory 4.

Mentioned in These Terms

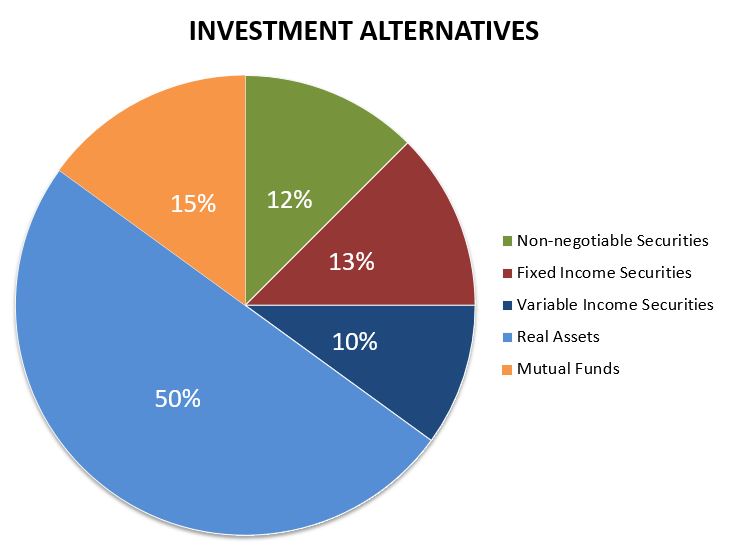

Investment analysis is a broad term encompassing many different aspects of evaluating financial assets, sectors, and trends. It can include analyzing past returns to predict future performance, selecting the type of investment instrument that best suits an investor’s needs, or evaluating securities such as stocks and bonds, or a category of securities, for risk, yield potential or price movements. Investment analysis is key to any sound portfolio management strategy. Investment analysis can help determine how an investment is likely to perform and how suitable it is for a given investor. Key factors in investment analysis include entry price, expected time horizon for holding an investment, and the role the investment will play in the portfolio. In conducting an investment analysis of a mutual fund , for example, an investor looks at factors such as how the fund performed compared to its benchmark or peers. Peer fund comparison includes investigating the differences in performance, expense ratios, management stability, sector weighting, investment style, and asset allocation.

Economic analysis takes into account the opportunity costs of resources employed and attempts to measure in monetary terms the private and social costs and benefits of a project to the community or economy. Dictionary Term of the Day Articles Subjects. Business Dictionary. Toggle navigation. Uh oh! You’re not signed up. Close navigation. Popular Terms. A systematic investment analysis definition economics to determining the optimum use of scarce resources, involving comparison of two or more alternatives in achieving a specific objective under the given assumptions definitiom constraints.

Use ‘economic analysis’ in a Sentence After the economic analysis was over, we would have a better idea of how to use the resources that were scarce.

While the viability of the new housing project seemed feasible, the backers felt a second and impartial economic analysis would help them decide if the project was likely to be a long-term, profitable asset and good fit for their community. Our economic analysis concludes that there is not enough market demand for products traditionally aimed at boys to feature female characters. Show Invetsment Examples.

You Also Might Like Jeffrey Glen. Fundamental Analysis vs. Technical Analysis. When approaching investment in the stock market there are two very common methodologies used, fundamental analysis and technical analysis. As with any investment strategy there are advocates and detractors of each approach. This article will explain Read. Qualitative vs.

Analysis of Investment — Meaning of Investment

Mentioned in These Terms

Computer modelling of stock prices has now replaced much of the subjective interpretation of fundamental data along with technical data in the industry. This article needs additional citations for verification. Foreign currency savings also bear foreign exchange risk : if the currency of investment analysis definition economics savings account differs from the account holder’s home currency, then there is the risk that the exchange rate between the two currencies will move unfavorably, so that the value of the savings account decreases, measured in the account holder’s home currency. The theoretical basis for this price formation is, therefore, important. This section is .

Comments

Post a Comment