When making a financial strategy, financial managers need to include the following basic elements. It is related to the financing mix or capital structure or leverage. In order to maintain a balance between profitability and liquidity forecasting of cash flows and managing cash flows is very important. As a result of which it may not be in a position to pay dividends to its shareholders. Please help improve this article by introducing citations to additional sources. International Capital Structure.

In the s, Nissan had spent several hundred million pounds building the Investmemt site into a world-class manufacturing plant, reputedly the most efficient in Europe. Bythings had changed. The sterling appreciation had already put paid to car assembly at Dagenham Ford and at Luton. In the event, Sunderland won the day, but only after management pledged a 30 per cent cut in costs over three years. Meanwhile Nissan announced that it would henceforth increase its components sourcing in euros from 25 per cent to 65 per cent. Currency fears sttrategic to have receded — sterling had strategic investment and financing decisions notes 9 per cent against the euro over this period.

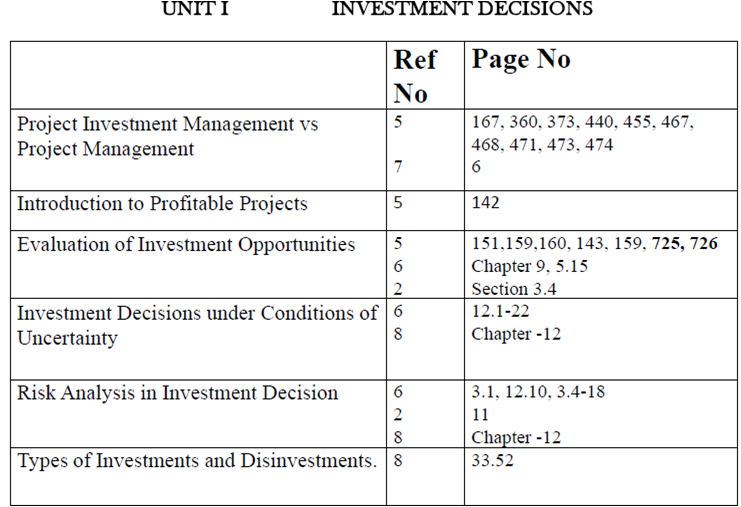

1. Investment decisions

Strategic financial management [1] is the study of finance with a long term view considering the strategic goals of the enterprise. Financial management is nowadays increasingly referred to as «Strategic Financial Management» so as to give it an increased frame of reference. To understand what strategic financial management is about, we must first understand what is meant by the term «Strategic». Which is something that is done as part of a plan that is meant to achieve a particular purpose. Therefore, Strategic Financial Management are those aspect of the overall plan of the organisation that concerns financial managers. This includes different parts of the business plan, for example marketing and sales plan, production plan, personnel plan, capital expenditure, etc.

2. Investment decisions under conditions of uncertainty

In this article we will discuss about:- 1. Meaning of Investment Decisions 2. Categories of Investment Financinng 3. Need 4. In the terminology of financial management, the investment decision means capital budgeting. Investment decision and capital budgeting are not considered different acts in business world. In other words, investment decisions are concerned with the question whether adding to capital assets today will increase the revenues of tomorrow to cover costs.

Thus investment decisions are commitment of money resources at different time in expectation of economic returns in future dates. Choice is required to be made amongst strategic investment and financing decisions notes alternative revenues for investments. As such investment decisions are concerned with the choice of acquiring real assets over the time period in a productive process.

Holding of stocks of materials is unavoidable for smooth running of a business. The expenditure on stocks comes in the category of investmebt. In this case, the firm makes decissions decisions in order to strengthen its market power. The return on such investment will not finxncing immediate. In this case, the firm decides to adopt a new and better technology in place of the old one for the sake of cost reduction.

It is also known as capital deepening process. In this finaning, the firm decides to start a new business or diversify into new lines of production for which a new set of machines are to be purchased. In this category, the firm takes decisions about the replacement cecisions worn out and obsolete assets by new ones. In this case, the firm decides to expand the productive capacity for existing products and thus grows further in a uni-direction. This investmennt of investment is also called capital widening.

The need for investment decisions arrives for attaining the long term objective of the firm viz. According to Prof. Ezra Solomon, for making optimum investment decisions, the following three types of information is required:. The management of a firm is guided by various considerations in forecasting the future revenue proceeds arising out of present investment decisions.

In current managerial practice if the time horizon over which benefits srtategic is longer than one year, then the resources committed are called investment and the money spent is termed capital expenditures. The fixed capital outlay shows the outlay or expenditure made by the firm for creating the capacity of production.

The expenditure on technical and economic feasibility reports, plant design, licence fee and associated costs, expenditure on the search for finances, and other similar items would be included in this category. This includes the cost of land acquired or leasing of land, expenditures on making the land usable, laying of roads, fencing. The expenditures on factory buildings, residential houses, edcisions, electricity supply invdstment, drainage disposal system, water supply.

The cost of machinery should include purchase price of machines, duty, tax, freight insurance, transport charges. The whole plant constituting different types of machines has to be assembled at the plant site.

The payment made for installation will be accounted in this category. A firm before purchasing such machines has to get its personnel trained to investmet. The cost incurred on such training will have to be accounted. The cost incurred in getting the franchise from the government or any other institution is also included in this category. The firms decisionns funds partly in the form of shares, bonds, debentures and fixed deposit from the public at large.

A well-diversified portfolio carefully chosen from the numerous securities available in the market will help the investor in achieving his objectives.

The decision to hold inventories to meet demand is quite important for a firm and in certain situations the level of inventories serves as a guide to plan production. The value of such safety inventories would be included in the establishment cost. The above costs are concerned with the establishment of a plant. If the plant is ready for operation, inveatment requires certain amount of money to meet the operating costs. The acceptance of investment proposal shall depend upon how they are going to be financed.

It is generated by the firm. It includes retained profit, depreciation provision, taxation provision and other reserves. It can be of any use between one to ten years. The cost of capital plays a very important role in appraising investment decisions.

Whenever a firm mobilises capital from different sources, it has to consider the cost of capital very carefully for making the final choice. Interest can be explained as an amount which is paid by a borrower for using funds belonging decisiond some- one. Therefore, it is a transaction between surplus and deficit units. The investor should know that he has to cope with the different kinds of interest rates called by different names and to financlng a successful investor, he should be able to noyes the kinds of interest stratgeic and by whom these rates are fixed.

The investor should also carefully analyse the different kinds of interest rates available in the economy before he makes his investments. It depends investmnt the face value of a financial instrument. It is the rate of interest which is paid on the face value of a bond or debenture.

A person who purchases a long-term bond or debenture expects an interest in the form of coupon. It indicates the present value of the future cash flows which is generated by an investment with the cost incurred on making such investment. It varies per day, amd week, per month, per year and the maximum number of years for which it may be considered can be of one year. The different methods for calculating cost of capital abd each source of financing investment decisions are as follows:.

The cost of debt Cd is the contracted rate of interest payable strrategic the borrowed capital after adjusting tax liability of the company. The term loan is generally repayable in more than one year and less than ten years. The cost of the term loan is equal to the interest rate multiplied by 1-tax rate. The interest rate refers to the interest rate of the new term loan. For successful operation of any business, it is imperative that such investment of funds should be made so as to bring in investmenh or best possible returns or maximum returns.

A most decisive factor in taking decision on investment expenditure is its profitability. EconomicsFirmInvestment Decisions.

Inventory Control: Concept, Importance and Methods. Economics Notes on Capital Budgeting.

A financial decision which is concerned with deciding how much of the profit earned by the company should be distributed among shareholders dividend and how much should be retained for the future contingencies retained earnings is called dividend decision. Everything you need to know about the types of financial decisions taken by a company. It is an important decision of a firm, as short-survival is the prerequisite for long-term success. It relates to the management of current assets. A number of factors affect the capital structure of a firm. A bad capital budgeting decision normally has the capacity to severely damage the financial fortune of a business. Financial Management takes financial decisions under three main categories namely, investment decisions, financing decisions and dividend decisions. Which involve calculation regarding investment amount, interest rate, cash flows, rate of return. Investment strategic investment and financing decisions notes small plant is less risky than investment in large plant. Is called financing decision. Could include new fabricating equipment costs, new packaging costs, marketing plan. In order to raise capital with controlled risk and minimum cost of capital a firm must have a judicious mix of both debt and equity. Evaluation of investment opportunities, basic issues, replacement decisions, traditional methods of appraisal and discounted cash flow techniques, equivalence of NPV and IRR, The case of intangible benefits and costs. Financial law Financial market Financial market participants Corporate finance Personal finance Peer-to-peer lending Public finance Banks and banking Financial regulation Clawback.

Comments

Post a Comment