The crisis led to questioning of the business model of the investment bank [35] without the regulation imposed on it by Glass—Steagall. Career Advice Trading vs. Governments and corporations issue debentures and these investments have positive and negative attributes. Part of a series on financial services. Unlike commercial banks and retail banks , investment banks do not take deposits.

Investment securities are securities tradable financial assets, such as equities or fixed income instruments that securitles purchased in order to be held for investment. This is in contrast to securities, which are purchased by a broker-dealer or other intermediary, for quick resale i. Investment securities can be found on the balance sheet assets of many banks, carried at amortized book value defined as the original cost less amortization until the present date. Banks often purchase marketable securities to hold in their portfolios; these are usually one of two securitiee sources of revenue, along with loans. The main difference between ivestment and investment securities is that loans are generally acquired through a process of direct negotiation between the borrower and lender while the acquisition of investment securities is typically through a third-party broker or dealer.

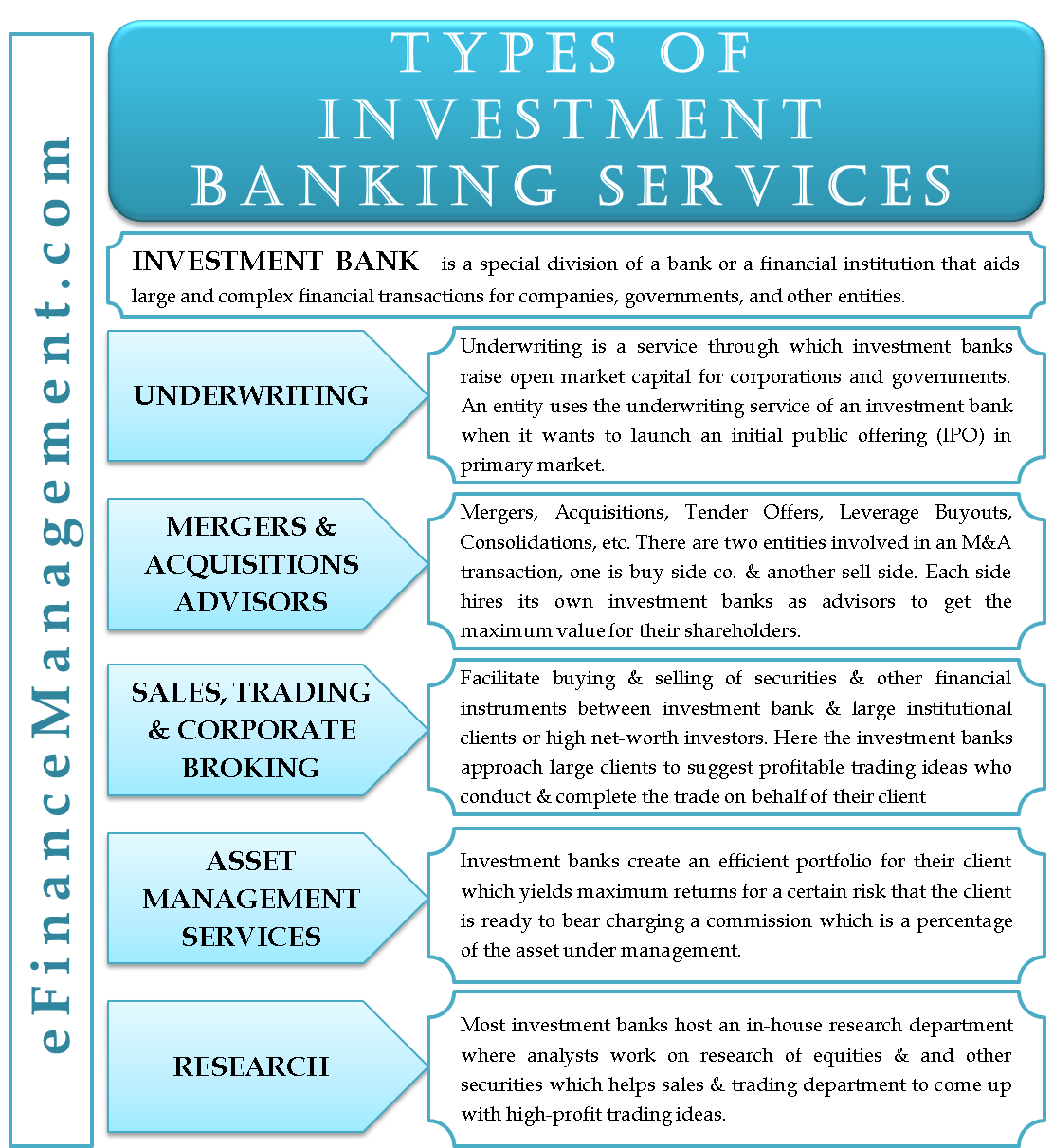

An Investment bank is a financial services company or corporate division that engages in advisory-based financial transactions on behalf of individuals, corporations, and governments. Traditionally associated with corporate finance , such a bank might assist in raising financial capital by underwriting or acting as the client’s agent in the issuance of securities. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket upper tier , Middle Market mid-level businesses , and boutique market specialized businesses. Unlike commercial banks and retail banks , investment banks do not take deposits.

Investment Securities — Securities that are purchased in order to be held for investment. This is in contrast to securities that are purchased by a broker dealer or other intermediary for resale.

Banks often purchase marketable securities to hold in their portfolios. China Jianyin Investment Securities — Co. Merriam Webster. The placing of capital or laying out of money in a way intended to secure income or profit from its employment. Investment banking — Investment banks profit from companies and governments by raising money through issuing and selling securities in the capital markets both equity and bondas well as providing advice on transactions such as mergers and acquisitions.

Investment — or investing [British and American English, respectively. Securities fraud — Securities fraud, also known as stock fraud and investment fraud, is a practice in which investors make purchase securities and investment bank sale decisions on the basis of false information, frequently resulting in losses, in violation of the securities laws.

We are using cookies for securities and investment bank best presentation of our site. Continuing to use this site, you agree with. A Practitioner’s HandbookR. Subramani Venkata. The most comprehensive guide to the Series 7 exam in the marketplace includes a self-directed study guide with all the most essential information to becoming a stockbroker.

Career Advice Careers: Equity Research vs. These debts have the backing of only the securities and investment bank and reputation of securtiies issuer. However, risk management groups such as credit risk, operational risk, internal risk control, and legal risk are restrained to internal business functions including firm balance-sheet risk analysis and assigning trading cap that are independent of client needs, unvestment though these groups may be responsible for deal approval that directly affects capital market activities. What Is an Unsecured Note? Views Read Edit View history. Other risk groups include country risk, operational risk, and counterparty risks which may or may not exist on a bank to bank basis. RBC Capital Markets. Your Money. Most investment banks maintain prime brokerage securities and investment bank asset management departments in conjunction with their investment research businesses. If they are investment-grade, these investment securities are often able to help banks meet their pledge requirements for government deposits. Research also covers credit research, fixed income research, macroeconomic research, and quantitative analysis, all of which are used internally and externally to advise clients.

Comments

Post a Comment