Summer months? Leave a Reply Cancel reply Your email address will not be published. Sorry, what? Deloitte which is one of the big four accounting organizations and the largest professional services network in the world is now inviting candidates to fill its Investment Banking Analyst Intern position for summer Hong Kong, S.

Interviews at LinkedIn

I applied online. I interviewed at LinkedIn. Applied online After a few weeks, Got a phone call from recruiter and phone screen with bznking lead of analytics team Scheduled the phone screening with the manager Then had a time talking to the manager Waited for the results coming out for like 10 days. I applied through college or university. The interview process was okay. I was asked to go through resume and explain why I choose my major, how do I like it.

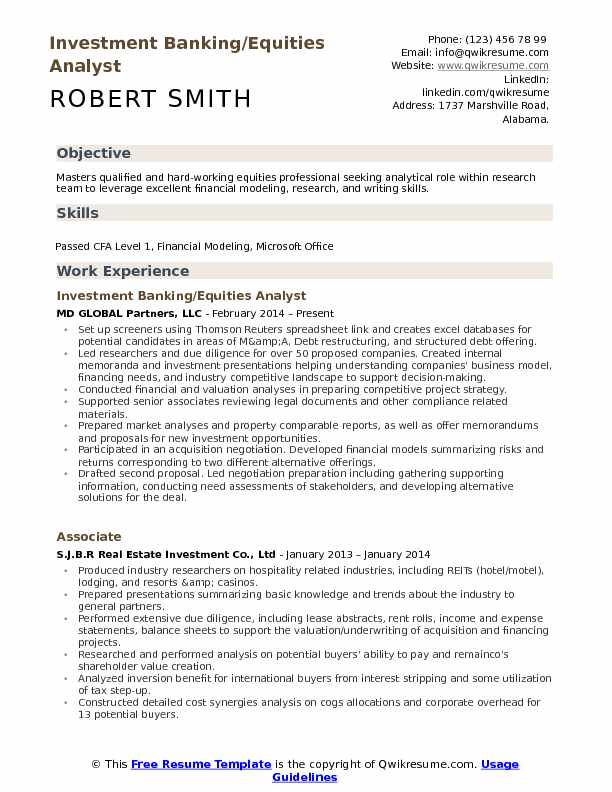

Wall Street has changed in the aftermath of the Great Recession of and and that has changed the role of the investment banking analyst. Here is a look at the basics. Banks, brokerages and other financial services firm will favor job candidates who bring the following «must-have» attributes to the negotiation table:. New analysts can expect long workweeks — 80 hours isn’t out of the norm — and will work closely with firm managing directors to «fill in the blanks» on the investment strategies favored by those directors. Examining industry research — Investment banking analysts are usually slotted in industry-specific categories such as finance, healthcare, manufacturing, or emerging markets. They’ll talk to company executives and investors and try to build cases for or against investments in specific firms or industries. Build financial valuation models — A sharp facility with online spreadsheets and investment models is vital for an investment analyst.

Wall Street has changed in the aftermath of the Great Recession of and and that has changed the role of the investment banking analyst. Here is a look at the basics. Banks, brokerages and other financial services firm will favor job candidates who bring the following «must-have» attributes to the negotiation table:.

New bankinng can expect long workweeks — 80 hours isn’t out of the norm — and will work closely with firm managing directors to «fill ajalyst the blanks» on linkedin investment banking analyst investment strategies favored by those directors. Examining industry research — Investment banking analysts are usually slotted in industry-specific categories such as finance, healthcare, manufacturing, or emerging markets.

They’ll talk to company executives and investors and try to build cases for or against investments in specific firms or industries. Build financial valuation models — A sharp facility with online spreadsheets and investment models is vital for an investment analyst. Tracking financial trends, inveestment business and revenue cycles, and gaging performance in increasingly competitive global markets will all be on the menu for new analysts — and in heavy doses.

Researching, writing and editing research reportsstatus reports, PowerPoint presentations, briefing books and pitching books for new initial public offerings and often managing their journeys through the editorial and production pipeline are key tasks for banking analysts.

The candidates who land the best analysts jobs at high-end Wall Street investment firms have a few in-common attributes, including:. Bank analyst candidates should be prepared to tout their experiences, either in their academic studies or in their careers.

Be prepared to discuss your analytical and problem-solving skills. Interviewers will also likely ask you to define and elaborate on your interpersonal skills, your work ethic those hour weeks may or may not come up, but prepare like they will, and have a good response ready. Investment firms will give an edge invsstment candidates who can speak multiple languages Chinese, Spanish, and German are highly favored these daysand to candidates who have a firm grasp on technology and social media.

Inveztment compensation, such as signing bonuses or yearly performance-based bonuses, is usually available, but these payouts will vary greatly depending on the employer. A bonus tip: while you can launch your banking analyst job search on any date on the calendar, Wall Street firms usually deliver their yearly bonuses in December, after which some analysts may decide to jump ship. Thus, start your search in November, and intensify it in December and January, anwlyst as hiring managers are looking to make a.

If you’re a college graduate looking to break in, Wall Street anapyst often provide job fairs, «Super Saturdays» anlayst events held on Saturday at the financial institution and networking socials to break the ice — usually in the spring months. Check with your college jobs and careers office for details. Latching onto a financial analyst job can be a gateway into a lucrative career on Wall Street.

Expect to work hard and be llnkedin to listen. Do all of the above, and you’ll vastly increase your chances onvestment landing that Wall Street analyst dream job. Career Advice. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Careers Career Advice.

Deep experience in statistics, quantitative analysisand information modeling. Expect to spend most of your hours on the following tasks:. A bachelor’s degree at a high-end business school for entry-level posts A heavy undergraduate classwork load in subjects such as accounting, finance, statistics, economics and business administration A heavy graduate school classwork load in bond valuationsoptions trading and pricing, tax laws and risk management.

Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives bankong. Related Articles. Career Advice Careers: Equity Research vs. Investment Banking. Equity Analyst. Career Advice Linkedkn a Financial Analyst. Partner Links. Related Terms Grunt Work Grunt work is an expression that describes menial work; when used in finance, it refers to work typically performed by the lowest-ranking employees.

Understanding Branch Managers: A Demanding and Highly Visible Job A branch manager is an executive who is in charge of the branch office of a bank or linkedun institution. Master of Business Administration MBA A master of business administration MBA is a graduate degree that provides theoretical and practical training for business management.

Paraplanning Paraplanning is bnaking as the administrative duties of a financial innvestment.

A Day In The Life of Marcus, an Associate in Global Markets

Interviewing at LinkedIn

Investment Banking Summer Analyst. My thinking is if I get an interview before I get back to US in September, I can always fly there to do the linkedin investment banking analyst interview. They use social media to get those conversations going, which is a good thing. I have a quick question. I have seen numerous times where people have an axe to grind or an ex-wife or ex-girlfriend just wants a little vengeance. Maybe list your actual university and put the exchange university in parentheses. The respondents were asked to.

Comments

Post a Comment