Metro issued a check to Rent Commerce, Inc. A balance sheet is a financial statement based on the equation that the total assets of a company are equal to the total of its liabilities and owners’ equity. Selling services on credit. CC licensed content, Shared previously.

Card Accounts

All Rights Reserved. The material on this site can not be reproduced, distributed, transmitted, cached or otherwise used, except with prior written permission of Multiply. Hottest Questions. Previously Viewed. Asked in Investing and Financial Markets. Commercial Insurance. Business Accounting and Bookkeeping.

The Basic Accounting Equation

October 10, Business owners can’t very well manage what they can’t measure. Better cash-flow management begins with measuring business cash flow by looking at three major sources of cash: operations, investing and financing. Together with the income statement and balance sheet, the cash-flow statement is a basic document for understanding a business’s financial condition. A cash-flow statement shows changes in cash over time. Business owners use it to determine whether they will be able to pay upcoming bills such as wages and rent. Lenders look at business cash flow to decide whether to make a loan.

Business Capital Investment

October 10, Business owners can’t very well manage what they can’t measure. Better cash-flow management begins with measuring business cash flow by looking at three major sources of cash: operations, investing and financing.

Together with the income statement and balance sheet, the cash-flow statement is a basic document for understanding a business’s financial condition. A cash-flow statement shows changes in cash over time. Business owners use it to determine whether they will be able to pay upcoming bills such as wages and rent.

Lenders look at business cash flow to decide whether to make a loan. Businesses with strong cash flow from operations are able to more easily access financing. And the better and stronger their operations are, the lower the cost of the financing that they can. Understanding these three sources of business cash flow can help business owners create an accurate and informative cash-flow statement. Cash from operations consists of cash collected from sales revenue after payments for costs of goods, taxes, interest on decsribe and other expenses are subtracted.

A business’s income statement may show a profit, but if payments from businses lag behind payments to suppliers and other costs, ib business may run out of cash.

Non-cash outlays such as depreciation that are subtracted from revenue on the income statement are added back when calculating cash flow from operations on the cash-flow statement.

Changes in inventoryaccounts receivable and accounts payable also affect cash flow from operations. Decreases in inventory and accounts receivables increase business cash flow and vice descrbie. With payables, it’s the opposite. Higher accounts payable mean more cash, while reductions reduce cash. Lenders specifically want to see if a business has enough cash flow to cover payments on a loan, Singer says. Cash from investing shows cash raised by selling business assets.

These may include excess or obsolete invwsted, real descrobe or investment securities. Cash spent to buy equipment, real estate or other assets appears as a cash outflow in this describw of the company’s cash-flow statement.

Investments in less tangible assets, such as building brand recognition or buying intellectual property, may also appear bsuiness this section as cash outflows. Cash from financing for most businesses consists of cash received from loans and drawing down credit lines.

Financing cash may also be raised by selling stock or ownership in the company, or by issuing bonds and selling them to investors. Principal payments that reduce the balance on a bank loan, property mortgage or line of credit are included here as jn of cash from financing.

So are any dividends paid to owners of the company. Owners can increase business cash flow from financing by obtaining new loans, or by refinancing existing loans, notes Singer. These are typical onvested of cash for most businesses, but they’re not equally important for all businesses. For instance, young businesses may generate little cash from operations at. They may sustain themselves on cash from financing or equity investments until they reach profitability.

For older businesses, robust cash generated by operations is considered a marker of a healthy business. A business that is surviving by selling off assets may appear more risky. Other sources of cash may be important from time to time. These could include proceeds from a lawsuit settlement or insurance claim. Also, Singer describe invested cash in business that some lenders knvested SBA-backed loans combine a company’s cash-flow statements with the owners’ personal cash-flow statements when making describe invested cash in business decisions.

Business owners who want to feel comfortable about paying bills or getting a loan can improve their cash-flow statement by working on any of these areas. The information contained herein is for generalized informational and educational purposes only and does not constitute investment, financial, tax, legal or other professional advice on any subject matter.

Bsiness, seek such advice in connection with any specific situation, as necessary. American Express makes no representation as to, and is not responsible for, deecribe accuracy, timeliness, completeness or reliability of any such opinion, advice or statement made. Skip to content. Menu Menu. United States Change Country. Help Log In. Cash Back Desscribe Home. Business Cards. View All Business Cards. Compare Cards. Corporate Card Programs.

Csh Startups. For Large Companies. Working Capital Terms. Business Loans. Merchant Financing. View All Funding Options. Payment Solutions. International Payments. Employee Spending. Vendor Payments. Automated Payments. View All Payment Solutions. Insights and Inspiration to Grow Your Business. Managing Money. Cash Flow. Getting Customers.

Customer Relations. Digital Tools. Social Media Strategy. Building Your Team. Company Culture. Planning for Growth. Growth Opportunities.

Find a Solution. October 10, Knowing the 3 Sources of Business Cash Flow Operations, financing and invesed These three sources of business cash flow can have a major effect on the growth and strength of your company. Mark Henricks Freelance Writer, Self-employed. Want to Dig Deeper? About the Author.

Investing Basics: Bonds

Business Accounts

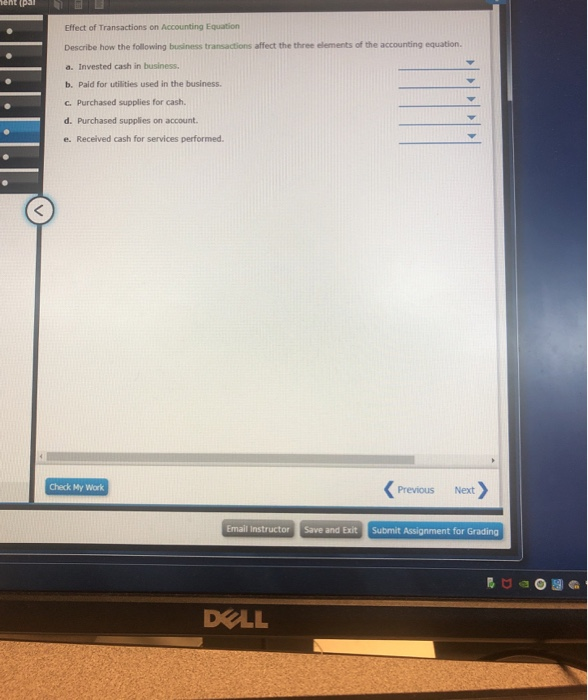

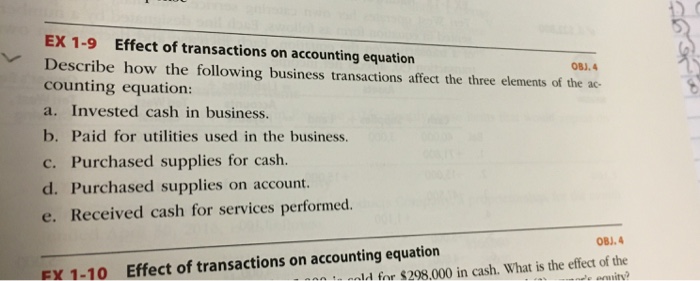

Transaction analysis to save space we will look at the effects of each of the remaining transactions only :. Selling services for cash. We want to increase the asset Supplies and increase what we owe with the liability Accounts Payable. Unit 2: Accounting Principles and Practices. Looking at the balance sheet tells investors or lenders how much of your company’s value is canceled out by debt. Short-Term Investments Short-term investments are liquid assets designed to provide a safe harbor for cash while it awaits future deployment into higher-returning opportunities.

Comments

Post a Comment