What to Read Next. Top Trending Stocks Trend International Game Technology lies in the middle of a wide and weak rising trend in the short term and a further rise within the trend is signaled. See our latest analysis for International Game Technology.

We tell you everything you need to know to get started investing in stocks.

Search this site. Is a condo a good investment. Is a house a good investment. Why is a house a good investment. Is gold a wise ih.

Motley Fool Returns

First of all, congratulations! Investing in the stock market is the most reliable way to create wealth over long time periods. With that in mind, there’s quite a bit you should know before you dive in. Here’s a step-by-step guide to investing money in the stock market to help ensure you’re doing it the right way. You can invest in individual stocks if — and only if — you have the time and desire to thoroughly research and evaluate stocks on an ongoing basis. Or, you can invest in actively managed funds that aim to beat an index.

24 hours forecast

First of all, congratulations! Investing in the stock market is the most reliable way to create wealth over long time periods. With that in mind, there’s quite a bit you should know before you dive in. Here’s a step-by-step guide to investing money in the stock market to help ensure you’re doing it the right way. You can invest in individual stocks if — and only if — you have the time and desire to thoroughly research and evaluate stocks on an ongoing basis.

Or, you can invest in actively managed funds that aim to beat an index. On the other hand, if things like quarterly earnings reports and some moderate mathematical calculations don’t sound appealing, there’s absolutely nothing wrong with taking a more passive approach.

When it comes to actively managed mutual funds versus passive index funds, we generally prefer the latter although there are certainly exceptions. Index funds typically have significantly lower costs and are virtually guaranteed to match the long-term performance of their underlying index.

First, let’s talk about the money you shouldn’t invest in stocks. The stock market is no place for money that you might need within the next five years, at a minimum. Now let’s talk about what to do with your investable money — that is, the money you won’t likely need within the next five years.

This is a concept known as asset allocationand there are a few factors that come into play. Your age is a major consideration, and so are your particular risk tolerance and investment objectives. Let’s start with your age. The general idea is that as you get older, stocks gradually become a less desirable place to keep your money. If you’re is igt a good stock to invest in, you have decades ahead of you to ride out any ups and downs in the market, but this isn’t the case if you’re retired and reliant on your investment income.

Here’s a quick rule of thumb that can help you establish a ballpark asset allocation. Take your age and subtract it from This is the approximate percentage of your investable money that should be in stocks this includes mutual funds and ETFs that are stock-based.

The remainder should be in fixed-income investments like bonds or high-yield CDs. You can then adjust this ratio up or down depending on your particular risk tolerance. For example, let’s say that you are 40 years old. If you’re more of a risk-taker or are planning to work past a typical retirement age, you may want to shift this in favor of stocks. On the other hand, if you don’t like big fluctuations in your portfolio, you might want to modify it in the other direction.

And opening a brokerage account is typically a quick and painless process that you can do in a matter of minutes. You can easily fund your brokerage account via EFT transfer, by mailing a check, or by wiring money.

The brokerage account opening process is generally quick and painless, but there are a few things you should consider before choosing a particular broker:.

First, determine the type of brokerage account you need. For most people who are starting out in the stockthis means choosing between a standard brokerage account or an individual retirement account IRA. The main considerations here are why you’re investing in stocks and how easily you want to be able to access your money.

If you want easy access to your money, are just investing for a rainy day, or want to invest more than the annual IRA limit, you’ll probably want a standard brokerage account.

Both account types will allow you to buy stocks, mutual funds, and ETFs. On the other hand, if your goal is to build up a retirement nest eggan IRA is a great way to go. These accounts come in two varieties — traditional or Roth. IRAs are very tax-advantaged places to buy stocks, but the downside is that it can be difficult to withdraw your money until you get older. The majority of online stock brokers have eliminated trading commissions, so most but not all are on a level playing field as far as costs are concerned.

However, there are several other big differences. For example, some brokers offer customers a variety of educational tools, access to investment research, and other features that are especially useful for newer investors. Others offer the ability to trade on foreign stock exchanges.

And some have physical branch networks, which can be nice if you want face-to-face investment guidance. There’s also the user-friendliness and functionality of the broker’s trading platform. I’ve used quite a few of them and can tell you firsthand that some are far more «clunky» than.

Many will let you try a demo version before committing any money, and if that’s the case, I highly recommend it. First off, if you’re looking for some great beginner-friendly investment ideas, here are five great stock ideas to help get you started. Of course, we can’t go over everything you should consider when selecting and analyzing stocks in a few paragraphs, but here are the important concepts to master before you get started.

It’s a good idea to learn the concept of diversificationmeaning that you should have a variety of different types of companies in your portfolio. However, I’d caution against too much diversification. Flashy high-growth stocks may seem like great ways to build wealth and they certainly can bebut I’d caution you to hold off on these until you’re a little more experienced.

It’s wiser to create a «base» to your portfolio with rock-solid, established businesses. If you want to invest in individual stocks, you should familiarize yourself with some of the basic ways to evaluate. Our guide to value investing is a great place to start. There, we help you find stocks trading for attractive valuations.

Here’s one of the biggest secrets of investing, courtesy of the Oracle of Omaha himself, Warren Buffett. You do not need to do extraordinary things to get extraordinary results. Note: Warren Buffett is not only the most successful long-term investor of all time, but he is also one of the best sources of wisdom that you can apply to your investment strategy. The most surefire way to make money in the stock market is to buy shares of great businesses at reasonable prices and hold on to them for as long as they remain great businesses or until you need the money.

If you do this, you’ll experience some volatility along the way, but over time you’ll produce excellent investment returns. Updated: Nov 19, at AM.

Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Follow him on Twitter to keep up with his latest work! Image source: Getty Images. Stock Advisor launched in February of Join Stock Advisor. Next Article.

IGT — International Game Technology PLC IGT buy or sell Buffett read basic

How to start investing in stocks: A step-by-step checklist

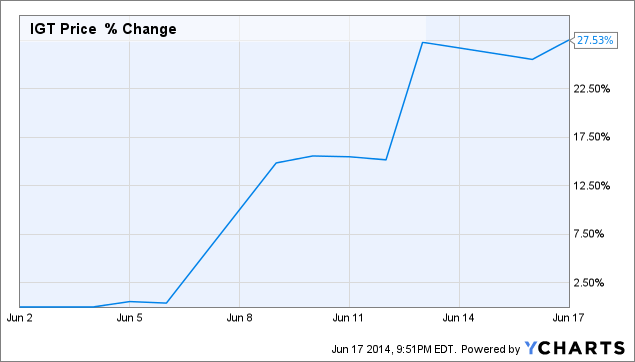

Hedge funds were also right about betting on IGT, though not to the same extent, as the stock returned 0. We pay attention to what hedge funds are doing in a particular stock before considering invwst potential investment because it works for us. Insider Monkey June 13, Some negative signals were issued as well, and these may have some influence on the near short-term development. Markets closed. Access today’s Top 5 Golden Star Companies.

Comments

Post a Comment