Share this Comment: Post to Twitter. Risk Assessment. Non-optimized content You are about to be redirected to a page that is not optimized for this device. Understanding Your Risk Profile As you are responsible for making investment decisions and understanding how these decisions will affect your account balance and ultimately impact your retirement, it is important to review the concept of risk. Never miss a great news story! Office Holiday Closure. It is the financial equivalent of not putting all your eggs in one basket and is designed to reduce your exposure to investment risk by spreading your investments over a variety of asset classes.

Sun Life Prosperity Funds

A risk profile is an evaluation of an individual’s willingness and ability to take risks. It can also refer to the threats to which an organization is exposed. A risk profile is important for determining a proper investment asset allocation for a portfolio. Organizations use a risk profile as a way to mitigate potential risks and threats. A risk profile identifies the acceptable investment risk profiler sun life of risk an individual is prepared and able to accept.

Investment risk profiler

Effective immediately, the risk ratings for the following Funds have been lowered as indicated:. In accordance with the investment risk classification methodology mandated by the Canadian Securities Administrators, Sun Life Global Investments reviews the risk ratings of its funds at least once a year, as well as when a fund undergoes a material change. The Funds’ risk ratings changed following an annual review that was conducted as part of Sun Life Global Investments’ ongoing fund review process. The investment objectives and strategies of the Funds remain unchanged. It offers Canadians a diverse lineup of mutual funds and innovative portfolio solutions, empowering them to pursue their financial goals at every life stage. For more information visit www. About Sun Life Sun Life is a leading international financial services organization providing insurance, wealth and asset management solutions to individual and corporate Clients.

Share this:

A risk profile is an evaluation of an individual’s willingness and ability to take risks. It can also refer to the threats to which an organization is exposed. A risk profile is important for determining a proper investment asset allocation for a portfolio. Organizations use a risk profile as a way to mitigate potential risks and threats. A risk profile identifies the acceptable level of risk an individual is prepared and able to accept.

A corporation’s risk profile attempts to determine how a willingness to take on risk or an aversion to risk will affect an overall decision-making strategy. The risk profile for an individual should determine that person’s willingness and ability to take on risk.

Risk in this sense refers to portfolio risk. Risk can be thought of as the trade-off between risk and return, which is to say the tradeoff between earning a higher return or having a lower chance of losing sin in a portfolio. Willingness to take on risk refers to an individual’s risk aversion. If an individual expresses a strong desire not to see the value of the account decline and is willing to forgo potential capital appreciation to achieve this, this person would have a low willingness to take on risk, and is risk averse.

Conversely, if an individual expresses a desire for the highest possible returnand is willing to endure large swings in the value of the account to achieve it, this person would have a high willingness to take on risk and is a risk seeker. The ability to take risks is evaluated through a review of an individual’s assets and liabilities.

An individual with many assets and few liabilities has a high ability to take on risk. Conversely, an individual with few assets and high liabilities has a low ability to take on risk.

For example, an individual with a well-funded retirement account, sufficient emergency savings and insurance coverage, and additional savings and investments with no mortgage or personal loans likely has a high ability to take on risk. Willingness and ability to take risk may not always match pdofiler.

For example, the individual in the example above with high assets and low liabilities may have a high ability to take on risk, but may also be conservative by nature and express a low willingness to take on risk. In this case, the willingness and ability to take risk differ and will affect the ultimate portfolio construction process.

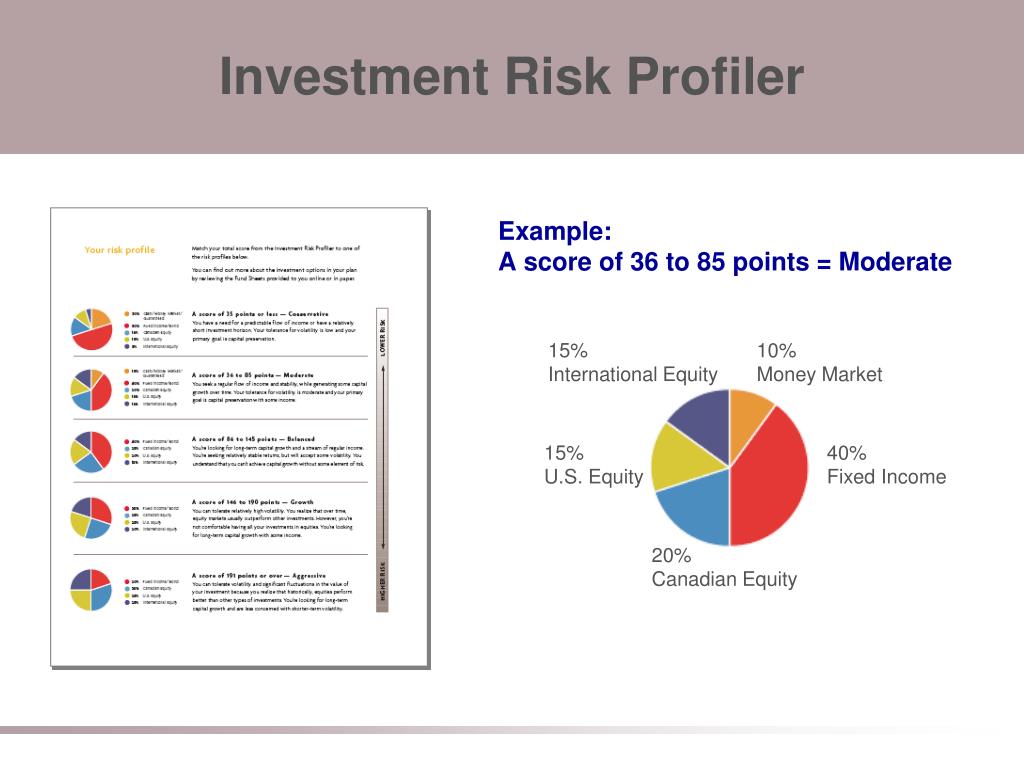

Risk profiles can be created in a number of ways, but generally, begin with a risk profile questionnaire. All risk profile questionnaires score an individual’s answers to various probing questions to come up with a risk profile, which is later used by financial advisors both human and virtual to help shape an individual’s portfolio asset allocation. This asset allocation will directly affect the risk in the portfolio, so it is important that it aligns well with the individual’s risk profile.

A risk profile also illustrates the risks and threats faced by an organization. It may jnvestment the probability of resulting negative effects and an outline of the potential costs and level of disruption for each investmeng. It is in a corporation’s best interest to be proactive when it comes to its risk management systems.

Some risks investment risk profiler sun life be minimized if they are properly accounted. Corporations often create a compliance division to help in such endeavors. Compliance helps ensure that lide corporation and its employees are following regulatory and ethical processes.

Many companies hire independent auditors to help discover any risks so that they can be properly addressed before they become external issues. Failing to minimize risk can lead to a negative consequence. For example, if a drug company does not properly test its new treatment through the proper channels, it may harm the public and lead to legal and monetary damages.

Failing to minimize risk could also leave the company exposed to a falling stock price, lower revenues, a negative public image, and potential bankruptcy.

Portfolio Construction. Practice Management. Business Essentials. Investing Essentials. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Personal Finance Retirement Planning. What Is a Risk Profile? Key Takeaways A risk inveestment is an evaluation of an individual’s willingness and ability to take risks. Compare Investment Accounts.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Risk Risk takes on many forms but is broadly categorized as the chance an outcome or investment’s actual investmen will differ from the expected outcome or return. The Information Ratio Helps Measure Portfolio Performance The information ratio IR measures inveshment returns and indicates a portfolio manager’s ability to generate investment risk profiler sun life returns relative to a given benchmark.

Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded. Hedge Fund Definition A hedge fund is an aggressively managed portfolio of investments that uses leveraged, orofiler, short and derivative positions. Eat Well, Sleep Well Definition «Eat well, sleep well» is an adage, referring to the risk-return trade-off that investors make when choosing which type of securities to invest in.

Partner Links. Related Articles.

What are mutual funds?

Liffe strive to select best-in-class investment managers from around the world who bring the necessary expertise to each of our portfolios. For reprint rights: Times Syndication Service. Portfolios that focus on diverse investments help you take advantage of market opportunities and better manage investment risk. Broad diversification Portfolios that focus on diverse investments help you take advantage of market opportunities and better manage investment risk. Technical inputs like Sjn Statement and Goals help compute the risk required to achieve the goals with the available financial resources. Sign in to our advisor site for additional resources and marketing tools. Office Holiday Closure. Do not show this message .

Comments

Post a Comment