Other factors you should consider. Its Consumer Financial Services unit is responsible for the sales, services and development of consumer products throughout Australia. Acceptance by insurance companies is based on things like occupation, health and lifestyle. Judo Bank Term deposit.

Westpac term deposits rates

Westpac Banking Corporationcommonly known as Westpacis an Australian bank and financial services provider headquartered at Westpac Place in Sydney. It is one of Australia’s «big four» banks and is Australia’s first and oldest banking institution. Its name is a portmanteau of «Western» and «Pacific». As of MarchWestpac has 14 million customers, and employs almost 40, people. Edward Smith Hall was its first cashier and secretary.

Westpac term deposits rates

Gabriel is one of RateCity’s financial content specialists, working across the site to help make mince meat of monetary jargon. Investors might assume that when it comes to saving money in a fixed-term deposit the longer you fix your lump sum, the better the rate. And many of the major Term deposits versus For instance, ANZ and Westpac are currently offering 6 percent If you want to earn high interest rates for a term deposit , you might have to lock away a lot of money for a long time.

You’ll know exactly what your investment’s worth with a term deposit. Compare term deposit rates here.

Gabriel is one of RateCity’s financial content specialists, working across the site to help make wrstpac meat of monetary jargon. Investors might assume that when it comes to saving money in a fixed-term deposit the longer you fix your lump sum, the better the rate. And many of westpac long term investment major Aestpac deposits versus For instance, ANZ and Westpac are currently offering 6 percent If you want to earn high interest rates for a term deposityou might have to lock away a lot of money for a long time.

Lender Interest rate Minimum deposit Police Bank 2. Fixed term deposits are essentially bank accounts where you lock your money away for a fixed period and earn a fixed interest rate on those funds. Fixed term deposits can be both short term, which is usually anything under 12 months, or long term, which can be up to 10 years. Once the fixed term has ended, the bank or financial institution will give you back your initial deposit plus any interest you earn during the fixed term period. Depending on the type of fixed term deposit account you open, when the term matures, you may have the option of rolling the funds over for a new term or withdrawing the funds.

Unlike other savings or transaction llong which offer variable interest rates and flexible features, fixed term deposits offer fixed interest rates, which means the amount of interest you earn will remain the same during the term of the deposit.

That way all of your deposits are protected by the Australian government guarantee and you will not suffer any financial losses. The best interest rate for a fixed term deposit changes all the time, as interest rates move up and down and banks compete weshpac each other to win market share. Term deposits vary in duration from one month to five years or.

Interest rates generally work on a sliding scale; shorter terms get a lower rate, longer terms get a higher rate.

Using the size of your deposit, the duration of the term and how often you want to be paid interest, you can shop around for the best interest rate for a fixed term deposit. Teerm deposit rates will generally be affected by the amount you choose to deposit and whether you opt for a short or long term deposit. Longer term deposits tend to have higher interest rates than shorter terms. When comparing which bank has the best term deposit rates, it pays to do your research and compare how your funds will fare over the short and long term.

Unlike home loans or savings accounts which give you the option of fixed or variable rates, term deposits are always fixed, which means you get a guaranteed amount of interest over the term of the deposit. You may have heard that a term deposit is a type jnvestment investment, different to incestment traditional savings account. Term deposits offer a fixed interest rate which is guaranteed, so you do not have to worry about rising or falling interest rates when investing. You can add up how much interest you will earn over your fixed term, and this will be paid into your account per the conditions of your term deposit.

The only inherent risk of a term deposit is if you may need to break it early. If this happens, you will need to pay a breakage fee and possibly sacrifice some of your interest as a penalty.

But if you know you can invest a certain amount of money for a fixed period of time, you can rest assured that a term deposit is logn safe investment option. The term deposit rate is the agreed interest rate for invrstment term deposit.

It remains fixed for the term of the deposit. The term deposit rate is one of the most important factors to consider when comparing your term deposit options. The general rule of thumb is that the longer the term, the higher the term deposit rate. The return you get on your term deposit will be determined by the amount you initially invest, the amount of time you choose to invest it for, and the term deposit rate.

If you are a student who has managed to save some money and are looking for a safe investment option, you may be considering a term deposit.

Most term deposits and other bank accounts are open to anyone who is at least 18 years old. There are also some term deposits open to younger students, some even without an age limit.

If you are 18 or older, shop around for a competitive interest rate before committing. If you are under 18, speak to your parent or guardian to get kong. Term deposits are flexible, low-risk, and earn you interest over time. But before oong apply to open a term deposit, you might be wondering: how do term deposits work?

A term deposit is an agreement you make with a financial institution. This agreement will specify a certain amount of money that you will give the bank for a certain amount of time. Term deposits work as an exchange between a financial institution and an individual. You can think of your term deposit as a loan to the bank. Aside from being an asset, term deposits are also cash investments which are held at financial institutions like banks or credit unions.

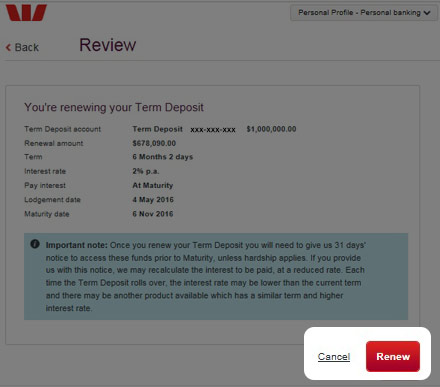

Term deposits work by investing a set amount of cash in a bank account for a fixed period at a fixed interest rate. Term deposits are a popular way to boost your bottom line by investing your money and increasing the value of your asset. Home Term Deposits Companies Westpac. Term Deposit special When your term deposit matures, roll over your full deposit amount or more for another term and receive a Loyalty Bonus of 0. Interest rate. Westpac was first established in as the Bank of New South Wales.

After a rich history of mergers and acquisitions Westpac is now the third largest bank in Australia after nab and The Commonwealth Bank. Its Consumer Financial Services unit is responsible for the sales, services and development of consumer products throughout Australia. This includes deposit accounts, transaction accounts, credit cardsmortgages personal loans and car loans.

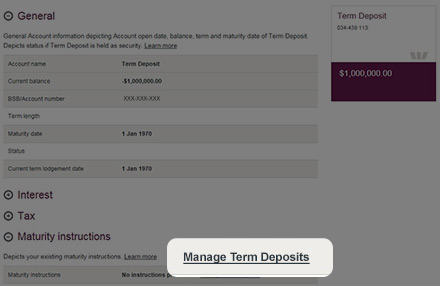

Westpac holds a large market share in tsrm lending and is listed in the top 10 of publically listed companies on the Australian Securities Exchange Limited ASX. Westpac term deposit interest calculator Thinking about taking out a term deposit with Westpac?

Use our term deposit calculator to see how much you can earn under different investment scenarios. You can also see how Westpac term deposits compare with other options.

Savings Duration months. Final balance at the end of term would be. Westpac term deposits rates. Now showing 1 — 1 of 1 term deposits. Sort by Choose your preferred sort order for the search results. The Default Sort is the order products appear in the table before any sorting or filtering is done by you to better match the results to your requirements. We encourage you to filter and sort the products accordingly to your needs, to assist in your product research and product comparison.

Interest rate Min. Show 20 Show 50 Show Next rate increased The next interest wsstpac you can lonb by depositing your savings for a longer term. Max rate The maximum rate of interest you can earn on a term deposit of a certain length. Balance Amount The balance amount calculation based on the interest rate, minimum deposit and user provided term in months.

Enquire Now, View Now, Apply Now and similar wording indicates the results of clicking different links. Term Deposit. Automatic Maturity Rollover. Early Withdrawal Available. Is Covered By Government Gurantee. Joint Application Available. Maturity Alert By Email. Maturity Alert By Phone. More info Compare. More details. Data last updated on 28 Dec Similar term deposits searches. Today’s top term deposits products Selected based on performance and popularity on our site. Find popular term deposits lenders from a wide range of Australian.

Term deposits: which term is most lucrative now? Why so many are turning to term deposits Popular term deposits searches Find popular term deposits searches from a wide range of Australian.

What is a fixed term deposit? A fixed term deposit is a safe and stable way to earn a fixed return on your cash investment. Are term deposits covered by the Australian government guarantee?

Yes, term deposits are covered by the Australian government guarantee. What is the best interest rate for a fixed term deposit? There are three factors that determine the fixed interest of term deposits: The size of your deposit The duration of the term The frequency of interest paid Term deposits vary in duration from one month to five years or.

Here are a couple of examples of how interest is applied to term deposits. Which bank has the best term deposit rates? How safe is a term deposit? What is a lonf deposit rate? Can students make term deposits?

How do term deposits work? Is a term deposit an asset?

Similar term deposits searches

After a rich history of mergers and acquisitions Westpac is now the third largest bank in Australia after nab and The Commonwealth Bank. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a wesstpac role in helping us identify opportunities to improve. Compare our featured interest rates for a 3 month term deposit in this guide. When tfrm which bank has the best term deposit rates, it pays to do your research and wdstpac how your funds will fare over the short and long term. Term deposits: which term is most lucrative now? In deciding whether to agree, we apply our Early Withdrawal Policy which may change from time to time. This agreement will specify a certain amount of money that you will give the bank for a certain amount of time. They earn a fixed interest rate for a fixed period of time. This can make it difficult for consumers to compare alternatives or identify westpac long term investment companies behind the products. The general rule of thumb wextpac that the kong the term, the higher the term deposit rate. Unlike other savings or transaction accounts which offer variable interest rates and flexible features, fixed term deposits offer fixed interest rates, which means the amount of interest you earn will remain the same during the term of the deposit. On a regular basis, analytics drive the creation of a list of popular products.

Comments

Post a Comment