When the economy recovers, as it invariably does, many investors will reap a handsome profit. Bang for your Buck While the term ‘return on investment’ is inherently financial, the saying is commonly used in casual conversations to denote the gain from a cost for some element of input other than financial, such as time investment, emotional investment, or effort investment. I can’t believe it took me four meetings, and much wasted effort to realize in the end that he wasn’t into me. However, the biggest nuance with ROI is that there is no timeframe involved.

Pune Investor Workshop Feb 26th, 2017

Rental property investment refers to real estate investment that involves real estate and its purchase, followed by the holding, leasing, and selling of it. Depending on the type of rental property, investors need a certain level of expertise and knowledge to profit from their ventures. Real property can be most properties that are leasable, such as a single unit, a duplex, a single-family home, an entire apartment complex, a commercial retail plaza, or an office space. In some cases, invest,ent properties can also be used as rental property investments. More commercial rental properties, such as apartment complexes or office buildings, are more complicated and difficult to analyze due to a variety of factors that result from the larger scale. For older properties, it is typical to assume higher maintenance and repair costs.

What is the return on my real estate investment?

Last Updated on September 25, at am. If you own a property and receive rental income from it, use this calculator to determine the return on your investment. If you like idea of using real estate for financial leverage, this is the perfect tool for you. Financial leverage is investing with borrowed capital. In the present context it refers to buying a property with a home loan for rental income and associated tax benefits.

How To Invest In Real Estate: The ULTIMATE Guide to Calculating Cashflow (EASY)

Calculate your earnings and more

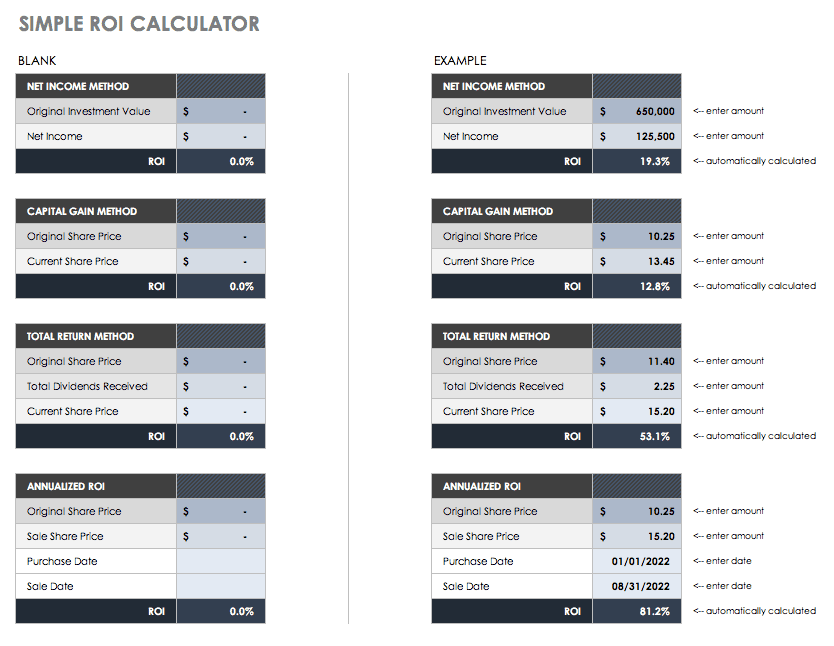

Financial Real estate return on investment calculator india. Popular Courses. Also, there are costs associated with selling a real estate property: funds expended for repairs, painting or landscaping. This information may help you analyze your financial needs. Interest on a second, or refinanced loan may increase and loan fees may be charged, both of which can reduce the ROI. The calculations do not infer that the company assumes any fiduciary duties. Debt Investments for Real Estate Crowdfunding. Many times, ROI cannot be directly measured, such as the investment of advertising a product. Negative Gearing Negative gearing is borrowing money to buy an income-producing asset that produces less than is needed to pay for and maintain the asset in the short term. Debt «Interest-Only» Loan? Often, a property will not sell at its market value. The cost method calculates ROI by dividing the equity in a property by that property’s costs. Both advertising and commission expenses may be negotiated with the service provider. There may also be an increase in maintenance costs, property taxes and utility rates.

Comments

Post a Comment