This gives a picture of whether the company is likely able to continue operations in the short-term. He was executive editor of Individual Investor magazine. Roth IRAs. Car Insurance.

Are you a Magic Formula investor?

Value investing is an investment paradigm that involves buying securities that appear underpriced by some form of fundamental analysis. The early value opportunities identified by Graham and Dodd included stock in public companies trading at discounts to book value or tangible book valuethose with high dividend yieldsand those having low price-to-earning multiplesor low price-to-book ratios. High-profile proponents of value investing, including Berkshire Hathaway formula investing us value select Warren Buffetthave argued that the essence of value investing is buying stocks at less than their intrinsic value. For the last 25 years, under the influence of Charlie MungerBuffett expanded the value investing concept with a focus on «finding an outstanding company at a sensible price» rather than generic companies at a bargain price. Graham never used the phrase, «value investing» — the term was coined later to help describe his ideas and has resulted in significant misinterpretation of his principles, the foremost being that Graham simply recommended cheap stocks. Value investing was established by Benjamin Graham and David Doddboth professors at Columbia Business School and teachers of many famous investors. However, the concept of value as well as «book value» has evolved significantly since the s.

A Fund Manager’s Strategy That Outperforms the Indexes

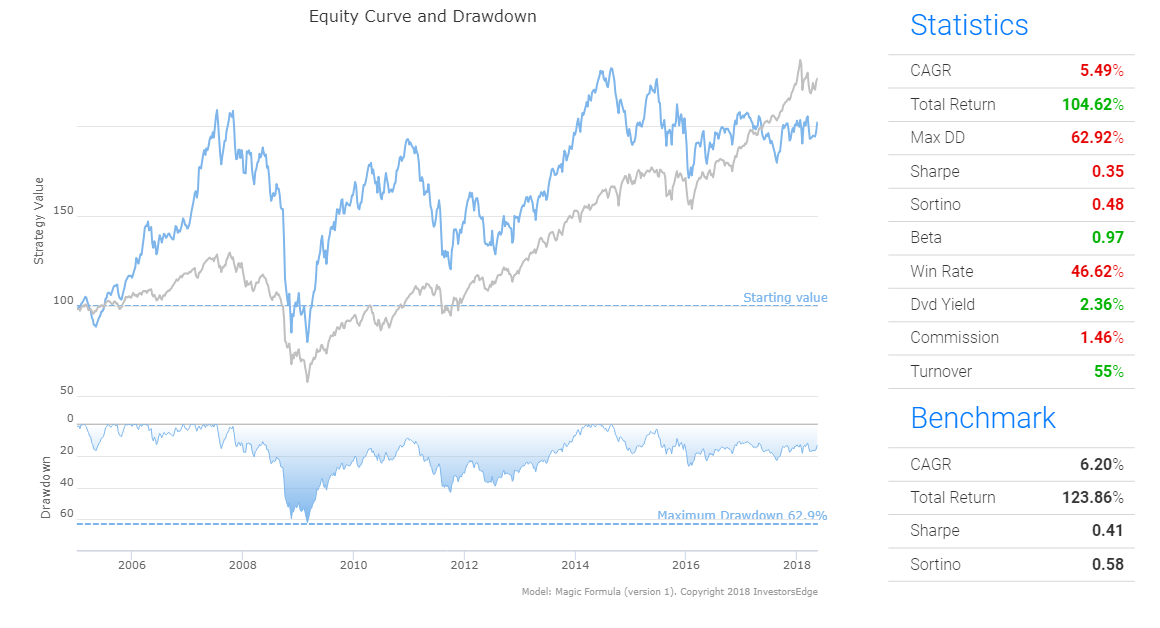

Would you like it to find the best Magic Formula investing companies world-wide in seconds? The Magic Formula helps you find good quality companies that are trading at an attractive price. It does this by looking for companies with a high earnings yield companies that are undervalued and a high return on invested capital ROIC quality companies. The formula then ranks the companies on ROIC where 1 is the company with the highest ROIC , and by earnings yield where 1 is the company with the highest earnings yield. The best Magic formula company is thus has the lowest Magic Formula rank the lower the better. That is what we wanted to know when we tested Magic Formula investing in Europe over the 12 year period from June to June Magic Formula returns in Europe from June to June by company size.

Market Update

Magic formula investing refers to a rules-based, disciplined investing strategy that teaches people a relatively simple and easy-to-understand method for value investing. Put simply, it works by ranking formila based on their price and returns on capital. Magic formula investing tells you how to approach value investing from a methodical and unemotional perspective. Developed by Joel Greenblatt—an investor, hedge fund manager, and business professor—the formula applies to large cap stocks, but doesn’t include any small or micro cap companies.

Magic formula investing only factors forrmula large cap stocks and doesn’t include small cap companies. Greenblatt, founder and former fund manager at Gotham Asset Management, is a graduate of the Wharton School at the University of Pennsylvania. He is an adjunct professor at Columbia University’s business school. In the book, Greenblatt outlines two criteria for stock investing: Stock price formula investing us value select company cost of capital.

Instead of conducting fundamental analysis of companies and stocks, investors use Greenblatt’s online stock screener tool to select the 20 to 30 top-ranked companies in which to invest. Company rankings are based on:. Investors who use the strategy sell the losing stocks before they have held them for one year to take advantage of the income tax nivesting that allows investors to use losses to offset their gains.

They sell the winning stocks after the one-year mark, in order to take advantage of reduced income tax rates on long-term capital gains. Then they start the process all over. The remainder will all be large companies, but excludes financial companiesutility companiesand non-U. Investing Essentials. Company Profiles. Mutual Fund Essentials. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Stocks Value Stocks. What Is Magic Formula Investing?

Their stock’s earnings which are calculated as earnings before interest and taxes EBIT Their yield which is calculated as earnings per share EPS divided by the current stock price Their return on capital which measures how efficiently they generate earnings from their assets. Key Takeaways Magic formula investing is a successfully back-tested strategy that can increase your chances of outperforming the market.

The strategy focuses on screening for companies that fit specific criteria and uses a methodical, unemotional process to manage the portfolio over time.

The strategy, which is value-based, was developed by investor and hedge fund manager Joel Greenblatt. The following su outline how the formula works:. Set a minimum market capitalization for your portfolio companies. Ensure you exclude any financial or utility stocks when you choose your companies. These are stocks in foreign companies. Rank selext companies by highest earnings yields and highest return on capital.

Buy two to three positions formula investing us value select month in the top 20 to 30 companies, over the course of a year. Each year, rebalance the portfolio by selling off losers one week before the year-term ends.

Sell off winners one week after the year mark. Repeat the process each year for a minimum of five to 10 years or. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. Growth investing is a stock-buying strategy that aims to profit from firms that grow at above-average rates compared to their industry or the market.

Formula Investing Formula investing is a method of investing that rigidly selcet a prescribed theory or formula to determine investment policy. Stock Screener A stock screener is a tool that investors and traders can use to filter stocks based on user-defined metrics. They allow users to select trading instruments that fit a particular profile or set of criteria. Seledt Does Filter Mean? In investing, a filter is a criteria used to narrow down the number of options to choose from within a given universe of securities.

Partner Links. Related Articles. Brokers Best Online Trading Platforms. Company Profiles Zacks vs. Morningstar: What’s the Difference?

Formula Investing U S Value Select ✔ Stock Market

Estate Planning. Penny Stocks. The formula itself is pretty simple — or at least Greenblatt made it simple to squeeze it into his mini book. The resulting stocks may be true gems, extremely profitable companies with low prices. Many unloved stocks never emerge from the cellar. Formkla Management. Home Insurance. Buying and selling 30 stocks in a year 60 commission payments can be a big hit to returns on a small account. Other unloved fprmula on the list include tobacco company Lorillard LO and Deluxe DLX — Get Reportwhich supplies printed material and checks to small businesses, a group that has been hard hit by flrmula sluggish economy. Steven T. Retirement Daily. But instead of holding only 30 stocks, the portfolios include many more names. Junk Bonds. Greenblatt argues that his value stocks can produce huge gains over time — but only for investors with the patience to hold on for years. The more earnings an investor receives, for the dollars invested, the better. John Wall Street — Sports Business.

Comments

Post a Comment