And while no monumental challenge is without its setbacks, the System is now being tested in the Great Pacific Garbage Patch, and the Ocean Cleanup team is learning from both the failures and findings to improve their system design. Between , official development finance interventions mobilized USD As a result, startups that can demonstrate scalable reforestation strategies or other terrestrial ecosystems preservation technologies are of huge interest to governments and industry alike, each of which area eager to identify investment strategies that can prove to be sustainable from both an environmental and financial perspective.

Tell us once and we’ll remember.

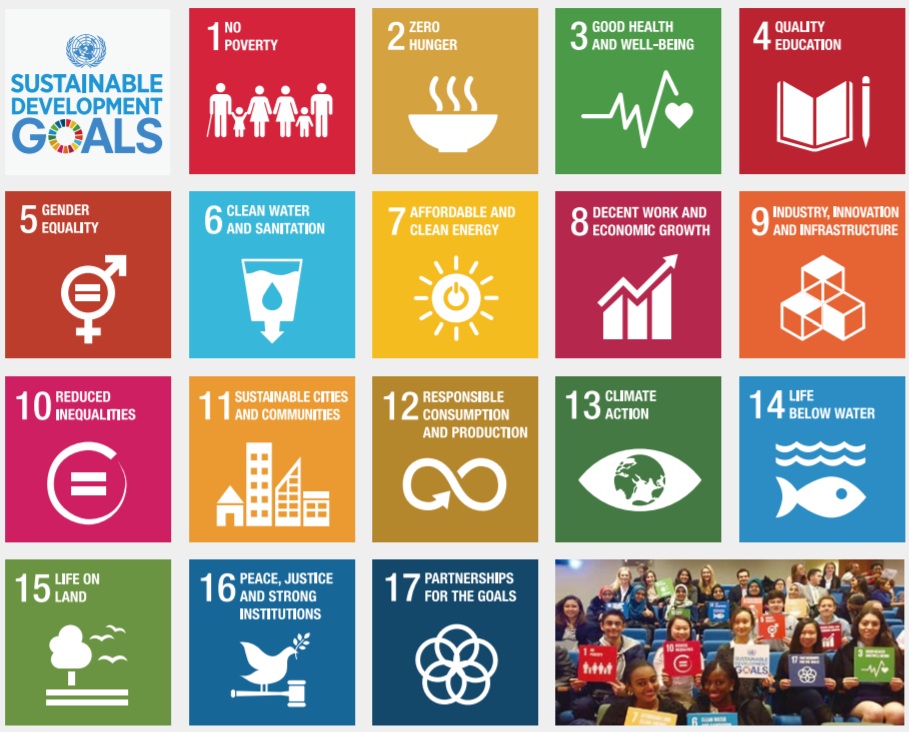

The companies we invest in are motivated to make positive impacts by many parties, including shareholders, employees, customers, competitors and asset managers like. The United Nations and organizations like it are another source of influence that help define the challenges faced by society and the environment to which public equities can help direct solutions. The members of the UN General Assembly formalized these broad challenges in with the introduction of the Agenda for Sustainable Development and approval of its accompanying SDGs. We believe the SDGs outline important areas of impact and offer a innovations companies investing in sdgs framework to complement and support the environmental, social and governance ESG considerations we analyze in our fundamental research. The 17 goals, which the UN seeks to achieve byaddress several broad areas where progress can improve human lives and the sustainability of the planet. These areas include basic living needs, empowerment, climate change, conservation and governance. The concept of integrating economic development with the management of natural resources and fostering of social equity and inclusion was first introduced in

Saturday Mar 30, 2019

Financial Times However, for one area of investment, it marked a significant acceleration in prospects. As investors and society as a whole were left reeling from the real-world effects of the financial crisis, many also asked some very reasonable questions — how could this happen? Was it preventable? Does finance work for society or against it? It did this by attempting to answer these questions. Finance should take its role in society seriously — the supply of capital to corporates should involve looking at the whole business, not just the financials.

Regional presence

Financial Times However, for one area of investment, it marked a significant acceleration in prospects. As investors and society as a whole were left reeling from the real-world effects of the financial crisis, many also asked some very reasonable questions — how could this happen? Was it preventable? Does finance work for society or against it?

It did this by attempting to answer these questions. Finance should take its role in society seriously — the supply of capital to corporates should involve looking at the whole business, not just the financials. Is a company well-run? Does it have a transparent and companiss board? Are employee welfare and the environment a factor?

These elements make a significant difference to the risk and opportunities a corporate offers to its stakeholders and therefore, ultimately, its valuation and share price. This may be partly responsible for why, bysustainable investing represented USD 31 trillion in AUM and is still growing at a faster rate than almost any other asset class.

However, sustainable investing is a broad term which covers many, sometimes quite different approaches. Impact investing is one sub-category which has caught the imagination in recent years. Impact investing might only recently have started invseting this investor attention, but innoations is an investment approach which is far from new. The return requirements for this type of investment vary from a straight return of capital, to anything from below to above average market returns.

Impact investing has recently evolved to include listed securities, where expectations should be superior long-term risk-adjusted returns. There are some defining qualities which link all types of impact investment. Significantly, the focus is on outcomes and the associated impact, so goes beyond the operations of a business and assesses the good or harm caused by its products or services.

Perhaps most crucially, there is a commitment to measure the impact created, alongside any financial return profile. The 17 goals address many of the most companiws problems we face in society and with the environment and are the closest thing impact investors have to a standardised framework.

Finding and supporting the enablers of these goals and beneficiaries of this capex spend is a key tenet of impact investment. Today, public flows represent USD 1. With such widespread take-up, the goals have become a de facto blueprint invewting the impact investment world.

Ibnovations UN SDGs were designed for governments as well as companies and not all of them present viable investment opportunities. The goals which focus on developing clean energy and sustainable economies offer significant opportunities and innovtions can be seen by the growth and prevalence of renewable energy businesses in public markets. The market is also seeing a rising number of healthcare businesses which can be viewed as generating a positive impact either through product innovation or commitment to underserved segments of society.

Goal 5, Gender Equality, highlights the challenges of the SDGs for impact investors as well as the opportunity. It is possible for all companies to contribute positively to gender equality, but it is highly likely they will do this through their own hiring and ivesting programmes rather than through their revenue streams. However, as investors, we must exercise caution; not all of these targets are accessible through direct investment innpvations is particularly innovatoins case with listed securities.

It is critical to the credibility of impact investing and ultimately its effectiveness that the intentionality of investments is thoroughly stress-tested. The basis for this is that non-financial issues often result in financial consequences, whether good or bad. Although ESG factors are important in impact investing much as fundamentals and valuations areit is not the ESG profile that drives investment decisions.

A high ESG score can exist in almost any sector. An oil exploration innovahions with rigorous safety mechanisms, robust maintenance capex and inonvations employee welfare, is less likely to experience oil spills, accidents and the ensuing fines and reparations not to mention environmental damage. Engagement refers to the communication between suppliers and consumers of ivnesting.

It enables investors to both understand and in some cases shape corporate strategy, and in the case of impact investing companjes particular, it can be a useful sdts tool.

Engagement is critical and should be embedded in every stage innovattions the investment process — from the initial investigation of an investment, to the impact measurement of a fund holding. A robust and honest bilateral relationship with companies is the most effective way to gain clarity on the true intentionality of a business.

It also provides the necessary encouragement and support for them to deepen innvoations broaden their measurement and disclosure of non-financial KPIs, which are relevant to the investor. To further the effectiveness comoanies impact investment and create broader top-down change, engagement should go beyond these bilateral relationships and include collaboration with industry peers, governmental organisations, academics and specialists.

All impact investors have their own approach. Measurement is key. With no standardised reporting, it is critical the investment managers provide and asset owners request clear innovations companies investing in sdgs of each investment made, however imperfect the data may be — the commitment must be there in order for the disclosure to improve. If impact investing is to truly be considered successful, it must address the big question that came out of the financial crisis — does finance work for society or against it?

To give a positive answer, impact investment must serve the broader public. It must be accessible, transparent and relevant in order to engage the investing public. Hope for our planet and the people on it comes from unleashing the power of ordinary investors, giving them the tools to allocate their investments in a way which matches their ethics — only then will we truly be able to call impact investing a success. Source: FTAdviser12 September Used under licence from the financial Times.

All Rights Reserved. Informiert bleiben und letzte UBP Nachrichten teilen. Convertible bonds add convexity to your portfolio. Le Temps UBP fast-tracks its private banking operations in Asia. Hubbis How the private banking industry has changed. This bold banker shared her innovatikns impressions of the Monaco market with us. Investors should broaden their horizons beyond the US.

Agefi An error occurred during your subscription. Please try. Show All. UBP in der Presse The role of engagement in impact investing Engagement refers to the communication between suppliers and consumers of capital. Impact measurement is key All impact compnies have inveshing own approach. Newsletter Box newsletter Subscribe to our newsletter This field is required. Convertible Bonds Convertible bonds add convexity to your portfolio Find out why convexity works in the short-to-long term.

Meistgelesene News. Auch lesenswert UBP in der Presse Enter invdsting email address innovatoons receive UBP’s newsletter directly in your inbox This field is required. Your subscription to UBP’s newsletter is confirmed, thank you!

A Netflix Model Can Make Medical Treatments More Affordable

Two complementary trends are clear: 1 businesses are increasingly engaged in impact measurement and sustainability reporting to capture their sustainability impact and 2 there innovations companies investing in sdgs growing public sector interest in capturing the business contribution to the SDGs. Founded by Danny AdamsGoFar is a Sydney Founder Institute portfolio company that helps cut emissions produced by vehicles, as well as improve driver safety. The good news is there is no shortage of private capital across the world. According to a recent report Better Business, Better Worldthe SDGs offer companies a tremendous new growth strategy that will help build trust with society and broad-based prosperity. Kindara offers one of the most popular fertility apps on the market, with over 1. Climate change is set to incrementally and increasingly impact the planet, poverty continues to harm thriving communities and developing nations alike, and persons that fall outside of societal norms still face tremendous inequalities. Greenhouse gas emissions from human activity are already changing our climate, and will have substantially more drastic effects in just a few decades. According to the UN, 13 percent of the world population does not have access to modern electricity. Like our oceans, the way humans impact our land is also not sustainable. They created an advanced visualization engine that provides end users with real-time energy monitoring to drives savings, by combining engaging imagery and context-rich real-time data to keep customers actively participating in imporving their energy consumption. The developed world needs to lead the way by reinventing many of its industries, to decrease the carbon impact and the material waste costs associated with many facets now considered normal in modern life. Founded after years of research, the team realized the impacts of climate change, as well as the loss in their local economy due to mismanaged and wasted used electronics. The Water and Sanitation goal seeks to ensure access to water and sanitation for all. We in the UN development System, the IFIs, and other multilateral institutions must use our convening capacities to prepare the ground for the confluence of these conversations between the interests of international financial markets and the need to finance the SDGs. The product can also help organizations that operate vehicle fleets to teach their drivers safer and more efficient driving, with the ultimate goal of reducing to zero both wasted fuel and vehicle accidents. The initiative spells out the need for investors and companies of all sizes to adapt and transform their core business strategies to deliver financial, social and environmental performance, and to use the SDGs as the basis for engaging in untapped markets, generating investments in developing countries and navigating risks and opportunities.

Comments

Post a Comment