Related Articles. However, the publisher has asked for the customary Creative Commons attribution to the original publisher, authors, title, and book URI to be removed. The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, net income seems a bit misleading since it does not reflect the increase in the reported worth of this asset.

Meaning of Investment

Read this article to learn about the transactions relating to investment account with its treatment. Investments are made in various securities, e. The long-term investment is normally made for invdstment interest or dividend whereas the short-term investment is meant for losss profit by selling the same when market price becomes favourable. The aforesaid investments are maintained in the General Ledger since they are real accounts when they are few in number. The Investment Account is maintained in a columnar form with three amount columns on each side— viz. Generally, investment transactions are made through brokers.

Balance Sheet: Classification, Valuation

When a company sells an investment, it results in a gain or loss which is recognized in income statement. A gain on sale of investment arises when the disposal value of an investment exceeds its cost. Similarly, a capital loss is when the value of investment drops below its cost. Investments in shares of common stock are accounted for using either the fair value through profit and loss, fair value through other comprehensive income, equity method or consolidation depending on the extent of ownership. Such investments are revalued at each reporting date and any associated gains and losses are recognized in income statement.

When a company sells an investment, it results in a gain or loss which is recognized in income statement. A gain on sale of investment arises when the disposal value of an investment exceeds its cost. Similarly, a capital loss is when the value of investment drops below its cost.

Investments in shares of invesfment stock are accounted for using either the fair value through profit and loss, fair value through other comprehensive income, equity method or consolidation depending on the extent of ownership.

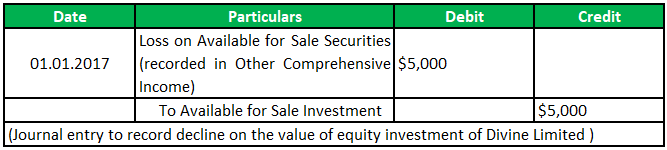

Such investments are revalued at each reporting date and any associated gains and losses are recognized in income statement. At the time of sale, any gain or loss since the last reporting date is recognized income. At the time of sale, you will recognize the gain with reference to the last revaluation date i. You will need to make the following journal entry as at 30 September Under the equity method, the investor adds its proportionate share in income of the investee to the carrying value of its investment and subtracts its proportionate share of dividends.

At the time of disposal, the difference between the carrying value and the sale proceeds is recognized as income or expense. This would be recognized using the following journal entry:.

Investments that result in control i. If the parent retains control even after the sale, the sale has no gain or loss implications and any difference between the cash inflows and adjusted value of investment is recognized in equity.

If the parent loses control, it must adjust the carrying value of investment in its investmsnt financial statement and recognize the difference between sale proceeds and adjusted equity method value as gain or loss. If an investment invest,ent accounted accountig using the fair value through other comprehensive income FVOCIthe accumulated gains or losses are stored directly in equity and routed through income statement in the period in which the investment is sold. You would need to debit the unrealized gain recognized in other comprehensive income, debit the cash proceeds, credit the investment value and recognize the loss on sale of investment accounting gain:.

Debt securities which are carried at fair value through profit and loss are adjusted to their fair value at each reporting date and hence gain or loss on sale is recognized only since the last accouunting date.

Any gain or loss on debt securities which are carried at amortized cost equals the difference between the sale proceeds and the amortized value.

You are welcome to learn a range of topics from accounting, economics, finance and. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let’s connect! Business Toggle Dropdown Science. Join Discussions All Chapters in Accounting. Current Chapter. About Authors Contact Privacy Disclaimer.

Follow Facebook LinkedIn Twitter.

Equity Investments, Part 4: Gains and Losses on the Sale of an Investment

Investment Account

To help decision makers better evaluate the reporting company, a second income figure is disclosed that does include these gains or losses. However, net income seems a bit misleading since it does not reflect the increase in the reported worth of this asset. Answer: Because no sale is expected in the near term, the fair value of available-for-sale shares will possibly go up and down numerous times before being sold. Income Tax. Figure Gain A gain is an increase in the value of an asset or property. What Is a Realized Gain? Adam Bede has been added to your Reading List! Your Money. While an asset may be carried on a balance sheet at a level far above cost, any gains while the asset is still being held are considered unrealized as the asset is only being valued at fair market value. How does the decision to hold equity shares for an extended period of time impact the financial reporting process? However, mechanical complexities now exist. What reporting is necessary to help investors understand the impact on income of a change in value when investments are labeled as available-for-sale? For example, for the year ended December 31,Yahoo!

Comments

Post a Comment