Because your line of credit is secured by your diversified investment portfolio, we can keep the rates low for you. Retirement Planning. How an Unsecured Loan Works An unsecured loan is a loan that is issued and supported only by the borrower’s creditworthiness, rather than by a type of collateral, such as property or other assets.

Personal Loan Calculator

View details. Be ready to manage the unexpected. Not available on Quebec accounts. TD investmen effective financing options at dealerships across Canada. Enjoy lower interest credit by leaving your investments untouched.

Sometimes you just want to say yes.

A line of credit is a credit facility extended by a bank or other financial institution to a government, business or individual customer that enables the customer to draw on the facility when the customer needs funds. A line of credit takes several forms, such as an overdraft limit, demand loan , special purpose, export packing credit, term loan, discounting, purchase of commercial bills, traditional revolving credit card account, etc. It is effectively a source of funds that can readily be tapped at the borrower’s discretion. Interest is paid only on money actually withdrawn. Lines of credit can be secured by collateral , or may be unsecured. Lines of credit are often extended by banks, financial institutions and other licensed consumer lenders to creditworthy customers though certain special-purpose lines of credit may not have creditworthiness requirements to address fluctuating cash flow needs of the customer. The term is also used to mean the credit limit of a customer, that is, the maximum amount of credit a customer is allowed.

A line of credit is a credit facility extended by a bank or other financial institution to a government, business or individual customer that enables the customer to draw on the facility when the customer needs funds. A line of credit takes several forms, such as an overdraft limit, demand loanspecial purpose, export packing credit, term loan, discounting, purchase of commercial bills, traditional revolving credit card account. It is effectively a source of funds that can readily be tapped at the borrower’s discretion.

Interest is paid only on money actually withdrawn. Lines of credit can be secured by collateralor may be unsecured. Lines of credit are often extended by banks, financial institutions and other licensed consumer lenders to creditworthy customers though certain special-purpose lines of credit may not have creditworthiness requirements to address fluctuating cash flow needs of the customer. The term is also used to mean the credit limit of a customer, that is, the maximum amount of credit a customer is allowed.

In the case of credit cards, the line of credit is typically called the credit limit. It may be called an overdraft limit. A cash credit is a short-term cash loan to a customer. A bank provides this type of fundingbut only after the required security is given to secure the loan.

In cash credit, the bank advances a cash loan up to a specified limit to the customer against a bond or other security. Once a security for repayment has been given, the business that receives the loan can continuously draw from the bank up to a certain specified.

In India, banks offer cash credit accounts to businesses to finance their «working capital» requirements requirements to buy raw materials or «current assets»as opposed to machinery or buildings, which would be called » fixed assets «.

The cash credit account is similar to current accounts as it is a running account i. But unlike ordinary current accounts, which are supposed to be overdrawn only occasionally, the cash credit account is supposed to be overdrawn almost continuously. The extent of overdrawing is limited to the cash credit limit that the bank sanctioned. This sanction is based on an assessment of the maximum working capital requirement of the organization minus the margin.

The organization finances the margin amount from its own funds. Generally, a cash credit account is secured by a charge on the current assets inventory of the organization. The kind of charge created can be either pledge or hypothecation.

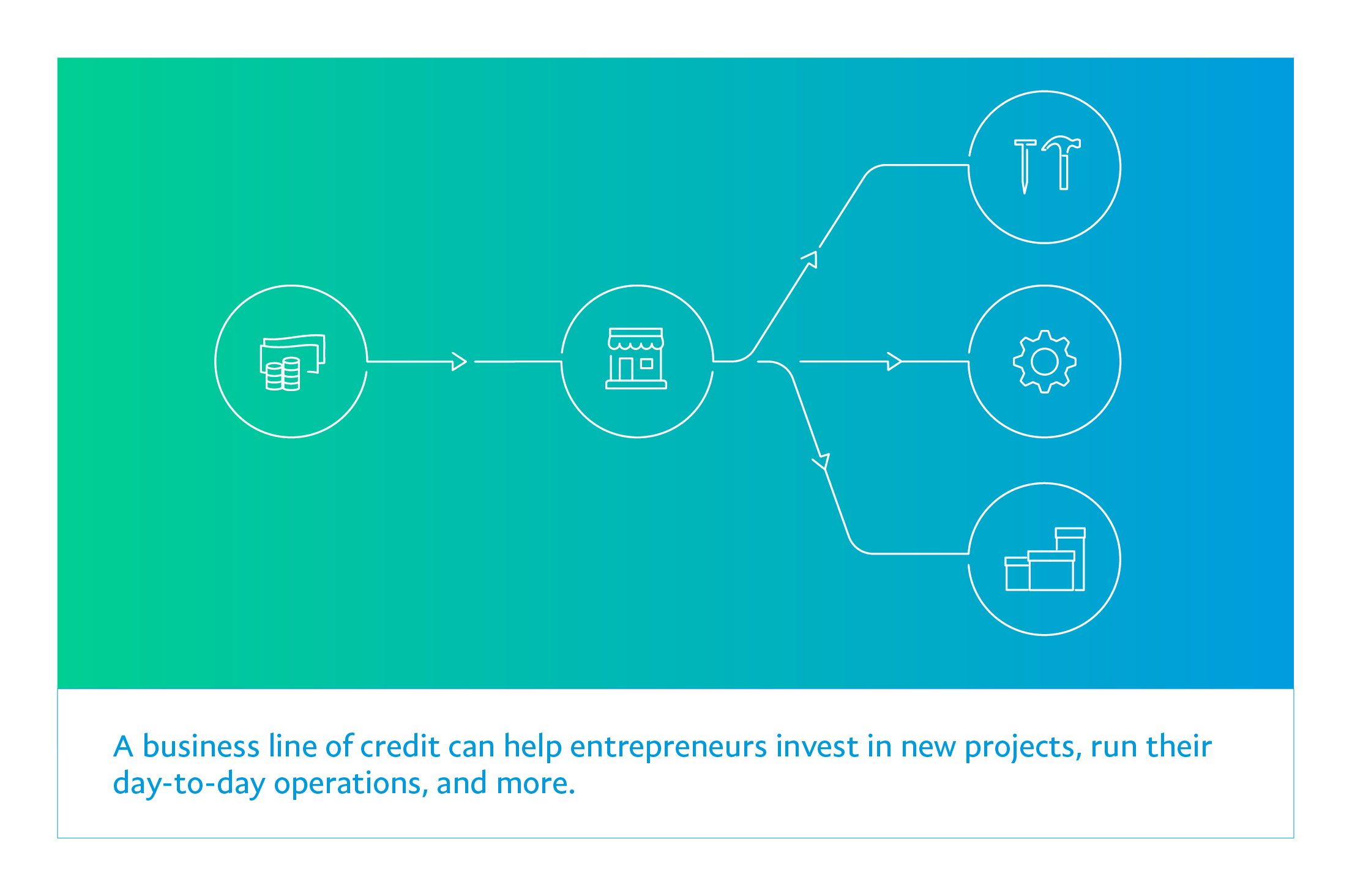

A business line of credit is quite similar to personal lines of credit. The financial institution grants access to a specific amount of financing. A business line of credit can be unsecured or secured typically, by inventory, receivables or other collateral Lines of credit are often referred to as revolving and can be tapped into repeatedly.

The bank or financial institution will normally charge a fee for setting up a line of credit. The fee would typically cover the cost of processing the application, performing security checks, legal fees, arranging collateral, registrations, besides other things.

Normally, investment line of credit interest is payable under the line of credit until the customer actually draws on a part or all of the credit facility.

There may also be a fee for keeping the credit facility open, which may be a monthly, quarterly or annual fee. From Wikipedia, the free encyclopedia. For the Georgian film, see Line of Credit film. This article has multiple issues.

Please help improve it or discuss these issues on the talk page. Learn how and when to remove these template messages. This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources.

Unsourced material may be challenged and removed. This article needs attention from an expert on the subject. Please add a reason or a talk parameter to this template to explain the issue with the article. When placing this tag, consider associating this request with a WikiProject. May Government spending Final consumption expenditure Operations Redistribution. Taxation Deficit spending. Economic history. Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals.

Categories : Credit. Hidden categories: Articles needing additional references from September All articles needing additional references Articles needing expert attention with no reason or talk parameter Articles needing unspecified expert attention Articles needing expert attention from May All articles needing expert attention Articles with multiple maintenance issues.

Namespaces Article Talk. Views Read Edit View history. By using this site, you agree to the Terms of Use and Privacy Policy. Investor institutional Retail Speculator. Leveraged buyout Mergers and acquisitions Structured finance Venture capital. Economic history Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals.

What is a Line of Credit? (And why credit cards are better)

It’s us, not you

Nonbank banks are financial institutions that are not considered full-scale banks because they do not offer both lending and depositing services. Continue Reading. Lines of credit tend to be lower-risk revenue sources relative to credit card loans, but they do complicate credi bank’s earning asset management somewhat, as the outstanding balances can’t really be controlled once the line of credit has been approved. Retirement Planning 10 Ways to Borrow in Retirement. Unfortunately, an equity loan is secured by your home, and if you default on the loan the lenders can attach a lien on that home.

Comments

Post a Comment