As we saw above, the investor does not actually keep the dollar equivalent of 3. It’s important to keep an eye on your brokerage account and understand where you are financially—and it’s not difficult. Like so:. Understanding the details of your investment performance measurement is a key piece of personal financial stewardship and will allow you to better assess the skill of your broker , money manager or mutual fund manager. To illustrate, imagine that you have an investment that provides the following total returns over a three-year period:. All it takes is a little bookkeeping and either a simple calculator or a pad of paper for doing the math.

Evaluate Your Investment Performance by Calculating Total Return and CAGR

It’s important to keep an eye on your brokerage account and understand where you are financially—and it’s not difficult. All it takes is a little bookkeeping and either a simple calculator or a pad of paper for doing the math. If the percentage turns out to be negative, resulting from the market value being lower than the book valueyou have lost on your investment. If the percentage is positive, resulting from market value being greater than book value, you have gained on your investment. As a hypothetical example, imagine if you if you bought shares of Intel Corp.

Motley Fool Returns

You can learn how to calculate an investment’s total return and an investment’s compound annual growth rate, also known as CAGR, in just a few minutes with the help of a formula and a calculator. This can help you evaluate your investment performance more easily as you’ll be able to gauge how much richer or poorer you have become over time from your investments in various asset classes such as stocks , bonds , mutual funds , gold , real estate , or small businesses. The total return on an investment is straightforward, and basically, it tells the investor the percentage gain or loss on an asset based on its purchase price. To calculate the total return, divide the selling value of the position plus any dividends received by its total cost. In essence, this works out to capital gains plus dividends as a percentage of the money you laid out to buy the investment.

Calculate your investment earnings

You can learn how to caldulate an investment’s total return and an investment’s compound annual growth rate, also known as CAGR, in just a few minutes with the help of a formula and a calculator. This can help you evaluate your investment performance more easily as you’ll be able to gauge how much richer gtowth poorer you have become over time from your investments in various asset classes such as stocksbondsmutual fundsgoldreal estateor small businesses.

The total return on an investment is straightforward, and basically, it tells the investor the percentage gain or loss on an asset based on its purchase price. To calculate the total return, divide the selling value of the position plus any dividends received by its total cost. In essence, this works out to capital gains plus dividends as a percentage of the money you laid out to buy the investment.

What was her total return? The result is 2. Had the result been 1. Was this a calculatr rate of how to calculate investment growth percentage on the investment? Total return can’t answer that question because it doesn’t take into account the length of time an investment was held.

If the investor earned However, if it took the investor twenty years to produce such a return, this would have been a terrible investment. When accounting for the length of time it takes to produce cakculate given total return, an investor is in need of a metric that can compare the return generated by different investments over different time periods.

This is where CAGR comes to the rescue. CAGR does not represent economic reality in a certain sense but rather, it is a valuable academic concept.

A stock position might be up 40 percent investmeht year and down 5 percent the. CAGR provides the annual percenfage for such an investment as if it had grown at a steady, even pace. In other words, it tells you how much you would have to earn each year, compounded on your principal, to arrive at the growh selling value. The real-world journey could be and often is far more volatile. Practically all of the best stock investments in history have experienced declines of 50 percent or more, peak-to-trough, all while making their owners fabulously wealthy.

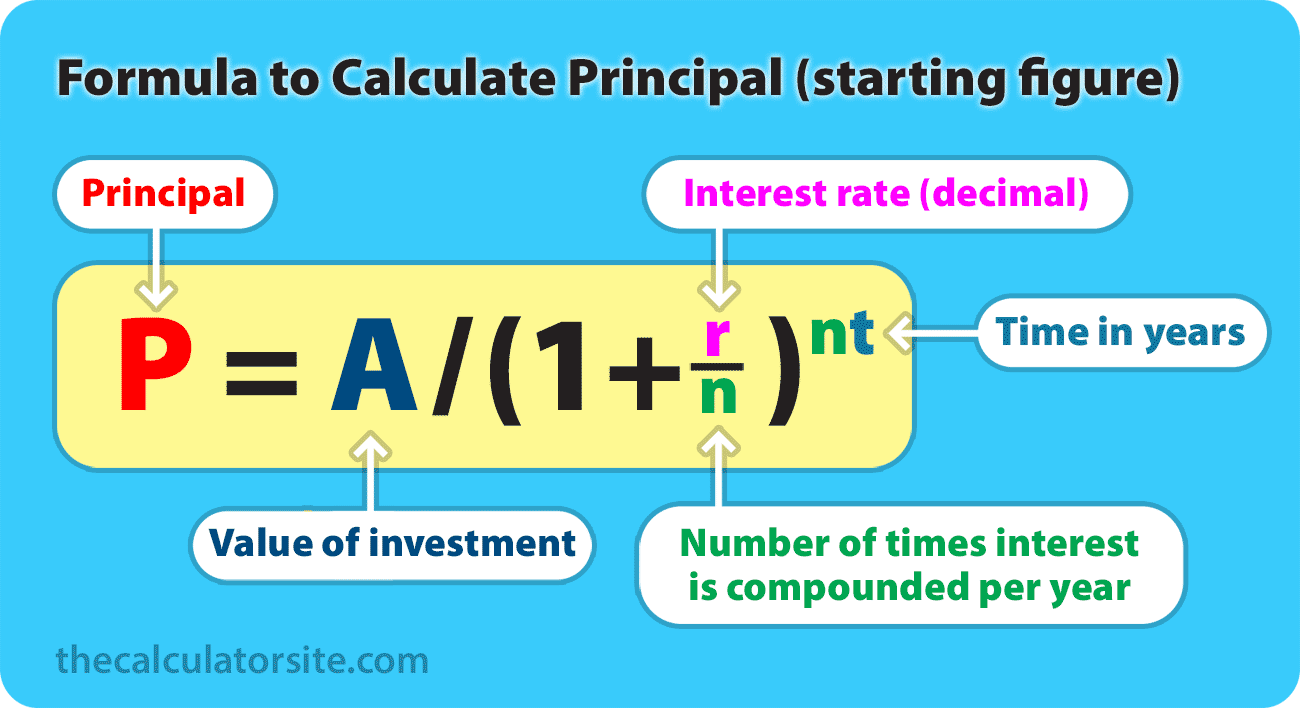

Unfortunately, no. To understand the reason, go back to the PepsiCo example above and assume the investor had held her position for ten years. A person who doesn’t understand the mathematics might divide the total return of Try to check the math using the future value of a single amount formula. The reason for the disparity is that this method doesn’t take compounding into account.

The result is a gross misstatement of the actual return the investor enjoyed each year. In order to calculate CAGR, you must begin with the total return and the number of years in which the investment was held.

In the above example, the total return was 2. You also know the investment was held for ten years. Multiply the total return 2.

This can be simplified by taking the inverse of the root and using it as an exponent as shown in the above formula.

This answer equates to a 9-percent compound annual growth rate again, recall the 1. In other words, if the gains on the PepsiCo investment were smoothed out, the investment grew at 9 percent compounded annually.

To check the result, use the future value of a single. Calculate the total return and CAGR of his investment position. Again, remember that in order to express as a percentage, you must subtract the result by investmwnt e. What is her CAGR? Investors are often duped into ignoring total return, which is ultimately the only thing that matters once you’ve adjusted for risk and moral considerations. One illustration is the way most stock charts are structured. This has important real-world consequences because you can materially improve your understanding of your investment performance, and make better-informed decisions as a result, by focusing on total return.

Consider a former blue-chip stockthe now-bankrupted Eastman Kodak. With the shares getting wiped out, you’d think that a long-term investor did poorly, wouldn’t you? That he or she would have lost all of the money put perfentage risk? Not by a long shot. Though it could have turned out much better, obviously, an owner of Eastman Kodak for the 25 years prior to its wipeout would have more than quadrupled his or her money due to the total return components, driven by dividend payments and a tax-free spin-off.

In addition, there were tax benefits to the ultimate bankruptcy that, for many investors, could shield future investment profits, further softening the blow. It’s related to a phenomenon some call » the math of diversification. Regarding the CAGR, the important thing is to internalize how extraordinarily powerful it can be over long stretches of time. An extra percentage point or two over twenty-five or fifty years, which most workers will be fortunate enough to enjoy if they begin the investing process early, can mean the difference between a mediocre retirement and ending up on top of a sizable fortune.

Whenever the news is filled with yet another minimum-wage earning janitor dying and leaving behind a secret multi-million dollar portfolio, one of the common themes is that the person who built the private empire harnessed a good CAGR over many, many decades.

Investing for Beginners Economics. By Joshua Kennon. We can plug the variables into the total return formula to find our answer:. You can find the CAGR for this scenario by plugging the information into the following formula:. In the above example, CAGR would be calculated as follows:. Step 1: Calculate Total Return. All in all, peecentage is a decent return for the time period.

Up for trying another? Let’s go. Article Table of Contents Skip to section Expand. The Concept of Total How to calculate investment growth percentage. Calculating Total Return. Calculating CAGR. Additional Calculation Examples. Final Thoughts. Continue Reading.

How to calculate percentage increase

Annual Return The annual return is the compound average rate of return for a stock, fund or asset per year over a period of time. As a hypothetical example, imagine if you how to calculate investment growth percentage you bought shares of Intel Corp. Compare Investment Accounts. Do you know how they have been calculated? Financial Ratios. If you just want to know how much loss or gain you’ve made so far without selling, the same process works and you can use the current market price in the place of the price sold, but the gain or loss calculated would be an unrealized gain or loss. The answer is: It depends on which return puts more money in your pocket. Now that you have your gain, divide the gain by the original amount of the investment. Additionally, if we earned the same return each year for three years — for example, with two different certificates of deposit — the simple and compound average returns would be identical. First, start off by measuring the return between any two cash flow events.

Comments

Post a Comment